Bitcoin Erases Recovery As Coinbase Users Relentlessly Sell

Bitcoin has retraced its recent recovery above $104,000 as data shows the Coinbase Premium Gap has continued to be negative.

Bitcoin’s Coinbase Premium Gap Has Been Red Recently

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, investors on Coinbase keep selling Bitcoin. The indicator of relevance here is the “Coinbase Premium Gap,” which measures the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

When the value of this metric is positive, it means the asset is trading at a higher rate on Coinbase than Binance. Such a trend suggests the users of the former are applying a higher buying pressure (or lower selling pressure) than those of the latter. On the other hand, the indicator being under the zero mark implies Binance users are the ones participating in a higher amount of accumulation as they have pushed the asset to a higher price on the platform.

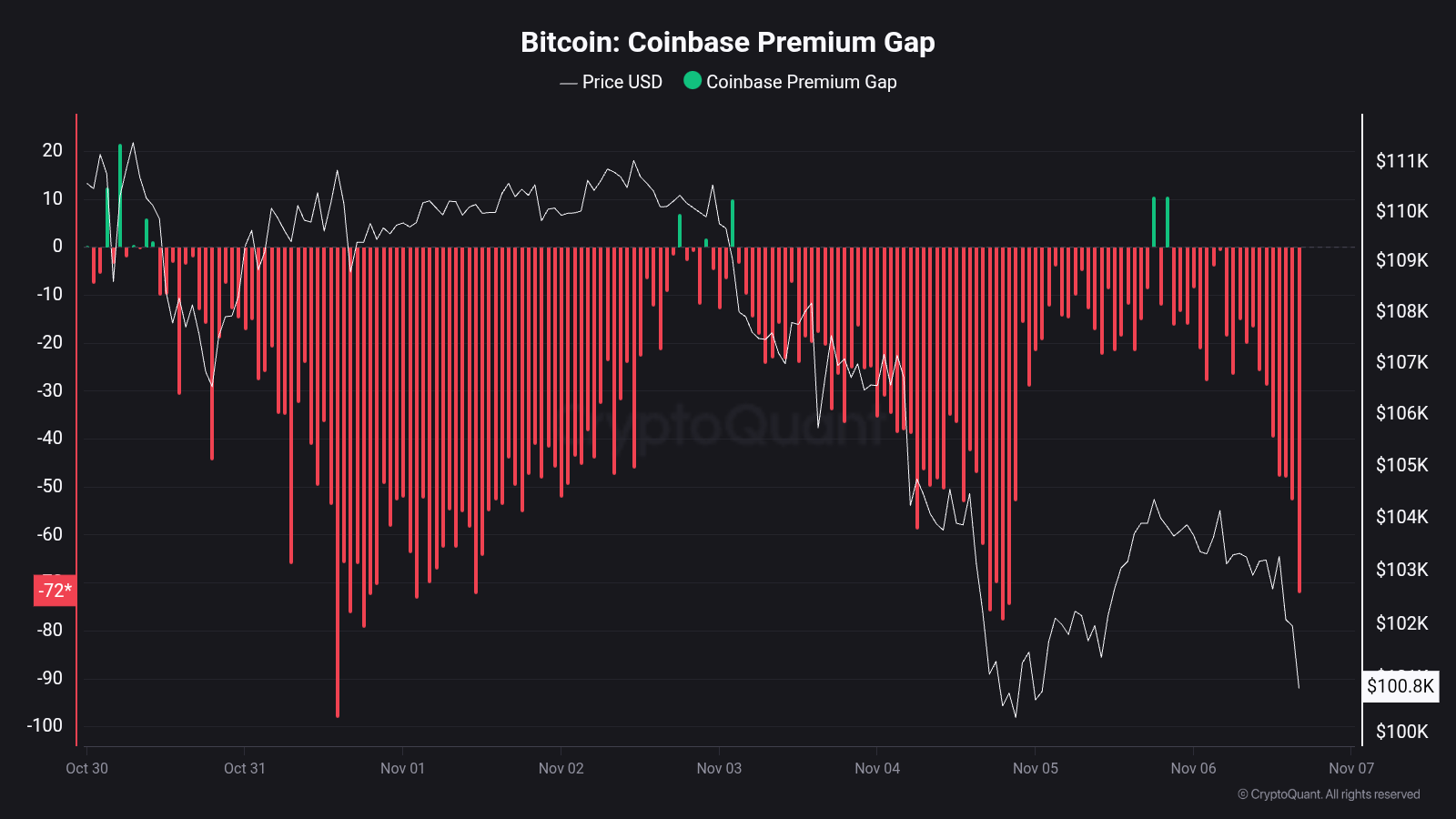

Now, here is the chart shared by Maartunn that shows how the Coinbase Premium Gap has fluctuated over the past week:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap has stayed mostly in the negative zone during the past week, implying users on Coinbase have been participating in selling. The metric briefly turned neutral-green as the cryptocurrency witnessed a surge back above $104,000, but since then, the indicator’s value has again plummeted, and with it, the BTC price has erased its recovery.

Since the start of 2024, Bitcoin has often reacted to movements in the Coinbase Premium Gap in a similar manner, showcasing how Coinbase users have been a driving force in the market. The exchange is mainly used by American investors, especially large institutional entities like the spot exchange-traded funds (ETFs), so the Coinbase Premium Gap essentially reflects how the US-based whales differ in behavior from Binance’s global traffic.

Since the indicator has been red recently, it would appear that the American institutions have been distributing the cryptocurrency. Considering the pattern over the last couple of years, it’s possible that BTC’s recovery might depend on whether a bullish sentiment can return among this cohort.

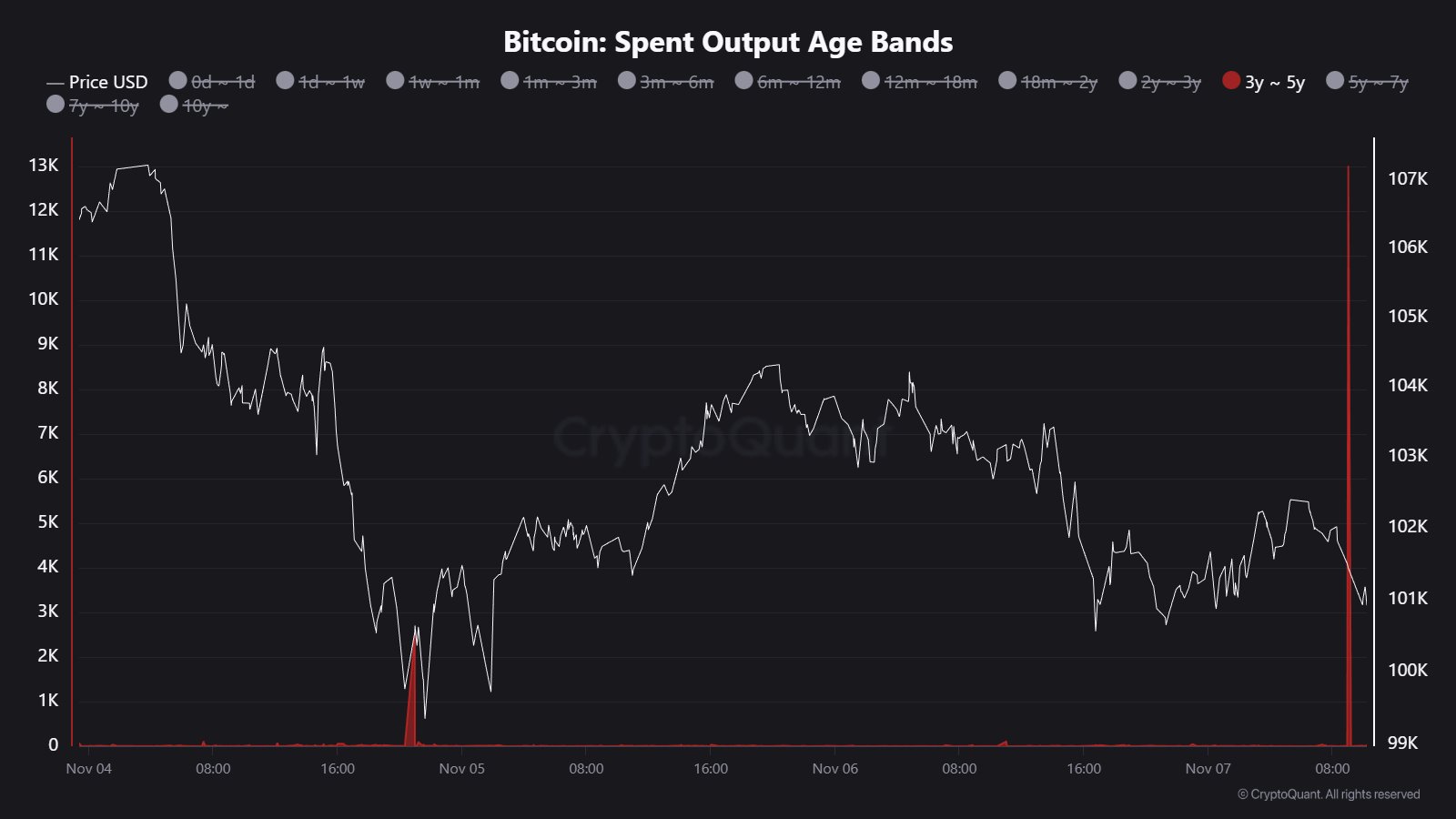

In some other news, a movement of old tokens has just been spotted on the Bitcoin blockchain, as Maartunn has highlighted in another X post.

From the chart, it’s visible that a stack of over 13,000 BTC that has been dormant for between 3 and 5 years has become involved in a transaction, a potential sign that a HODLer may be gearing up for selling.

BTC Price

At the time of writing, Bitcoin is trading around $100,200, down almost 9% over the last week.