Traders Split Ahead of FOMC as Bitcoin Liquidity Builds, Whales Double Down on Longs

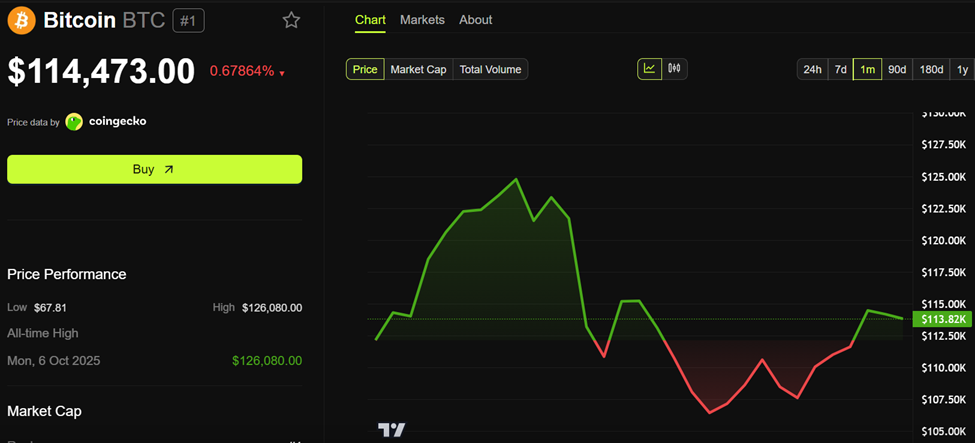

Bitcoin (BTC) traders remain on edge as the pioneer crypto consolidates below $115,000. Liquidity heatmaps show crowded short positions and whales quietly increasing exposure ahead of Wednesday’s Federal Open Market Committee (FOMC) meeting.

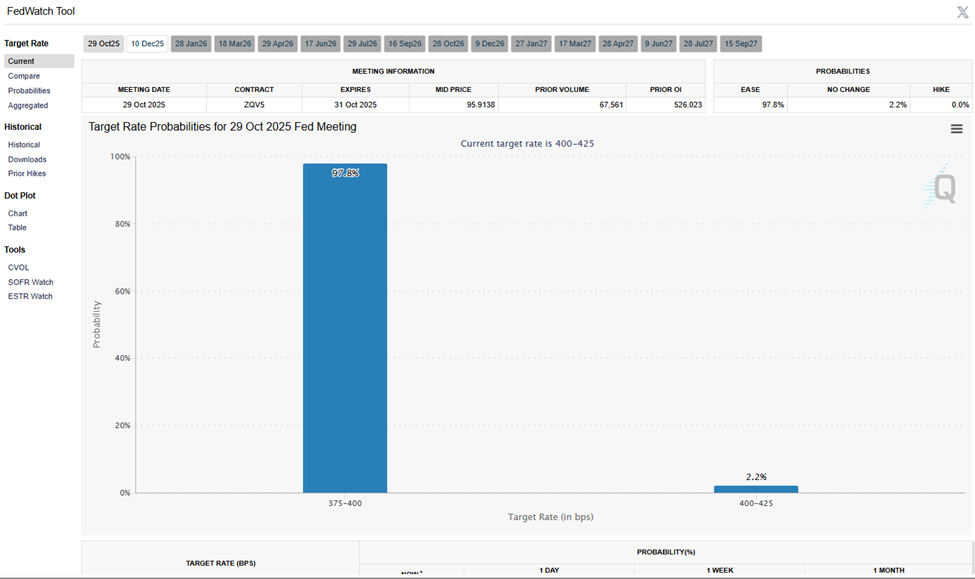

Investors wager a 97.8% chance that the Fed will cut interest rates by a quarter of a percentage point (25bps).

Liquidity Builds Ahead of FOMC as Bears Walk into a Trap

As of October 28, Bitcoin traded between $114,473, cooling off from last week’s $116,000 test. Analysts say the next major move could depend less on charts and more on the Fed.

Mark Cullen, a market analyst with AlphaBTC, described current conditions as a “Bitcoin liquidity sandwich” after identifying trapped short positions above the October 13 bounce high.

“The attempt to take the liquidity above the Mon 13th bounce high has only compounded the short liquidity as the bears piled in on the sweep. They will get rinsed again before any chance of a deeper correction,” Cullen wrote on X (Twitter).

Based on Coinglass liquidation heatmaps, Cullen’s analysis shows growing short-side pressure between $115,000 and $121,000, suggesting a possible squeeze before any deeper correction.

This view reflects a broader bullish bias among traders expecting a near-term “rinse” before new highs.

Elsewhere, data aggregator CoinAnk flagged intensifying liquidation zones on both sides of the market, with heatmap tension building between $102,000 and $112,000.

“Heat intensity in the 102,000–105,000 range rises to pink-orange, with extreme pressure on support… while the 108,000–112,000 band shows dense resistance,” the platform noted.

Such two-sided pressure often precedes sharp Bitcoin volatility, echoing broader trader indecision ahead of policy announcements.

Ran Neuner, host of Crypto Banter, highlighted a CME futures gap at the $111,000 level, a zone often targeted by retracements before larger breakouts.

“We now have a CME gap down at the $111,000 level,” he teased.

According to TradingView data, CME gaps have a 70% fill rate historically. Neuner’s comment suggests Bitcoin’s current consolidation could precede a renewed surge, depending on whether macro catalysts align post-FOMC.

FOMC Looms as Whale Confidence Returns

Data on the CME FedWatch Tool shows betters see a near-certain probability that the FOMC meeting will bring rate cuts.

Against this backdrop, trader Crypto Rover reminded followers that a similar setup in 2024 triggered a “massive Bitcoin pump.” The anticipation of a dovish pivot has revived bullish sentiment, particularly among large players.

Rover also revealed that a whale with a “100% win rate” had added $237 million in BTC longs and $194 million in ETH longs, signaling a deep-pocketed conviction that any short-term dips could be buying opportunities.

“This whale is betting big on post-FOMC upside,” Rover said, calling it “a signal that smart money expects acceleration, not hesitation.”

As traders position ahead of the Fed, Bitcoin’s order books tell a story of hesitation and hope. Bears see an overcrowded market ripe for a correction, while bulls, armed with liquidity maps and macro bets, are preparing for another leg up.

Nonetheless, as Standard Chartered predicted, this week is critical for Bitcoin. The FOMC outcome could decide whether Bitcoin breaks out of its $110,000–$116,000 range or sets up the next big rinse in crypto’s ongoing liquidity game.

The post Traders Split Ahead of FOMC as Bitcoin Liquidity Builds, Whales Double Down on Longs appeared first on BeInCrypto.