BlackRock signals selling these 2 cryptocurrencies worth $500 million

As the broader cryptocurrency market remains in a consolidation phase, BlackRock, the world’s largest investment management firm, has moved a significant amount of digital assets, signaling potential selling activity.

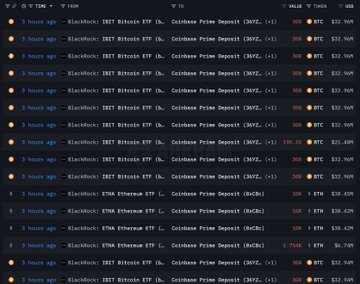

According to data from Arkham, retrieved by Finbold on November 1, BlackRock transferred a total of $506 million in cryptocurrencies.

On-chain data shows that roughly 3,496 Bitcoin (BTC), valued at about $384 million, and 31,754 Ethereum (ETH), worth approximately $122 million, were moved to Coinbase Prime. The transactions were traced to wallets linked to BlackRock’s iShares Bitcoin ETF (IBIT) and iShares Ethereum ETF (ETHA).

Notably, when institutions transfer assets to Coinbase Prime, it often indicates preparation for selling, portfolio rebalancing, or investor redemptions, since the platform provides deep liquidity and secure settlement for large-volume transactions.

While the transfer does not confirm an immediate sale, such sizable movements frequently precede liquidation events, particularly during periods of market uncertainty.

The transactions come as BlackRock’s cryptocurrency ETF products have recorded mixed inflows and outflows over the past week.

BlackRock ETFs mixed weekly trend

In this case, IBIT began the week with inflows of roughly $76 million on October 27 and $67 million on October 28, before reversing sharply with outflows of $88 million on October 29, $290 million on October 30, and $149 million on October 31.

Over the five-day period, the fund saw cumulative outflows of about $384 million, almost mirroring the amount of Bitcoin moved to Coinbase Prime.

A similar trend appeared in BlackRock’s Ethereum ETF. The ETHA fund attracted inflows of $72 million on October 27, $76 million on October 28, and $21 million on October 29, but sentiment shifted midweek, resulting in outflows of $118 million on October 30 and $38 million on October 31.

Meanwhile, both Bitcoin and Ethereum are showing limited price action as markets await a clearer direction. As of press time, Bitcoin was trading at $109,871, down less than 1% over the past 24 hours, while Ethereum gained about 0.5%, trading at $3,868.

Featured image via Shutterstock