Has Bitcoin Peaked This Cycle or Is There More Fuel in the Tank?

The biggest question in bitcoin right now is: has it topped for the cycle at $126,500 on Oct. 6, or is there still more room to run?

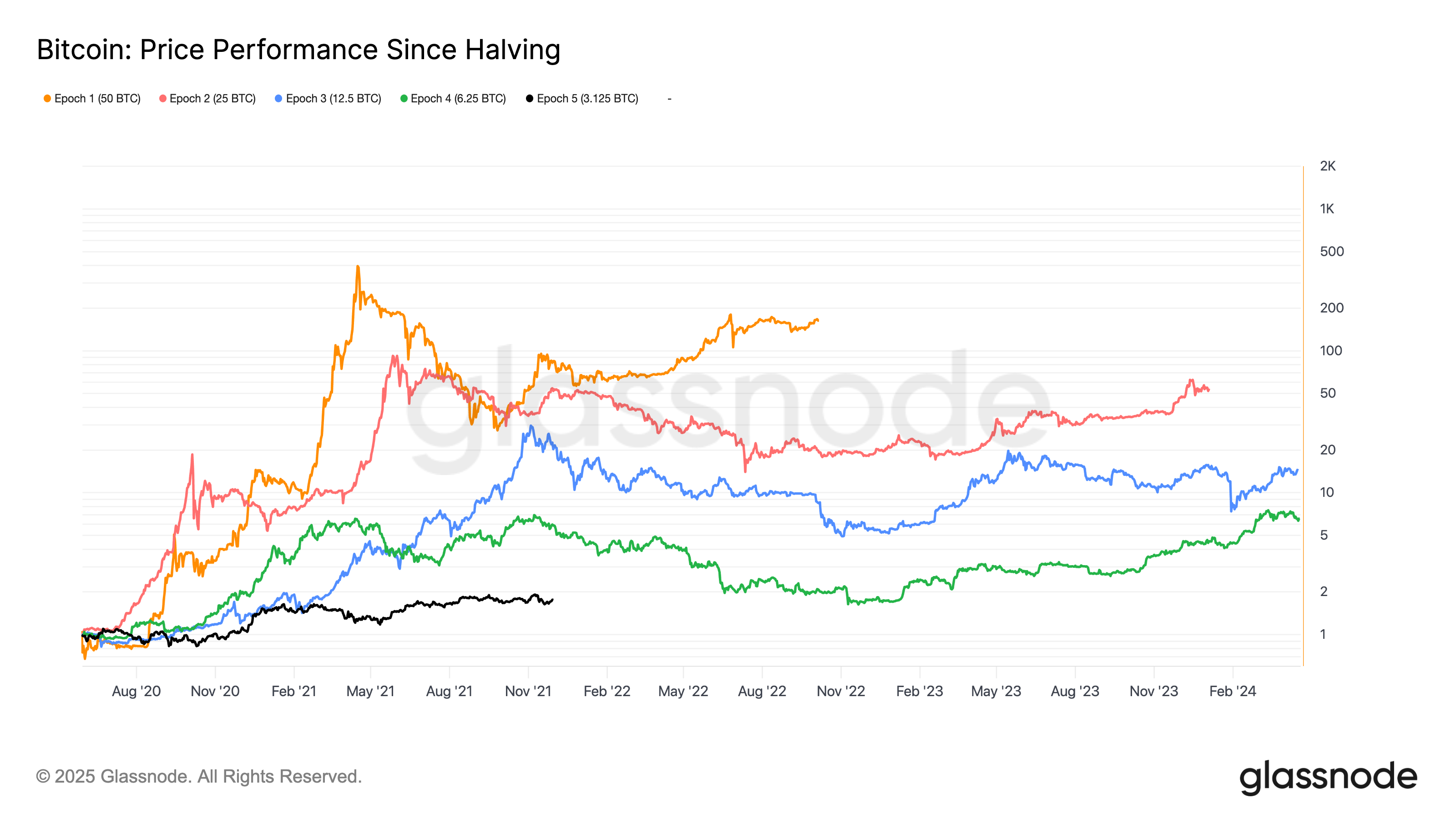

Every four years, a halving cuts the new supply of bitcoin in half. Historically, the most explosive gains have occurred roughly 18 months after a halving, yet despite being in that window, there’s been no classic “blow-off top” in price action.

As bitcoin’s market cap expands and its inflation rate and issuance become less significant each cycle, the halving’s marginal impact should, in theory, continue to diminish.

A recurring pattern since bitcoin’s early years has been three consecutive years of strong growth followed by one sharp and often prolonged bear market. With 2023, 2024, and likely 2025 posting gains, many expect 2026 to be a red year.

Even so, several indicators suggest the top may not be in as sentiment has not reached true euphoria; volatility remains subdued, and the typical blow-off top characteristics are still missing.

Onchain data show heavy realized profits from whales and long-term holders at the psychological $100,000 level throughout the year, while old coins are moving as low transaction fees and quantum security concerns encourage repositioning or selling. Eventually, however, sellers tend to become exhausted.

Unlike previous peaks in 2017 and 2021, which coincided with Federal Reserve rate hikes, this cycle is unfolding amid a cutting cycle. The Fed has already reduced rates by more than 100 basis points since September 2024, with another 25-basis-point cut expected on Wednesday and rates projected near 3.25–3.50% by Q1 2026—conditions that could give risk assets further room to run. The Fed is also ending quantitative tightening, the process of shrinking its balance sheet and draining liquidity, signaling a shift toward easier policy.

The biggest structural shift this cycle has been the introduction of U.S. spot bitcoin ETFs, launched in early 2024. Since their debut, corrections have been notably muted, rarely exceeding 20%, as these funds provide a consistent source of demand and liquidity. The addition of ETF options has further changed market dynamics, introducing volatility management strategies that minimize sharp moves in both directions.

This new layer of institutional participation has helped bitcoin evolve into a more mature macro asset. As a result, the textbook blow-off tops and deep bear markets that once defined previous cycles may no longer play out in the same way.

Gold—bitcoin’s traditional “debasement trade” counterpart—has corrected roughly 10% from its all-time high, while bitcoin has rallied more than 10% from its October low, echoing the 2020 setup when gold peaked in August just before bitcoin began its bull run in October, 2021.

Bitcoin remains below its prior cycle highs against the Magnificent 7 tech stocks (currently at 42 versus 55 in 2021) and against gold (around 40 ounces, near its 2021 level). This means bitcoin has set new highs against the U.S. dollar but not yet against key benchmark assets.

Macro uncertainty persists, with a U.S.–China tariff war, government shutdown, and sub-50 ISM Manufacturing PMI readings, although Trump’s manufacturing reshoring push and record AI investment could drive meaningful economic growth.

Despite this, sentiment remains subdued—Coinglass data show 16 days of fear and only six of neutral in the past month and volatility sits near historic lows, conditions rarely seen at a true market top. In short, while many believe the cycle has peaked, the evidence suggests bitcoin may still have room to grow.