Standard Chartered sees $2T in tokenized RWAs by 2028, matching stablecoins

Tokenized real-world assets (RWAs) may reach a cumulative value of $2 trillion in the next three years as more global capital and payments migrate onto more efficient blockchain rails, according to investment bank Standard Chartered.

The bank said in a Thursday report shared with Cointelegraph that the “trustless” structure of decentralized finance (DeFi) is poised to challenge the dominance of traditional financial (TradFi) systems controlled by centralized entities.

DeFi’s growing use in payments and investments may bolster non-stablecoin tokenized RWAs to a $2 trillion market capitalization by 2028, the investment bank predicts.

Of the $2 trillion, $750 billion is projected to flow into money-market funds, another $750 billion into tokenized US stocks, $250 billion into tokenized US funds, and another $250 billion into “less liquid” segments of private equity, including commodities, corporate debt and tokenized real estate.

Related: $19B market crash paves way for Bitcoin’s rise to $200K: Standard Chartered

“Stablecoin liquidity and DeFi banking are important pre-requisites for a rapid expansion of tokenised RWAs,” said Standard Chartered’s global head of digital assets research, Geoff Kendrick, who added:

“We expect exponential growth in RWAs in the coming years.”

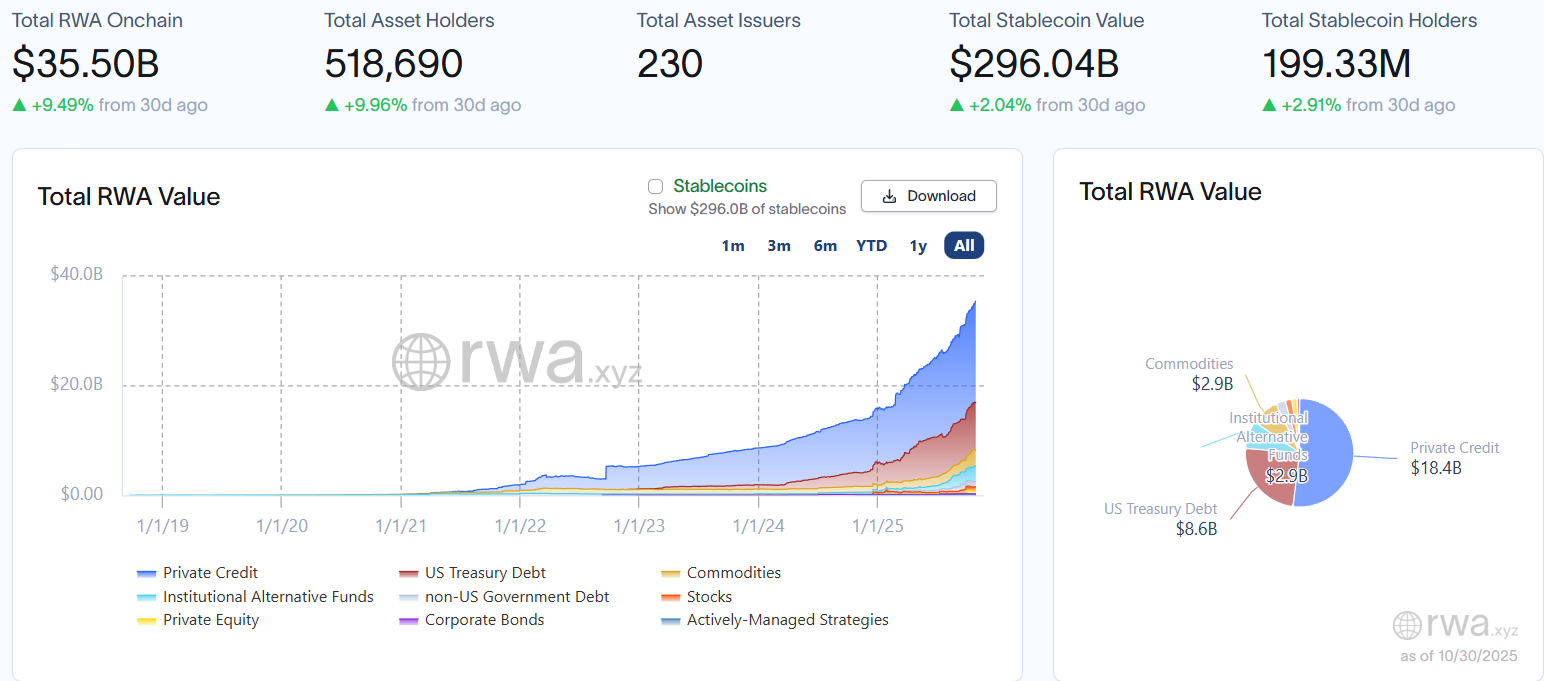

Reaching a $2 trillion market capitalization implies an over 57-fold growth for RWAs in the next three years from their current $35 billion cumulative value, according to data from RWA.xyz.

Related: Saylor’s Strategy tipped for S&P 500 inclusion after Q3 earnings: 10X Research

Stablecoins fueling DeFi’s self-sustaining growth cycle

The total stablecoin supply reached a new record of over $300 billion on Oct. 3, marking a 46.8% year-to-date growth rate.

Kendrick said the stablecoin expansion is reinforcing the broader DeFi ecosystem. “In DeFi, liquidity begets new products, and new products beget new liquidity,” he wrote. “We believe a self-sustaining cycle of DeFi growth has started.”

Despite the optimism, Standard Chartered said regulatory uncertainty remains the biggest threat to the RWA sector. The report warned that progress could stall if the Trump administration fails to deliver comprehensive crypto legislation before the 2026 midterm elections.

Magazine: Bitcoin to suffer if it can’t catch gold, XRP bulls back in the fight: Trade Secrets