Bitcoin and Ether ETFs Close the Week in Red as Outflows Top $660 Million

Bitcoin exchange-traded funds (ETFs) recorded a massive $418 million outflow while ether ETFs logged their fifth straight day of redemptions with $248 million.

ETF Exodus Deepens: Bitcoin Funds Shed $418 Million, Ether Sees $248 Million Outflow

It was a week the ETF market would rather forget. Bitcoin and ether funds closed Friday, Sept. 26, deep in the red, sealing one of the toughest stretches of the month. Bitcoin ETFs saw a $418.25 million outflow, their largest single-day loss of the week.

Fidelity’s FBTC bore the brunt, bleeding $300.41 million. Blackrock’s IBIT and Bitwise’s BITB followed with $37.25 million and $23.79 million in exits, while Ark 21shares’ ARKB lost $17.81 million. Grayscale’s GBTC and Bitcoin Mini Trust added to the exodus with withdrawals of $17.14 million and $12.57 million.

Vaneck’s HODL rounded out the declines with $9.28 million gone. No fund posted inflows, making it a completely red session. Trading volumes were strong at $3.92 billion, but net assets slipped to $143.56 billion.

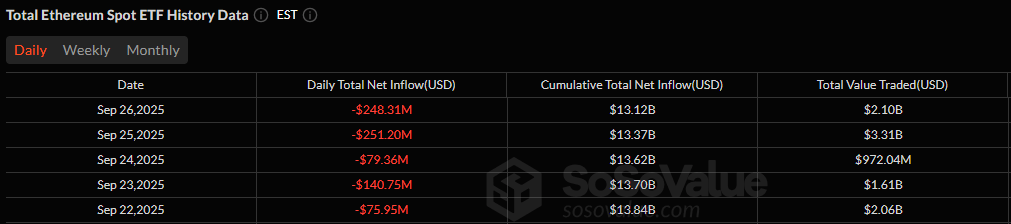

Ether ETFs extended their losing streak to a fifth day with $248.31 million in outflows. Blackrock’s ETHA led the retreat, suffering a sharp $199.87 million exit, while Fidelity’s FETH shed $74.39 million.

There were only small signs of resistance. Grayscale’s ETHE attracted $17.91 million in inflows, and 21Shares’ TETH added $8.05 million, but these gains barely dented the broader decline. This capped a brutal week for ether ETFs with no single day of net inflows. Total value traded reached $2.10 billion, as net assets closed at $26.01 billion.

The week’s end underscores a clear trend: investors are pulling capital from crypto ETFs at scale, reflecting caution after months of strong momentum. All eyes now turn to whether next week brings stabilization or if the tide of redemptions continues.