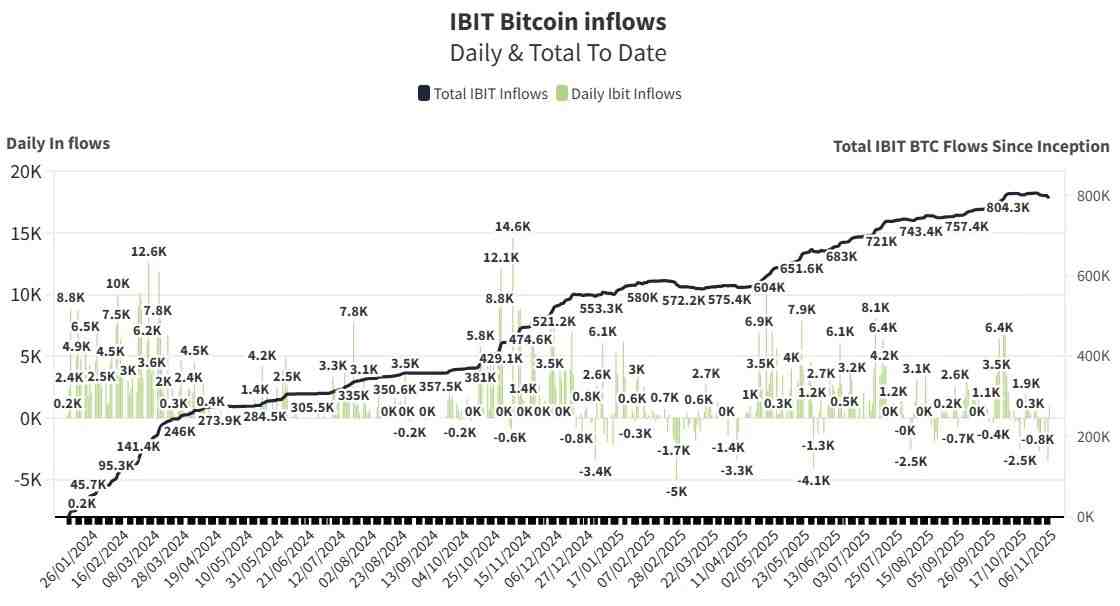

BlackRock, the world’s largest asset manager, added 921 Bitcoin (BTC) to its portfolio on Thursday, November 6, but the overall net holdings are still 5,300 BTC in the red this week, signaling active portfolio adjustments amid ongoing market volatility.

With the recent sales, the fund’s reserves have diminished, now totaling around 798,000 BTC, valued at over $80 billion at current prices, according to HeyApollo ETF tracker data shared by co-founder Thomas Fahrer on November 7.

Looking at the broader picture, BlackRock has accounted for more than half of this week’s Bitcoin ETF outflows, which have amounted to a total of 8,132 BTC, worth $861 million.

Will Bitcoin recover?

Trading at $100,840 at the time of writing and down more than 2% on the day, Bitcoin has slipped 20% from its October all-time high of $126,080.

The weakness has been the result of a convergence of bearish factors, including escalating U.S.–China tensions, government shutdowns, and institutional outflows. What’s more, October’s historic crash that wiped out $19 billion in liquidations has extended into November, dragging BTC down 17% over the past month.

Some optimism still lingers, though. For instance, Tom Lee, Co-Founder and Head of Research at Fundstrat Global Advisors, believes the macro conditions could soon reverse.

“Hopefully headwinds become tailwinds when you can resolve these things…. The October 10 deleveraging was the biggest in history, and that means there are still ripple effects being felt even two weeks later. It’s going to take some time for confidence to come back,” said Lee in a November 6 interview with CNBC.

From this point of view, the year’s finish will thus hinge on inflation data, liquidity, and Federal Reserve policies. Of course, the weakening U.S. dollar and renewed ETF inflows will also be important catalysts to watch.

Short-term uncertainty, on the other hand, remains, as the crypto has already slipped below $100,000 this week, with some warning signs pointing to a potential drop to as low as $92,000.

Featured image via Shutterstock