Bitcoin Retests Historical Make-Or-Break Level: Here Are Possible Scenarios

Recent consolidatory price trends have pushed Bitcoin to a critical price level, and its reaction from here will determine its short-term direction.

If things close as they currently stand, Bitcoin would record its first red October in seven years. The premier asset is down 3.7% this October, and yesterday’s price fluctuation reflects the predominant uncertainty around Bitcoin’s price recently.

For perspective, Bitcoin started on a positive note, rallying to $111,620 amid a positive outcome from the US-China trade talks. However, the apex cryptocurrency quickly turned bearish as the day progressed, dropping to a low of $106,323 before closing at $108,350.

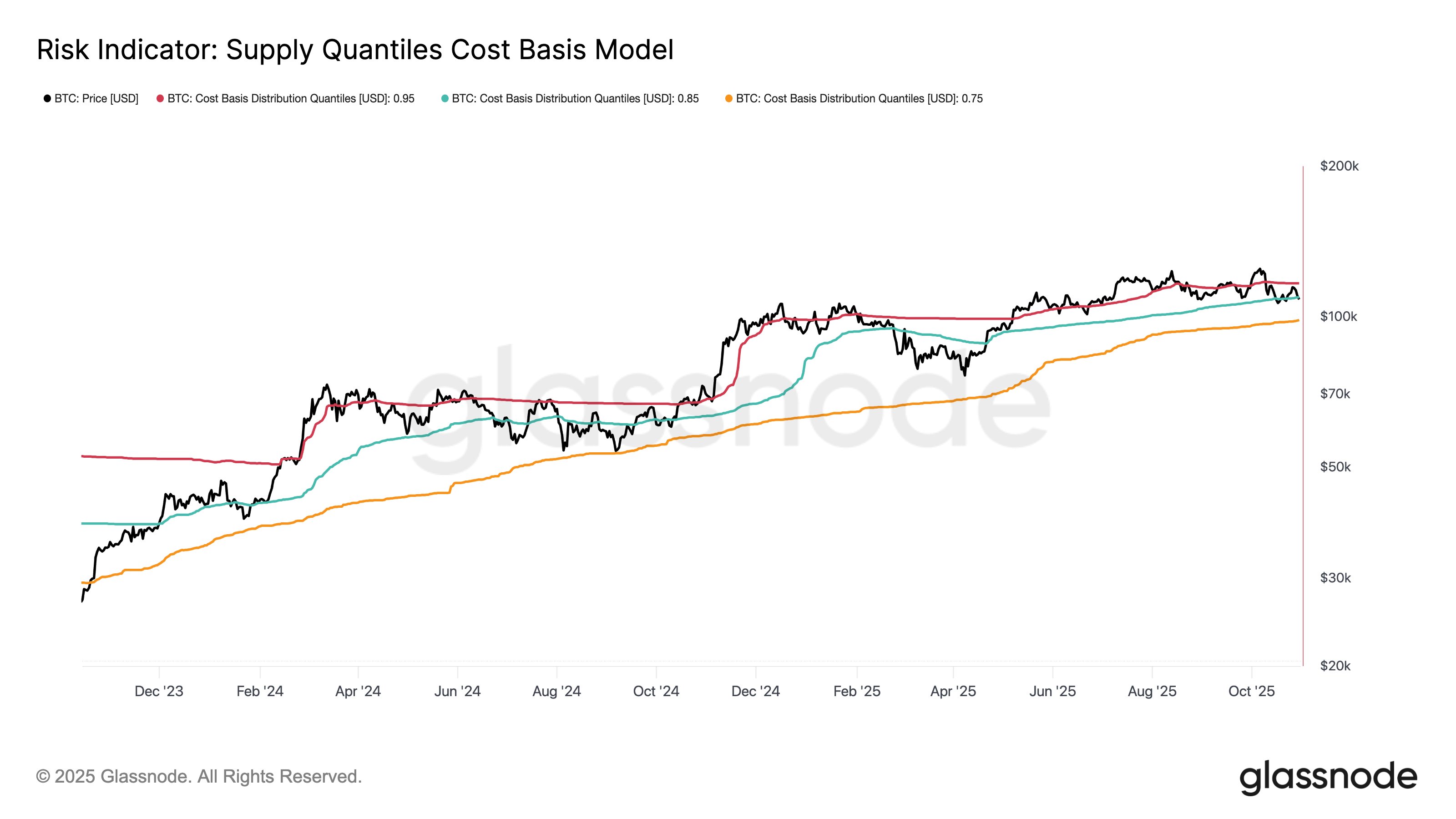

Notably, the 85th quantile, or the 0.85 cost-basis band, currently stands at around $109,000, and Glassnode has emphasized the importance of this area. The platform described the band as a “make or break” level, which has historically determined the near-term price action of Bitcoin.

Possible Scenarios for Bitcoin

Glassnode highlighted that Bitcoin needs to hold this percentile to have a chance at rebounding. The band has historically sparked major rallies when BTC holds above it.

Hence, continuing above it is bullish for the largest cryptocurrency by market cap. At the time of writing, BTC changes hands at $110,120.

However, Bitcoin would see far lower prices if it lost the area. Glassnode predicts a possible slide towards the 75th quantile, which currently stands at $98,000. The move would see BTC drop below the psychological $100,000, marking an 11% correction from the current price.

Meanwhile, Ali Martinez has highlighted the “most important” supply zone for Bitcoin in case it rebounds to higher prices. He identified it at $112,340, using data from the UTXO realized price distribution (URPD): ATH-partitioned indicator.

Right now, the most important resistance level ahead of Bitcoin $BTC is $112,340. pic.twitter.com/2s3nMJ3OQ8

— Ali (@ali_charts) October 31, 2025

The metric highlights major resistance and support areas for Bitcoin using areas where large amounts of the token changed hands. At $112,340, approximately 654,535.556 (654K) BTC (3.28% of the circulating supply) moved between addresses, potentially serving as a point of selling pressure.

Breaking above the level, which is just 2% away, would set Bitcoin up for higher prices. Notably, November is the month when Bitcoin has had its best average performance, and analysts are optimistic that BTC will perform better if it holds major support areas and breaks through this resistance.