Bitcoin Feels the September 'Curse' as Bears Target $90K–$95K Range, Expert Warns

Bitcoin traded below $110,000 on Sept. 26 amid bearish sentiment and ETF outflows, but analysts see potential for recovery if macro conditions improve.

Analyst Perspectives on the Bearish/Bullish Outcome

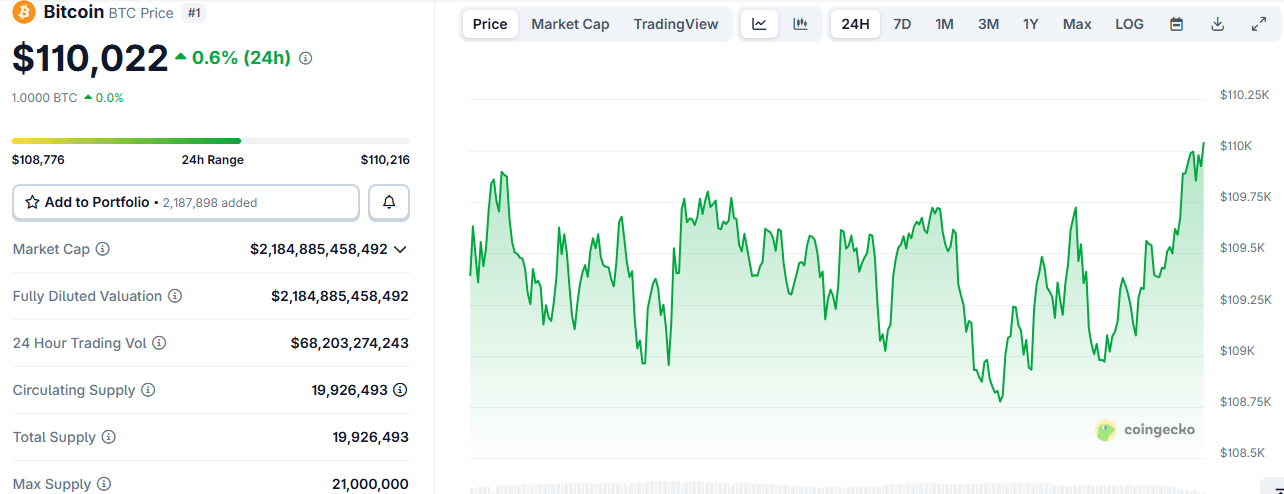

On Sept. 26, bitcoin ( BTC) continued to trade below $110,000 as bearish sentiment swept across the cryptocurrency market. According to Coingecko data, the top crypto asset dipped below $109,000 at least three times during the day, with $109,724 marking its intraday high.

The top cryptocurrency’s decline—which brought its weekly losses to nearly 6%—combined with marginal losses from high-cap altcoins such as XRP and BNB, dragged the total crypto market capitalization down 0.8% to $3.85 trillion. Since Sept. 18, when BTC nearly reached $118,000, the crypto asset has fallen 7.5%, and some analysts expect further downside in the coming weeks.

BTC’s brief plunge below $109,000 has been interpreted by some market watchers as a sign of overheating and a potential shift into a slowdown phase. Supporting this view, Arthur Azizov, founder and investor at B2 Ventures, pointed to exchange-traded fund (ETF) flows, which he said went down by 50% over the past week. Azizov also pointed to the Fear and Greed Index, which he said is at its lowest level since spring. He warned of a possible further decline before BTC resumes its rally.

“Technically, the $108,000–$108,500 zone is key to watch. In July, consolidation here triggered a rally to $123,000, and in late August it preceded a surge to $117,000. This time, however, bears are eyeing the $90,000–$95,000 level,” he said.

Market Liquidation and Structural Demand

Other analysts argue that BTC’s price action this month aligns with historical patterns. Bitcoin typically underperforms in September, reserving stronger performances for October, and 2025 appears to be no exception. Analyst Cryptobirb also warned that the so-called “September Curse” tends to intensify toward the end of the month.

As reported by Bitcoin.com News, the market downturn on Sept. 22 triggered the liquidation of $1.7 billion in leveraged positions—the largest single-day wipeout so far this year. As shown by Coinglass data, another $1 billion in leveraged bets was erased on Sept. 25, with long positions accounting for the majority.

Meanwhile, Gadi Chait, head of investment at Xapo Bank, said structural demand trends suggest BTC’s pullback is “more of a tactical pause than a trend reversal.” He added that cryptocurrency’s current consolidation reflects a maturing market digesting recent volatility and one that could rally if macroeconomic uncertainty clears.

“Institutional sentiment has been mixed: after $977 million in Bitcoin ETF inflows last week, we saw a sharp reversal with $363 million in outflows on Sept. 22—likely profit-taking—before stabilizing at neutral the following day. This shows institutional demand remains strong but sensitive to policy shifts and leveraged position unwinding,” Chait said.

As of 1:20 p.m. EST, Bitcoin ( BTC) had climbed above $110,000 and appeared poised for further gains.