Investors should be 'cautious' when using BTC stock-to-flow model: Analyst

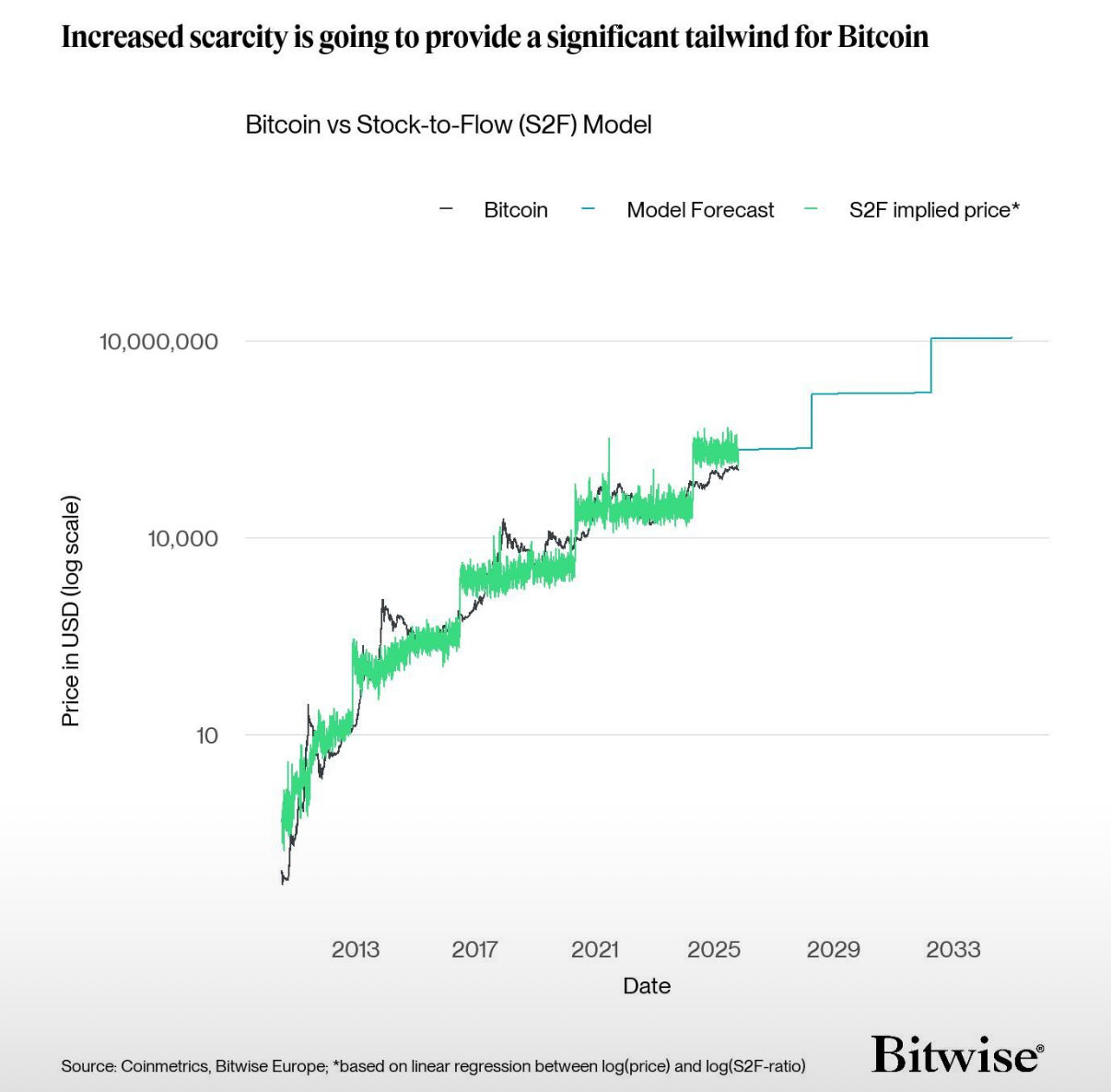

Bitcoin’s (BTC) Stock-to-Flow (S2F) model, one of the most widely cited BTC valuation frameworks, forecasts a peak price of $222,000 during this market cycle, but investors should exercise caution when using the model, according to André Dragosch, the European head of research at investment firm Bitwise.

The Stock-to-Flow model does not take into account demand-side factors, and instead, centers its price modeling on Bitcoin’s halvings, which reduce the amount of newly issued BTC by half every four years, Dragosch said. He added:

“Today, institutional demand via Bitcoin exchange-traded products (ETPs) and treasury holdings outweighs the annualized supply reduction from the latest Halving by more than seven times.”

Exchange-traded funds, ETPs, and other Bitcoin investment vehicles have created a price floor for BTC, supporting prices above the $100,000 level.

Crypto Investors and analysts continue to debate the price of Bitcoin during the current market cycle and whether BTC has topped out, or still has room to run, as the market structure matures due to the presence of institutional investors.

Related: Worst Uptober ever? Bitcoin price risks first ‘red’ October in years

Analysts debate how high BTC can go in this market cycle

Bitcoin can still reach $200,000 by the end of 2025, according to Geoff Kendrick, the global head of digital assets research at Standard Chartered, a pro-crypto bank.

The flash crash in October that took BTC down to under $104,000 might present a buying opportunity for investors, who could drive BTC to new highs.

Other analysts forecast a BTC price as much as $500,000 in 2026, driven by an explosion of the M2 money supply, a metric tracking the total amount of US dollars in existence globally.

Higher M2 is seen as a bullish catalyst for BTC, as the liquidity from the increased money supply flows into assets, raising prices.

However, crypto industry executives like Tom Lee, the CEO of investment research firm FundStrat, and Mike Novogratz, the CEO of crypto investment company Galaxy Digital, disagree.

Novogratz said that $250,000 by the end of 2025 is unlikely to materialize unless “crazy stuff” happens, while Tom Lee warned that a 50% BTC drawdown can still occur despite institutional adoption.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds: Trade Secrets