Bitcoin Derivatives Heat Up: $77.45B Futures Stack, Calls Still Rule the Options Pit

Derivatives desks are firing on all cylinders this weekend, and bitcoin’s options board is basically screaming “pick a side” while futures stack up near cycle highs.

Deep Liquidity, Sharper Bets: Bitcoin Options Crowd Eyes $110K Strikes

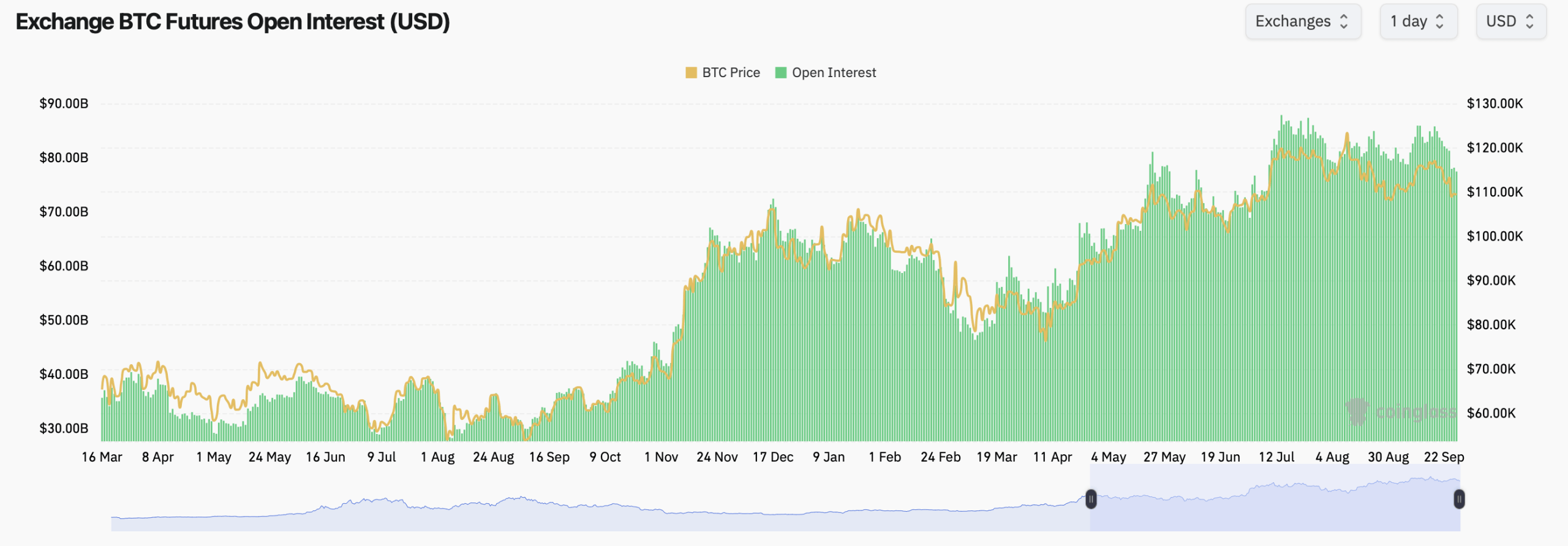

Bitcoin is trading at $109,449 on Saturday, and the futures complex is thick: total open interest (OI) sits at 707.59K BTC, or $77.45 billion. Depth is broad, and the tape shows plenty of two-way interest.

CME holds the biggest slice with 138.82K BTC ($15.19 billion), a 19.6% share, and a modest 24-hour lift of 0.32%. Binance follows with 123.30K BTC ($13.50 billion) and a 17.42% share, though its OI slipped 0.90% on the day.

Bybit’s book carries 84.39K BTC ($9.23 billion), down 0.87% in 24 hours. OKX posts 37.78K BTC ($4.13 billion) with a 1.31% daily rise, while Gate shows 78.24K BTC ($8.56 billion), off 1.07%.

Second-tier flow is mixed: Bitget holds 52.33K BTC ($5.72 billion), up 0.45% on the day. Kucoin sits at 6.12K BTC ($669.49 million), down 2.88%. WhiteBIT has 20.94K BTC ($2.29 billion), off 0.55%. MEXC pops 4.87% to 26.42K BTC ($2.89 billion). BingX shows 9.15K BTC ($1.00 billion) after a steep 42.96% drop.

This weekend, bitcoin options lean bullish by positioning but not by tape. Calls command 60.66% of open interest at 199,102.16 BTC versus 39.34% for puts at 129,149.11 BTC.

Yet in the last 24 hours on Deribit, puts narrowly led volume with 16,247.21 BTC (50.87%) against 15,694.48 BTC in calls (49.13%). Traders are hedging into the weekend, not just cheerleading.

The busiest contracts clustered near bitcoin’s current trading range. On Sept. 28, the Deribit $110,000 put option saw 1,311.9 BTC in volume. The Oct. 10 $100,000 put added 853.3 BTC, while the Oct. 31 $116,000 call recorded 812.5 BTC. Several other contracts tied to the $110,000 strike also kept activity humming.

Looking further out, December’s calls dominate the open interest leaderboard. The Dec. 26 $140,000 call holds 9,804.5 BTC, followed by the $200,000 call with 8,527.2 BTC. Strong stacks also sit at the $120,000 and $150,000 strikes, underscoring traders’ appetite for lofty upside bets into year-end.

Max pain—the level where option buyers feel it most—tracks a smooth band around $110,000 to $116,000 across near-term expiries, with a shallow dip toward $105,000 into late-December rolls.

Put together: futures liquidity is ample, options OI favors calls, near-term volume tilts to puts, and the max-pain map pins the magnet near $110K. Bitcoin traders have their playground; now price decides who pays for the ride.