As the cryptocurrency market experiences a notable sell-off, whales have been offloading massive amounts of Bitcoin (BTC), contributing to bearish sentiment.

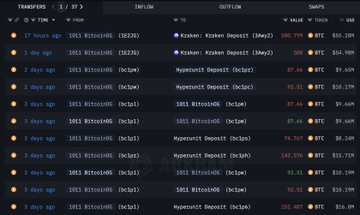

Specifically, long-term holders have deposited roughly 13,000 BTC, valued at $1.48 billion, to major exchanges including Kraken, Binance, Coinbase, and Hyperliquid since October 1, according to the latest on-chain data retrieved from Arkham by Finbold on November 3.

Further analysis indicates that a prominent address, identified as Owen Gunden, transferred 3,265 BTC, worth about $364.5 million, to Kraken since October 21.

Notably, such exchange deposits typically signal selling pressure, as large holders move assets from cold storage to trading platforms. The trend suggests that some of Bitcoin’s earliest investors are taking profits or reducing exposure amid growing market volatility.

These whale deposits have coincided with Bitcoin’s price decline, adding to concerns that more sell-offs could follow. Bitcoin has lagged the broader market, plunging below the $110,000 mark.

Bitcoin price analysis

By press time, BTC was valued at $107,165, down 3% in the past 24 hours and over 7% on the weekly timeline. The sell-off comes as the broader market drains about $120 billion in capital.

The current sentiment follows a flash crash earlier in October that dragged Bitcoin as low as $104,000, with the broader crypto market struggling to recover.

Currently, markets also slid alongside equities after Federal Reserve Chair Jerome Powell indicated that a December rate cut isn’t “a foregone conclusion,” fueling investor caution. Meanwhile, Bitcoin-focused ETFs recorded $1.15 billion in outflows last week, highlighting institutional hesitancy.

Traders will closely watch the U.S. jobs report on November 7, as stronger-than-expected employment data could reinforce a hawkish Fed stance. A recent U.S.-China trade agreement offered little relief, while Coinbase data showed Bitcoin’s usual U.S. premium had turned negative, reflecting subdued retail and institutional demand.

Featured image via Shutterstock