Bitcoin Valuation Reset: MVRV Slides Into Macro Correction Territory — What This Means

Bitcoin’s latest market pullback has pushed its MVRV ratio back into a critical zone that has historically been associated with macro correction lows and early-stage recovery setups. The MVRV metric now reflects a valuation reset similar to the conditions that preceded major rebound phases in prior cycles.

Why The Reset Reinforces Bitcoin Value Proposition

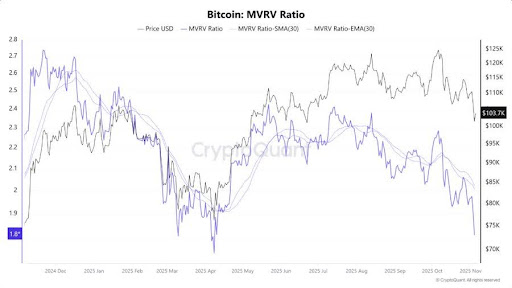

The crypto bearish performance echoes through the Bitcoin community as the Market Value to Realized Value (MVRV) ratio dips into the critical 1.8 to 2.0 range, a zone significant for past cycle corrections where BTC found its footing before initiating a recovery. An ambassador and market expert, BitBull, has revealed on X that for those unfamiliar with its significance, the MVRV ratio compares BTC’s current market value to its realized value, which is what investors actually paid for their coins.

However, when this ratio dips near 2, it signals that a majority of holders are hovering around their cost basis. At this point, there’s no greed left in the system, just conviction. Historically, this 1.8 to 2.0 MVRV range has coincided with major market bottoms in June 2021, November 2022, and April 2025, when the market felt broken, but BTC was quietly resetting.

With the MVRV ratio currently re-entering this same critical zone, combined with the massive liquidations observed recently and a palpable sense of panic across the market, the pattern feels eerily familiar. Every time sentiment turns into hopelessness, on-chain data would show a different story of exhaustion, not collapse.

BitBull personally views this phase as one of compression, not capitulation, indicating short-term pain but a long-term opportunity. The same market dynamics cycle that previously punished excessive leverage is now washing out the remaining weak hands. BitBull concluded that if history rhymes, this will be the part of the story where the bottom gets written, not the top.

Why Liquidity Matters More Than Interest Rates

Liquidity has been a crucial component of the Bitcoin market. A full-time crypto trader and investor, Daan Crypto Trades, has pointed out that if there is one macro factor that drives BTC and the broader crypto market, it’s the amount of global liquidity within the financial system, not interest rates.

This correlation is clear from comparing the global liquidity index with BTC’s price movements over the years. Daan has recently observed a shift where global liquidity has stopped expanding and begun to trend downwards again.

However, this change has put a halt to BTS’s upward momentum, combined with the anticipated profit-taking behavior observed during the 4-year market cycle. “Once global liquidity starts expanding at a rapid pace, the market environment for crypto will become significantly more supportive than it is currently,” the expert noted.