Bitcoin now under threat of crashing below $120k as investors cash out

With Bitcoin (BTC) retreating from its weekend record high of $125,000, the asset faces the threat of further losses as traders take profits.

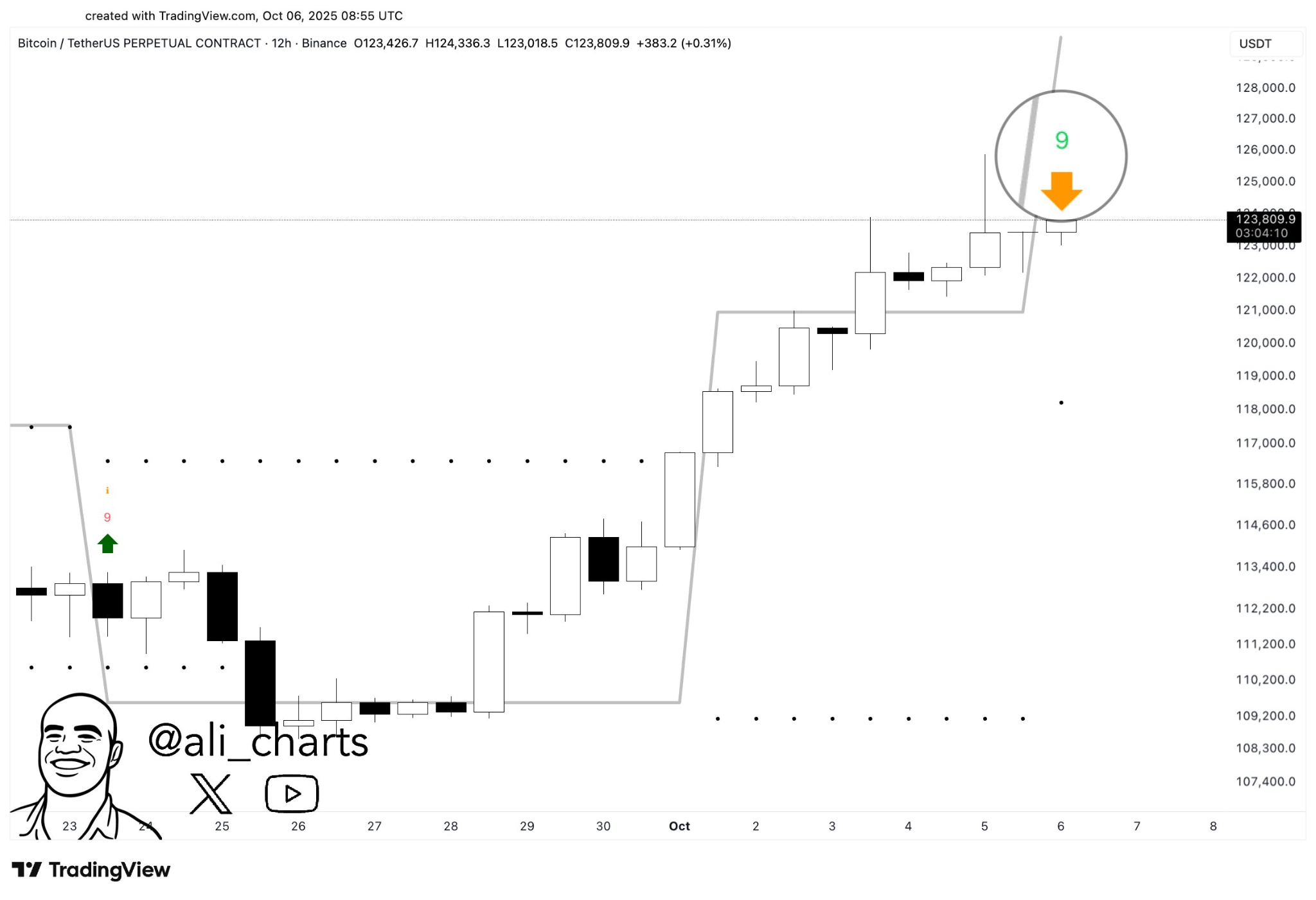

In this line, the TD Sequential indicator has flashed a sell signal on Bitcoin’s 12-hour chart, a pattern that often precedes short-term corrections, according to insights shared by analyst Ali Martinez in an X post on October 6.

The signal, marked by a “9” count, suggests profit-taking may be accelerating after Bitcoin’s sharp move past $125,000. Historically, similar patterns have signaled local tops followed by pullbacks, as traders lock in gains from overextended rallies.

If selling pressure intensifies, Bitcoin could test support levels near $120,000, a key psychological and technical zone that previously acted as a launchpad for the latest leg higher.

A breakdown below this level could pave the way for a deeper retracement, especially as market momentum cools following the asset’s parabolic run.

Key Bitcoin price levels to watch

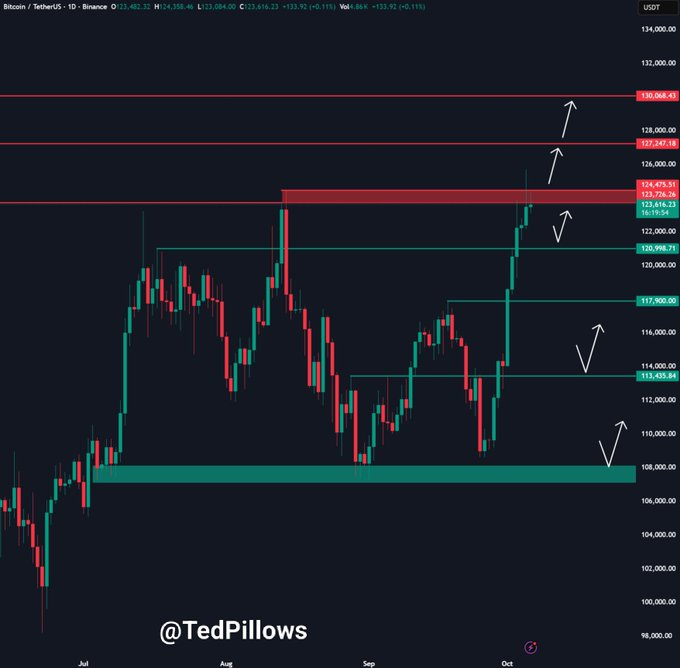

Meanwhile, cryptocurrency analyst Ted Pillows highlighted key price zones to watch in an X post on October 6. According to him, Bitcoin’s rally has stalled at the $124,000 resistance level, where momentum now appears to be fading.

The recent breakout attempt above this zone was largely driven by leveraged futures traders, indicating limited spot or institutional demand behind the move.

Pillows noted that if institutional investors return as they did last week, Bitcoin could reclaim resistance and aim for $127,000 and $130,000. However, if buying pressure fails to emerge, the market could see a retracement toward the $118,000 and $120,000 range.

Attention now turns to institutional flows through Bitcoin exchange-traded funds (ETFs), which have played a major role in driving the asset’s recent all-time highs.

Bitcoin price analysis

As of press time, Bitcoin was trading at $123,881, up 0.4% in the past 24 hours and more than 10% higher on the week.

The focus now is on whether buyers can step in to push Bitcoin decisively above the $124,000 mark.

Featured image via Shutterstock