This is an analysis post by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

As bitcoin BTC$124,843.47 trades in uncharted territory near record highs, traders may be searching for cues on what comes next, especially key levels that could act as magnets or resistance points.

Here are three important levels worth watching closely.

$126,100

This level represents the upper boundary of the broadening or expanding range pattern that has been developing since mid-July. The potential resistance is defined by the trendline connecting the July 15 and Aug. 14 highs.

A reversal from this level could trigger a corrective pullback down toward the lower boundary of the range, represented by the trendline drawn from the Aug. 3 and Sept. 1 lows.

$135,000

A breakout from the expanding range would shift focus to $135,000, where market makers currently hold a net long gamma position, according to activity in Deribit-listed options tracked by Amberdata.

When market makers are net long gamma, they tend to trade against the market direction – buying on dips and selling on rallies – to maintain their overall market-neutral exposure. Other things being equal, this hedging activity tends to dampen price volatility.

In other words, the $135,000 level could act as a resistance on the way higher.

$140,000

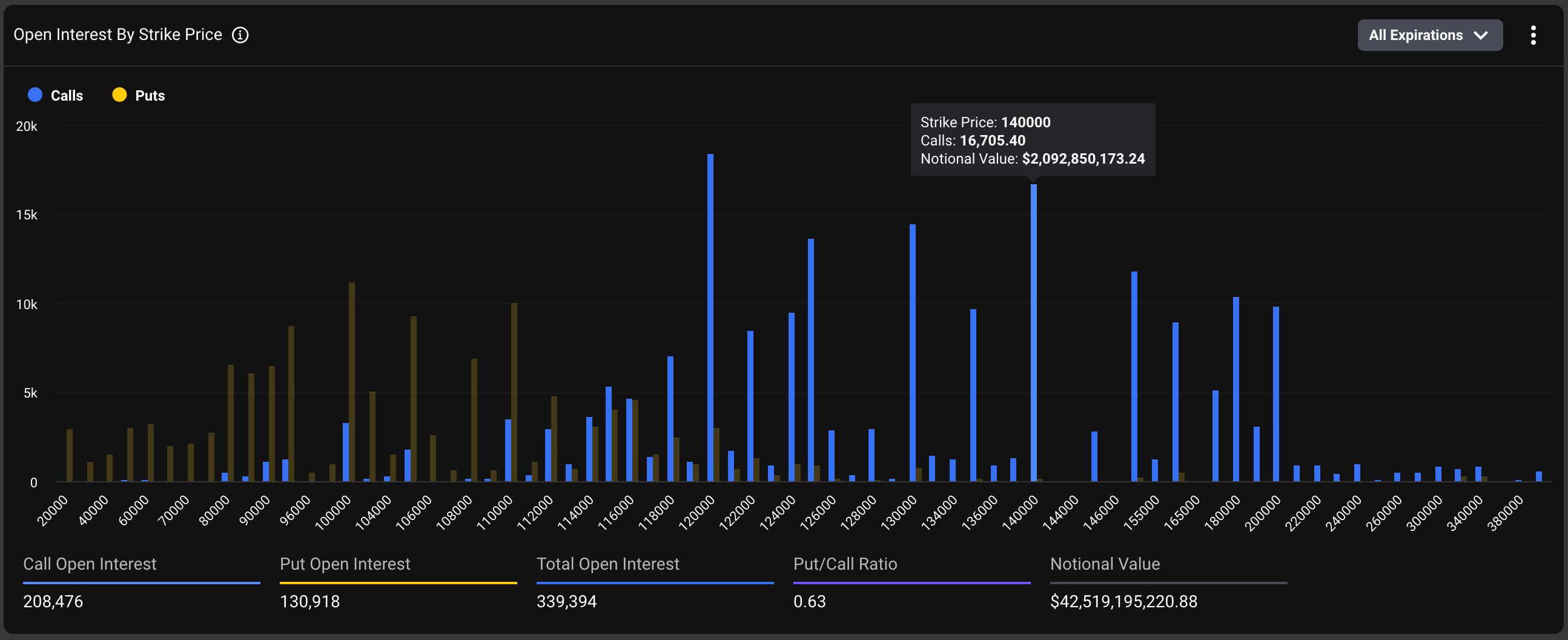

Lastly, $140,000 stands out as key level, as data from Deribit shows the $140,000 strike call is the second-most popular on the exchange, holding a notional open interest of over $2 billion.

Notional open interest refers to the dollar value of the number of active or open options contracts at a given time.

Levels with large concentrations of open interest often act as magnets, drawing the price of the underlying asset toward them. A high open interest in call options suggests that many traders expect the spot price to approach or top that level.

At the same time, those who have sold these calls, often large institutions, have an incentive to keep the price below that strike. Their hedging and trading activity around that level can create resistance, making it harder for the price to break through.