BlackRock splashed $2.6 billion on this crypto as market tanked

BlackRock’s spot Bitcoin ETF continued to attract heavy investor demand even as the cryptocurrency market plunged.

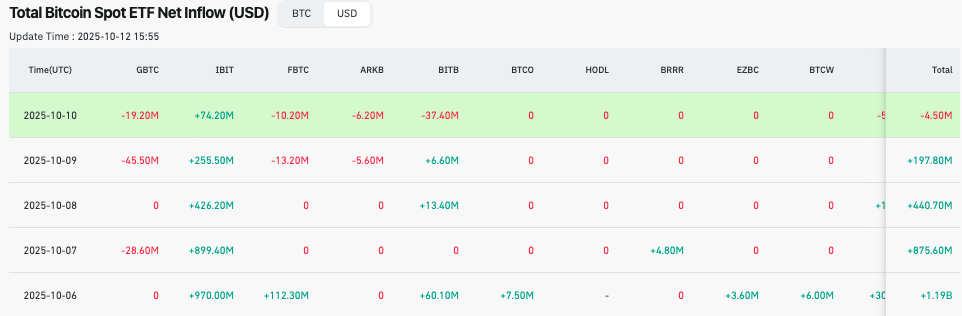

Data from October 6 to October 10 shows that the firm’s iShares Bitcoin Trust (IBIT) logged five straight days of inflows totaling roughly $2.63 billion, according to the latest on-chain data retrieved by Finbold from Coinglass on October 12.

According to ETF inflow data, IBIT recorded $970 million on October 6, $899.4 million on October 7, $426.2 million on October 8, $255.5 million on October 9, and $74.2 million on October 10.

The consistent inflows made IBIT the clear standout among U.S. spot Bitcoin ETFs, while several peers such as GBTC and FBTC saw redemptions on multiple days.

The buying spree came amid a sharp market downturn that wiped out hundreds of billions in crypto value.

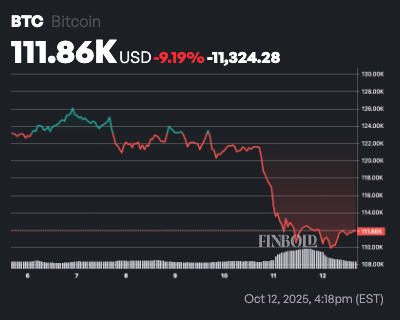

Notably, Bitcoin briefly dipped below $110,000 as panic selling swept through leveraged positions, triggering mass liquidations across exchanges.

A new round of U.S.–China trade tensions, including a 100% tariff on Chinese tech imports , unsettled global risk sentiment and sent investors fleeing from volatile assets.

The announcement sparked a broad selloff across equities, commodities, and digital assets, erasing more than $400 billion in total crypto market capitalization within days.

To this end, BlackRock’s ability to post five consecutive “green days” of inflows during one of the year’s worst crypto selloffs indicates a shift in investor behavior, suggesting that many are anticipating a rebound in the coming days.

Bitcoin price analysis

As of press time, Bitcoin was still struggling to hold the $110,000 support zone. In the past 24 hours, the cryptocurrency is down 0.5%, while over the weekly timeframe BTC had fallen more than 9%, settling at $111,918.

The asset’s main task now is reclaiming the $112,000 resistance level. If institutional capital inflows continue, Bitcoin could soon target the $115,000 range.

Featured image via Shutterstock