Morgan Stanley recommends 'conservative' crypto allocation for some portfolios

Financial services giant Morgan Stanley issued guidelines for crypto allocations in multi-asset portfolios, recommending a “conservative” approach in an October Global Investment Committee (GIC) report to investment advisors.

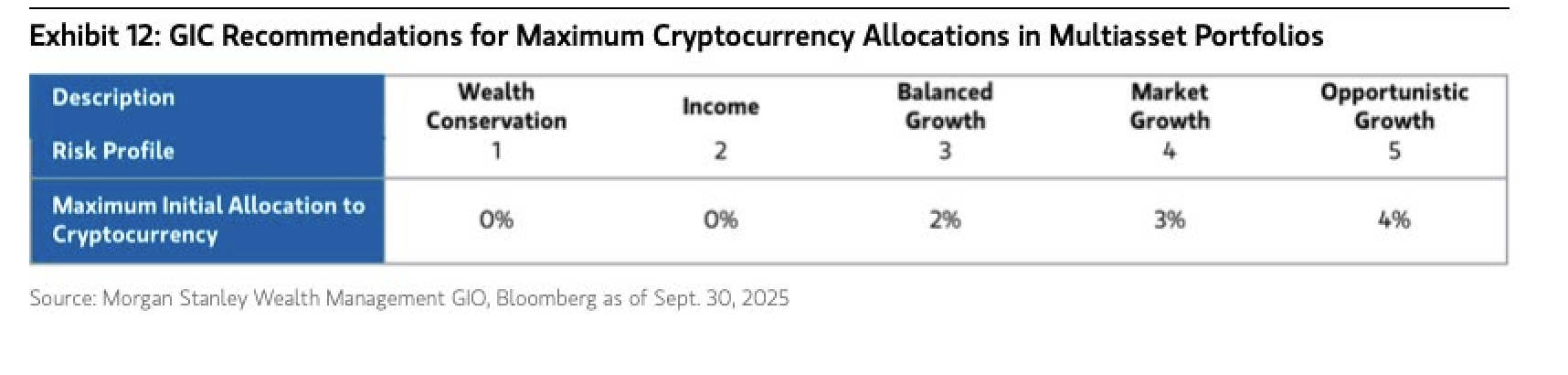

Analysts at Morgan Stanley recommended up to a 4% allocation for cryptocurrencies in “Opportunistic Growth” portfolios, which are structured for higher risks and higher returns.

The analysts also recommended up to a 2% allocation for “Balanced Growth” portfolios featuring a more moderate risk profile. However, the report recommended a 0% allocation for portfolios oriented toward wealth preservation and income. The authors wrote:

“While the emerging asset class has experienced outsized total returns and declining volatility over recent years, cryptocurrency could experience more elevated volatility and higher correlations with other asset classes in periods of macro and market stress.”

Hunter Horsley, CEO of investment manager Bitwise, called the report “huge” news. “GIC guides 16,000 advisors managing $2 trillion in savings and wealth for clients. We’re entering the mainstream era,” he wrote.

Morgan Stanley’s report reflects the growing institutional adoption and acceptance of crypto, particularly among large banks and financial services companies, which attracts more capital into the crypto markets and cements crypto’s legitimacy as an asset class.

Related: E*Trade to add Bitcoin, Ether, Solana in Morgan Stanley’s crypto expansion

Morgan Stanley report calls Bitcoin digital gold as BTC hits new all-time high

Bitcoin (BTC), which the Morgan Stanley analysts view as a “scarce asset, akin to digital gold,” continues to gain institutional adoption as a treasury reserve asset and through investment vehicles like exchange-traded funds (ETFs).

The price of Bitcoin hit a new all-time high of over $125,000 on Saturday, as BTC exchange balances, the number of coins held by exchanges available for purchase, hit a six-year low, according to data from Glassnode.

Bitcoin surged to its new all-time high amid a government shutdown in the United States and a rise in the prices of safe-haven, store-of-value, and risk-on assets.

“There is a widespread rush into assets happening right now. As inflation rebounds and the labor market weakens,” investment analysts at The Kobeissi Letter wrote on Sunday.

Magazine: Metric signals $250K Bitcoin is ‘best case,’ SOL, HYPE tipped for gains: Trade Secrets