US Bitcoin ETFs post 2nd-highest inflows since launch on crypto rally

Spot Bitcoin exchange-traded funds in the United States clocked their second-biggest day of inflows in history as Bitcoin notched a new record high on Monday.

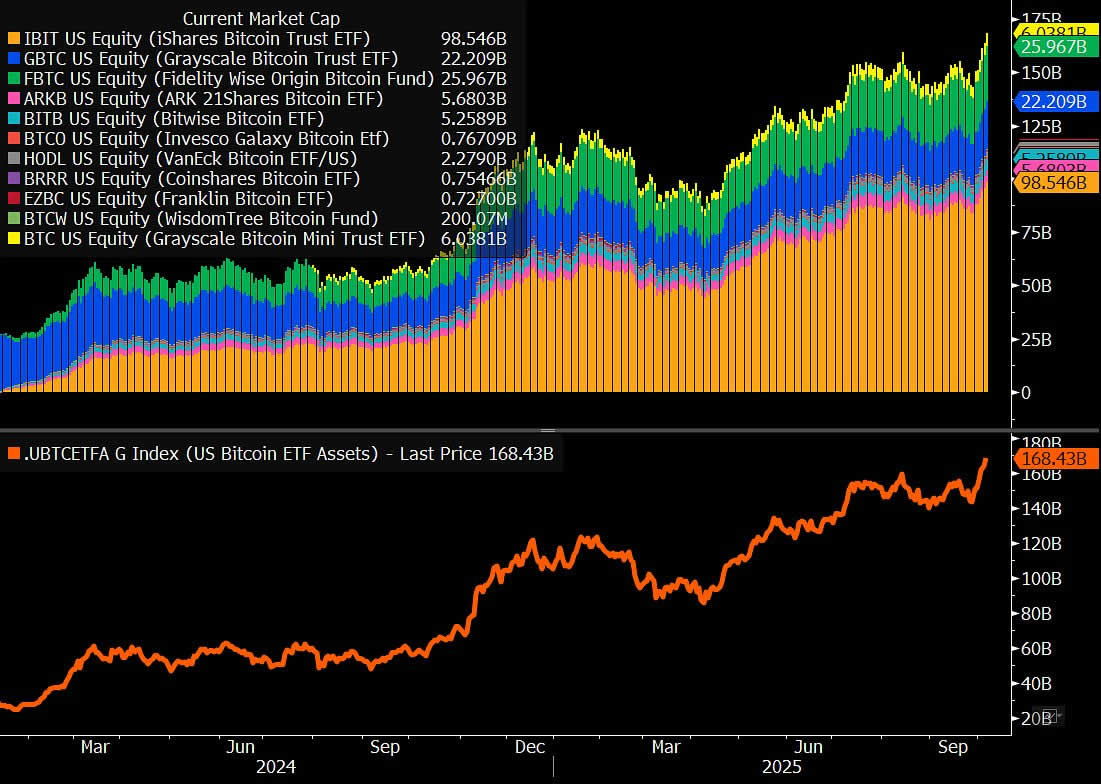

The 11 US-based spot Bitcoin ETFs saw a cumulative $1.18 billion in inflows on the day, second only to Nov. 7, 2024, when the ETFs raked in $1.37 billion after Donald Trump won the election to become the next President of the United States.

The bumper day for the ETFs, which coincided with Bitcoin’s new all-time high of over $126,000, brings October’s total inflow to $3.47 billion across just four trading days, according to CoinGlass.

Meanwhile, Bitcoin ETFs have cumulatively raked in around $60 billion since their launch, Bloomberg’s ETF analyst James Seyffart said on Monday on X.

The massive demand for Bitcoin ETPs underscores the significant influence of institutional investors in this bull market, with retail investors reportedly still on the sidelines.

BlackRock’s IBIT leads the pack

The BlackRock iShares Bitcoin Trust (IBIT) saw the lion’s share of the inflows with a whopping $967 million entering the product on Monday. The ETF has brought in $2.6 billion in inflows since the beginning of October.

Related: BlackRock chases Bitcoin yield in latest ETF as a ‘sequel’ to IBIT

The Fidelity Wise Origin Bitcoin Fund (FBTC) recorded an inflow of $112 million, the Bitwise Bitcoin ETF (BITB) had $60 million, and the Grayscale Bitcoin Mini Trust (BTC) recorded $30 million. There were minor inflows for Invesco, WisdomTree, and Franklin’s funds.

IBIT fastest to $100B AUM

The BlackRock Bitcoin ETF is on the verge of surpassing $100 billion in assets under management, observed Nova Dius President Nate Geraci on Tuesday.

According to the official website, IBIT has an AUM of almost $98.5 billion in Bitcoin and cash, and it holds 783,767 BTC.

The world’s largest ETF, the Vanguard S&P 500 ETF, took more than two thousand days to hit that mark, and IBIT is about to do it in under 450 days, said Geraci. Only 18 of over 4,500 trading ETFs have over $100 billion in AUM, he added.

Magazine: Bitcoin may move ‘very quick’ to $150K, altseason doubts: Hodler’s Digest