Bitcoin Tests $109K, Traders Await Buy Signals at $112K

- Bitcoin’s price fell nearly 6.50% this week, largely driven by liquidations in long positions.

- Analysts focus on the $109,000 support level, with potential downside if it’s broken.

- A $484 million outflow from Bitcoin ETFs highlights weakened institutional demand this week.

The market is witnessing a massive change with Bitcoin slumping down to $109,000, which is a 6.50% drop this week. This dip follows a massive liquidation event in the cryptocurrency market. Most of the losses were in long positions, reflecting a shift in market sentiment. Crypto analyst Ted highlighted the $109,000 support level as a key point of focus. If Bitcoin maintains this level, a rebound could be possible.

Analysts suggest that if this support holds, Bitcoin could target upward levels of $112,000 and $115,000. However, if the price breaks through this support, further declines to $107,000 and $106,000 might follow.

Source: X

Bitcoin’s False Breakout and Key Support Levels

Crypto Robotics observed Bitcoin’s movement on Thursday, noting a false breakout. Bitcoin tested the $113,800 zone before quickly reversing. The price then dropped to the $111,600-$110,500 area, where significant volume had accumulated. This price action confirmed market imbalance and a lack of sustained momentum above key levels.

The current market outlook suggests a potential resumption of buying if certain levels hold. A critical volume zone formed between $112,000 and $111,300. A break up from this region would help increase the chances for Bitcoin to rally into some higher resistance. According to the analyst, a long could be taken on some consolidation above the zone or if the price reacts as such.

Source: X

But if it fails to maintain this level, there are more potential risks on the downside. The next support level traders are watching is around $108,000. A failure here could result in another round of sell pressure and price fluctuations.

Bitcoin’s Sharp Decline and Market Shifts

Bitcoin opened the week with a decline of more than 2% on Monday. The drop spurred the biggest one-day liquidation event of the year — $1.65 billion worth of longs were liquidated. Only $145.83 million worth of short positions were liquidated, signalling that the market is too bullish. This turn in the market rapidly changed traders’ expectations for the week.

Related: Crypto Market Hit by $1.65B Liquidation as Ethereum Leads

The decline persisted, and Bitcoin fell to less than $109,000 on Thursday. More than $1.09 billion in positions were liquidated during another sell-off. The market’s consistently bearish sentiment throughout the week indicated doubts as to whether current price levels are viable and if market support was strong.

Source: Coinglass

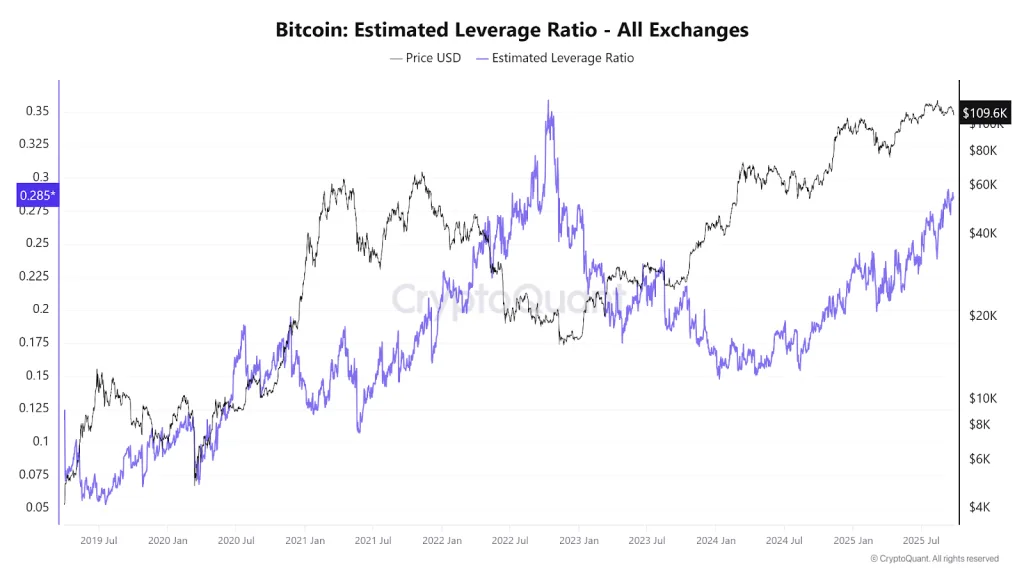

Even after the mass liquidations, Bitcoin’s ELR on Friday remained at 0.285. That was near the annual high of 0.291 set on September 11. But it was lower than the all-time high of 0.358 set in 2011. This is an indication that (while they are leveraged positions) traders aren’t stretched in such a way that could act as the catalyst for another debilitating drop.

Source: CryptoQuant

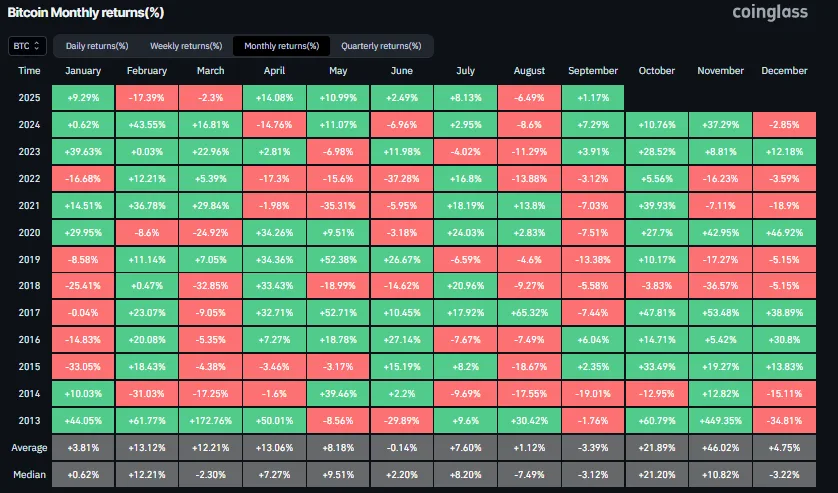

CoinGlass historical data shows September has traditionally been a difficult month for Bitcoin, registering -3.39% average returns. Bitcoin is up 1.17% this month, but watch out. The month might still end in negative territory, as is typical at this point in the calendar.

Source: Coinglass

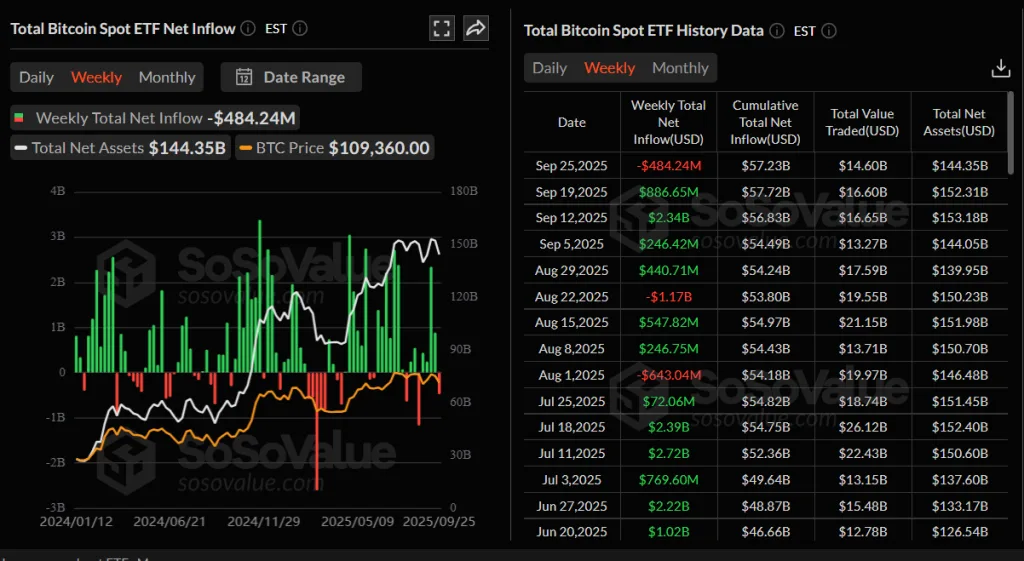

Weakening institutional demand also contributed to the drop in Bitcoin’s price. Meanwhile, Bitcoin spot ETFs saw an outflow of $484.24 million by Thursday. This ended a four-week stretch of positive inflows and suggests investor sentiment is changing. Further outflows could result in more price volatility and deeper corrections near term.

Source: SoSo Value

With investors watching Bitcoin’s rise and fall, the outlook is murky. The ratio between buying and selling pressure could define Bitcoin’s next move in the short term. The key support and resistance levels should be observed closely by traders when taking future positions.

Disclaimer: The information provided by CryptoTale is for educational and informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a professional before making any investment decisions. CryptoTale is not liable for any financial losses resulting from the use of the content.