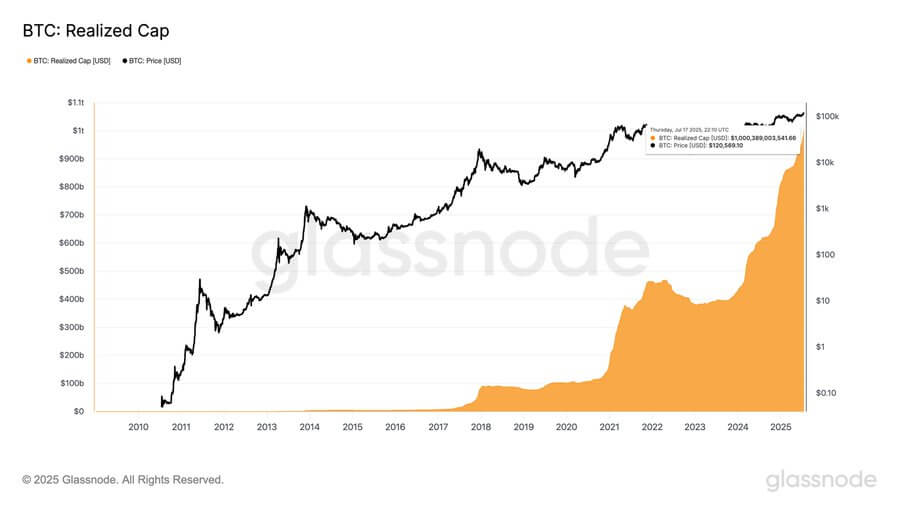

Bitcoin hits $1T realized cap as price aims to break resistance

Bitcoin has reached a new milestone with its realized capitalization crossing the $1 trillion mark for the first time, according to on-chain analytics firm Glassnode.

The surge comes just a few days after BTC’s spot price hit a fresh all-time high above $123,000, underlining the intensity of recent investor demand.

Unlike traditional market capitalization, realized cap measures the value of Bitcoin based on the price each coin last moved on-chain. This approach offers a clearer picture of actual capital stored in the network and is widely regarded as a more accurate indicator of investor conviction.

James Check, an on-chain analyst at Checkonchain, highlighted the importance of this metric by describing it as the “most important Bitcoin market metric.”

He explained:

“[The metric] values every coin at the price when it last transacted onchain. If you DCA’d 0.1 BTC back at a $10,000 price, it will be saved at 0.1x$10,000 = $1,000, irrespective of spot price. When it transacts again, it will be revalued, capturing capital flows in or out of the asset. What this metric means, is Bitcoiners have ‘saved’ $1 Trillion in real capital in Bitcoin.”

Meanwhile, Glassnode revealed that 25% of Bitcoin’s realized cap was added this year. According to the firm, this reflects the accelerating inflow of capital into the asset amid broader macro and institutional interest.

Bitcoin price faces resistance

Following this milestone, market analysts have cautioned that BTC must overcome a key resistance level at $123,370 before targeting new highs.

Joao Wedson, CEO of blockchain analytical firm Alphractal, warned that BTC’s recent rejection at this second “Alpha Price” level is a short-term red flag.

The Alpha Price is a dynamic on-chain model that blends realized price, historical average cap, and other factors to estimate likely resistance and support zones.

Wedson said:

“[Alpha Price] behaves almost like pressure zones: lower levels tend to act as strong support, while upper levels often signal increased selling pressure—especially when most wallets are deep in profit. These thresholds reflect shifts in investor sentiment and can define where buyers and sellers are likely to react.”

However, should BTC price overcome the resistance at $123,370, Alphractal forecasts the next major target between $143,000 and $146,000.

Still, the risk of an overheated derivatives market hangs on the horizon.

According to Alphractal, long positions, or traders betting on further price increases, have been dominating in recent months.

While this reflects bullish sentiment, it also increases the risk of a sudden “Long Squeeze”, a situation where falling prices liquidate overleveraged longs and could amplify downward pressure on the market.