Monster insider trading alert for CoreWeave stock as insiders dump $1 billion

CoreWeave (NASDAQ: CRVW) is under heavy scrutiny after a wave of insider sales worth over a billion hit the tape in October, raising questions about confidence at one of 2025’s hottest AI infrastructure plays.

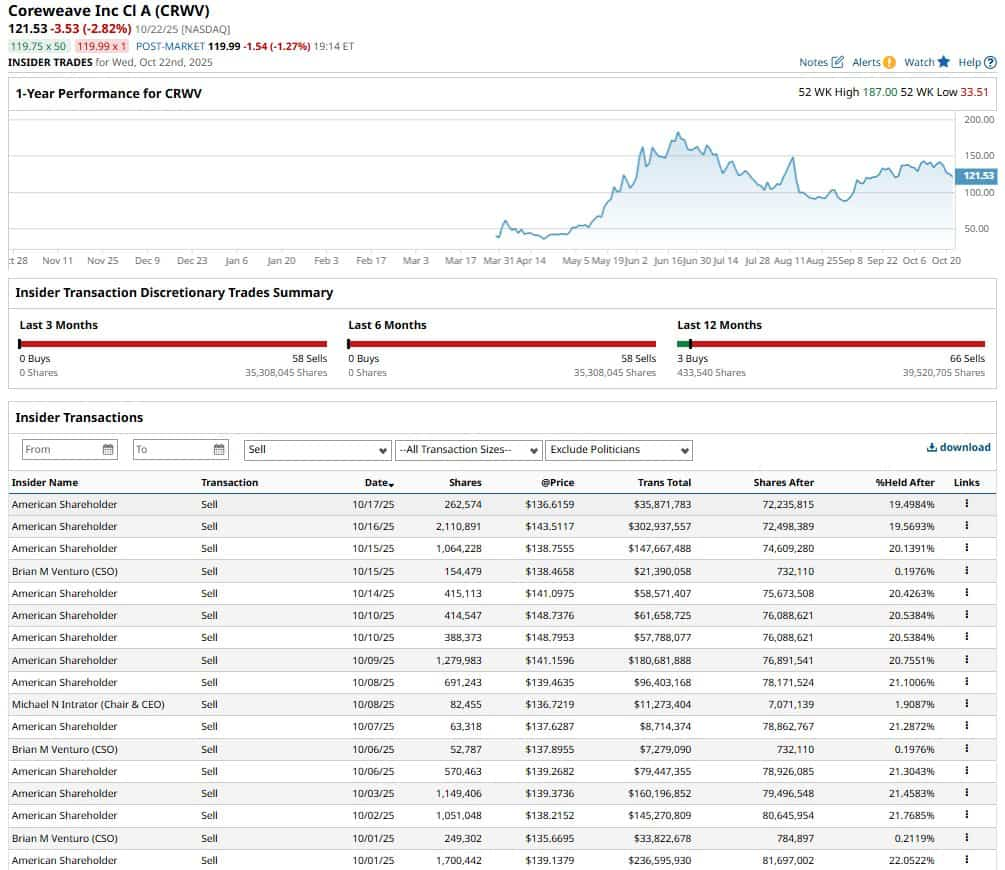

According to SEC filings, insiders unloaded more than 35 million shares in the past three months alone, with transactions valued at roughly $1.4 billion. Over the last twelve months, insiders have executed 66 sales versus just 3 buys, a lopsided picture that investors often interpret as a bearish signal.

The selling has been broad and aggressive. Between October 9 and October 17, multiple “American Shareholders” offloaded blocks ranging from 262,000 shares to over 2.1 million shares, priced between $136–$148.

Notably, Brian M. Venturo, CoreWeave’s Chief Strategy Officer, sold several tranches exceeding 150,000 shares each, while CEO Michael Intrator divested 82,455 shares at $136.72, cashing out more than $11 million in a single trade.

Despite these sales, insiders still control sizeable stakes. Venturo, for example, retains more than 22% ownership, while major shareholders continue to hold between 19–21% each. That suggests profit-taking rather than full-scale exit, but the scale of the disposals is enough to spook investors.

CoreWeave stock has already felt the pressure. Shares closed October 22 at $121.53, down nearly 3% on the day and well off the 52-week high of $187. Post-market trading pushed the stock below $120, hinting at further volatility as the market digests the insider activity.

What it means for CRVW investors

Insider selling doesn’t always mean a company is in trouble, executives often diversify holdings or lock in gains. But when selling is this concentrated, with little evidence of insider buying, it raises concerns about near-term valuation.

With AI infrastructure demand still booming, CoreWeave’s long-term story remains intact. Yet in the short term, investors will be watching whether insider confidence, or lack thereof signals that the stock’s best momentum is behind it.