AI predicts Bitcoin price with Mt. Gox repayments delayed until 2026

Finbold turned to artificial intelligence (AI) to project an average Bitcoin (BTC) price target for the end of 2025 following the news that Mt. Gox, a defunct cryptocurrency exchange, would postpone repayments to its creditors by another year.

Entities associated with Mt. Gox still control around 34,689 BTC, valued at around $3.98 billion as of the time of writing, according to Arkham.

While the figure is just a quarter of the 142,000 BTC supply the exchange held in mid-2024, analysts are still wondering how the delay could affect Bitcoin’s price in the following months, now that a dump is no longer in consideration.

BTC price prediction

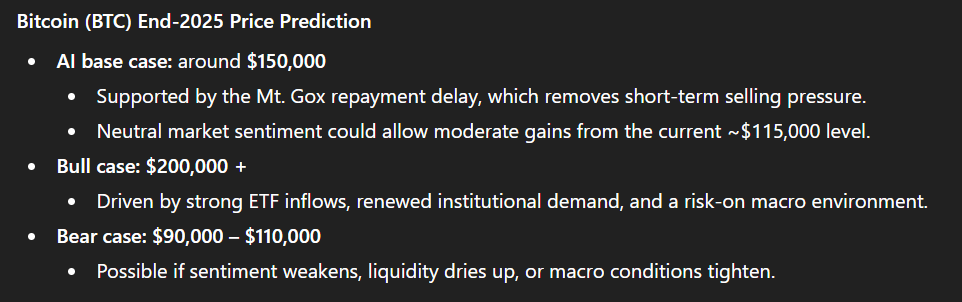

According to OpenAI’s leading model, ChatGPT-5, Bitcoin could trade around $150,000 by the end of 2025, assuming the Mt. Gox repayment delay can relieve selling pressure and the market sentiment can remain neutral in the coming months.

A more bull case, however, could see the asset trading at $200,000, provided institutional exchange-traded flows (ETF) also pick up in a “risk-on” macro environment, now that the crypto has started to recover.

However, the AI also cautioned against overly bullish expectations. That is, Mt. Gox supply delay reduces one risk factor, but it can’t guarantee that inflows or demand will pick up. Likewise, the time horizon is too short for the full impact of the new deadline to be fully appreciated.

Accordingly, a bear-case scenario could lead to a much lower price in the $90,000–$110,000 range.

BTC price analysis

At the time of writing, BTC was trading at $114,970, up 1.30% in the past 24 hours, closely tracking the broader crypto market’s 1% gain.

The rebound comes amid a mix of technical improvement, aforementioned macroeconomic relief, and renewed institutional inflows.

Most importantly, Friday’s Consumer Price Index (CPI) report came in softer than expected at +0.3% vs. +0.4%, boosting expectations of a Fed rate cut on October 29.

Meanwhile, a temporary U.S.-China trade truce over the weekend paused new tariffs and eased rare-earth restrictions, further improving risk sentiment.

In addition to Mt. Gox developments, traders are expecting the results of the next Fed meeting scheduled this Wednesday and the November 1 Washington–Beijing summit, two events that could determine Bitcoin’s short-term trajectory.

Featured image via Shutterstock