With Bitcoin (BTC) regaining bullish momentum, insights from OpenAI’s artificial intelligence tool ChatGPT suggest that the cryptocurrency is likely to trade at a new record high by the end of October.

Notably, Bitcoin’s momentum is positive after breaking $120,000, showing a bullish short-term trend despite the U.S. government shutdown.

At present, Bitcoin and the broader market outlook are likely to see further momentum, as the macroeconomic environment supports risk assets.

For instance, a Federal Reserve rate cut expected later this month could boost investor appetite for cryptocurrencies. Institutional interest continues to grow, with ETFs and crypto funds adding upward pressure on the market.

Bitcoin price prediction

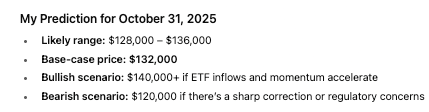

Based on these factors, ChatGPT projects that by October 31, Bitcoin could trade in a range of $128,000 to $136,000, with a base-case price of $132,000.

A bullish scenario could push Bitcoin above $140,000 if momentum and ETF inflows accelerate, whereas a sharp correction or regulatory concerns could see it drop toward $120,000.

The AI model also noted that key technical levels show support at $118,000 and $115,000, while resistance sits at $125,000 and $130,000, with the psychological barrier of $140,000 also in focus.

Meanwhile, insights shared by prominent cryptocurrency analyst Ali Martinez indicate strong potential upside, with Glassnode’s MVRV Extreme Deviation Pricing Bands supporting a bullish outlook.

According to Martinez’s analysis on X on October 4, as long as Bitcoin maintains support above $117,650, the model points to a target near $139,800, a new record high.

At the current price, Bitcoin is comfortably above its 50-day simple moving average (SMA) of $113,680, signaling sustained short-term bullish momentum, trading roughly 7.4% higher than this key support level.

The 200-day SMA at $104,714 further reinforces a bullish long-term uptrend, with the price elevated by about 16.5%.

Complementing this, the 14-day Relative Strength Index (RSI) at 67.57 remains in bullish territory, nearing but not yet overbought, suggesting room for continued upside before potential consolidation.

Featured image via Shutterstock