Securitize in talks to go public via Cantor’s blank-check firm: Report

Securitize, the tokenization platform behind several major blockchain-based investment products, including BlackRock’s tokenized US Treasury fund, is reportedly in talks with Cantor Fitzgerald to go public via a Special Purpose Acquisition Company (SPAC).

Bloomberg reported Friday, citing anonymous sources, that Securitize is in discussions to merge with Cantor Equity Partners II Inc., a blank-check firm backed by Cantor Fitzgerald. The deal could value Securitize at more than $1 billion, the report said.

Securitize did not immediately respond to Cointelegraph’s request for comment.

A SPAC is a publicly traded shell entity that raises capital with the aim of acquiring a private company. Once the merger is complete, the private company becomes public without going through the traditional, and typically lengthier, initial public offering (IPO) process.

Several crypto-focused companies have pursued this route in recent years, including Bakkt via VPC Impact Acquisition Holdings and Core Scientific via Power & Digital Infrastructure Acquisition Corp. Core was later acquired by CoreWeave for $9 billion.

Circle, the issuer of the USDC (USDC) stablecoin, announced a planned SPAC merger with Concord Acquisition Corp in 2021, though that deal was later terminated. Circle went public earlier this year with a blockbuster debut.

The talks come amid a resurgence of public listings in the digital-asset sector. In 2025 alone, companies such as Circle, Figure Technology, Gemini and Bullish have gone public, underscoring renewed institutional appetite for crypto-related equities.

Securitize has been active on the fundraising front as well. In May 2024, the company raised $47 million in a funding round led by BlackRock, with additional participation from Paxos, Aptos Labs and Circle.

Related: Wall Street’s next crypto play may be IPO-ready crypto firms, not altcoins

SPAC talks underscore growing institutional momentum behind tokenized RWAs

News of a potential SPAC involving one of the tokenization market’s biggest players underscores the accelerating interest in onchain finance.

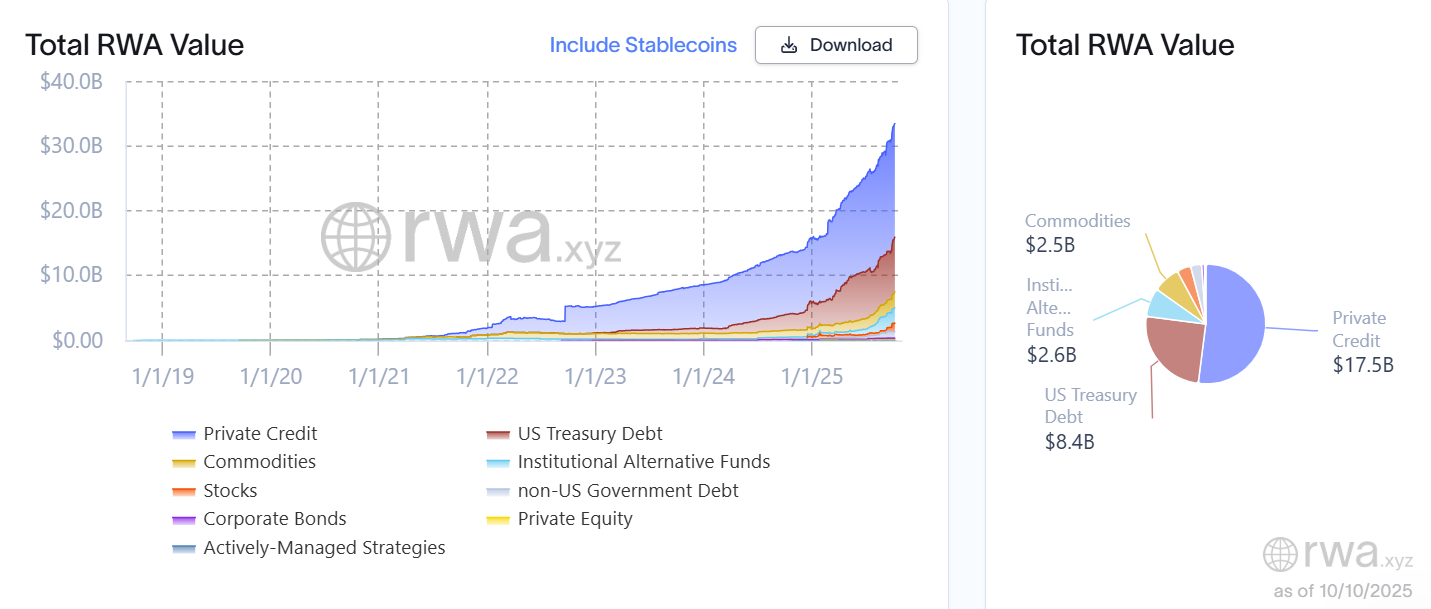

According to industry data from RWA.xyz, more than $33 billion in real-world assets (RWAs) have been tokenized on public and private blockchains, with private credit and US Treasury bonds leading the early adoption trend.

At the same time, several major financial institutions are deepening their involvement in tokenization. BNY Mellon, one of the world’s largest custodians, recently announced that it is exploring tokenized deposits to enable clients to transfer funds instantly.

Earlier this year, the bank partnered with Goldman Sachs to offer tokenized money market funds that use blockchain to track ownership and settlement.

Meanwhile, S&P Global announced earlier this week that it is launching the Digital Markets 50 Index, designed to track the performance of 15 cryptocurrencies and 35 blockchain-linked equities. The index is being developed in partnership with tokenization firm Dinari, which said it plans to offer a tokenized version of the index later this year.

Magazine: Thailand’s ‘Big Secret’ crypto hack, Chinese developer’s RWA tokens: Asia Express