Options and derivatives to take Bitcoin to $10T market cap: Analyst

Derivatives products, like options contracts — financial instruments that give investors the right but not the obligation to buy or sell an asset at a pre-determined price — will drive the Bitcoin (BTC) market capitalization to at least $10 trillion, according to market analyst James Van Straten.

Van Straten said that options and other derivatives attract institutional investors and cushion markets from the high volatility that is a hallmark of digital assets.

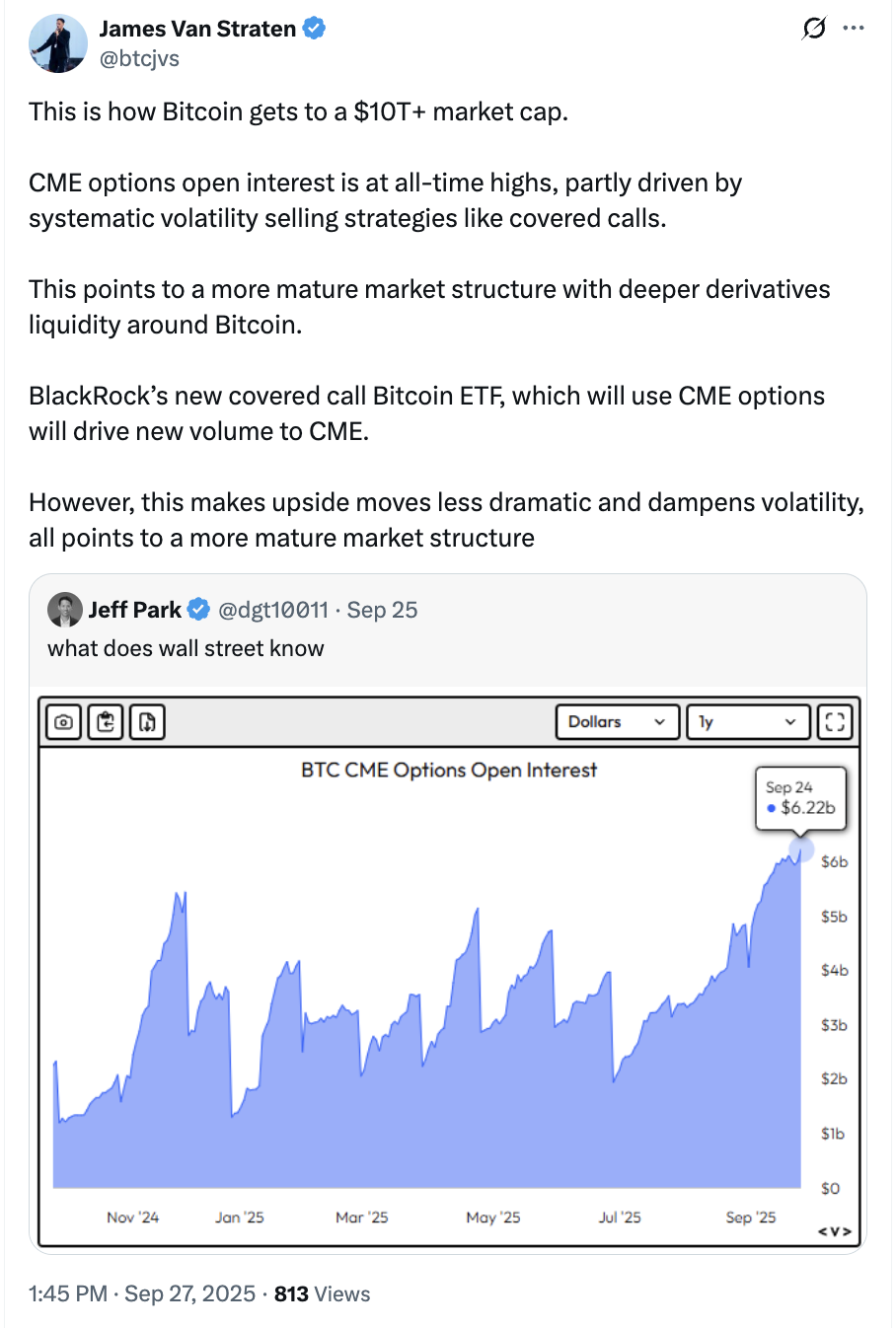

He pointed to open interest for BTC futures on the Chicago Mercantile Exchange (CME), the world’s largest derivatives marketplace, as evidence of a shift. Van Straten wrote:

“CME options open interest is at an all-time high, partly driven by systematic volatility selling strategies like covered calls. This points to a more mature market structure with deeper derivatives liquidity around Bitcoin.”

Reduced volatility works both ways, and the crushing drawdowns common to crypto markets will also dampen the meteoric gains traders have become accustomed to, Van Straten added.

Market analysts continue to debate the effects of financial derivatives products and investment vehicles on the Bitcoin market cycle and the broader crypto market, with some arguing that all signs point to market maturation, while others say that investor psychology is the true undercurrent that moves markets.

Related: Bitcoin’s ‘biggest bull catalyst’ may be the next Fed chair pick: Novogratz

Is the four-year market cycle dead?

Analysts remain divided on the effect that institutional investors, investment vehicles, and financial derivatives are having on crypto markets.

Seamus Rocca, CEO of financial services company Xapo Bank, told Cointelegraph that Bitcoin’s four-year market cycle isn’t dead and markets will continue to be influenced by news cycles, crowd sentiment, and investor psychology.

“So many people are saying, ‘Oh, the institutions are here, and, therefore, the cyclical sort of nature of Bitcoin is dead.’ I’m not sure I agree with that,” Rocca said.

Bitcoin advocate and market analyst Matthew Kratter said that human psychology is the real undercurrent that moves markets, arguing that institutional investors are just as irrational as retail participants.

“The very last Bitcoin crypto bear Market from 2021 to 2022 was mostly caused by institutional investors doing really stupid things at places like Grayscale, Genesis, Three Arrows Capital, and FTX,” Kratter added.

Magazine: Crypto traders ‘fool themselves’ with price predictions: Peter Brandt