Robert Kiyosaki says he’s buying, targets $250K Bitcoin and $27K gold

Rich Dad Poor Dad author Robert Kiyosaki has doubled down on his bullish outlook for hard assets, saying he’s buying more gold, silver, Bitcoin and Ethereum even as markets brace for a potential crash.

In a post shared on X on Sunday, Kiyosaki warned of an impending economic downturn but said he’s preparing for it by accumulating assets he calls “real money.”

“Crash coming: Why I am buying, not selling,” he wrote, setting ambitious targets of $27,000 for gold, $100 for silver and $250,000 for Bitcoin (BTC) by 2026.

Kiyosaki said his gold projection came from economist Jim Rickards, while his $250,000 Bitcoin target aligns with his long-held view of BTC as protection against the Federal Reserve’s “fake money.”

Related: Bitcoin is having its IPO moment, says Wall Street veteran

Kiyosaki turns bullish on Ether, citing Tom Lee’s call

Kiyosaki is also turning bullish on Ether (ETH). Inspired by Fundstrat’s Tom Lee, Kiyosaki said he views Ethereum as the blockchain powering stablecoins, giving it a unique edge in global finance.

He explained that his conviction in these assets stems from Gresham’s Law, which says that bad money drives out good, and Metcalfe’s Law, which ties network value to the number of users.

Kiyosaki, who claims to own both gold and silver mines, criticized the US Treasury and Federal Reserve for “printing fake money” to cover debts, calling the United States “the biggest debtor nation in history.” He repeated his well-known mantra that “savers are losers,” urging investors to buy real assets even during market corrections.

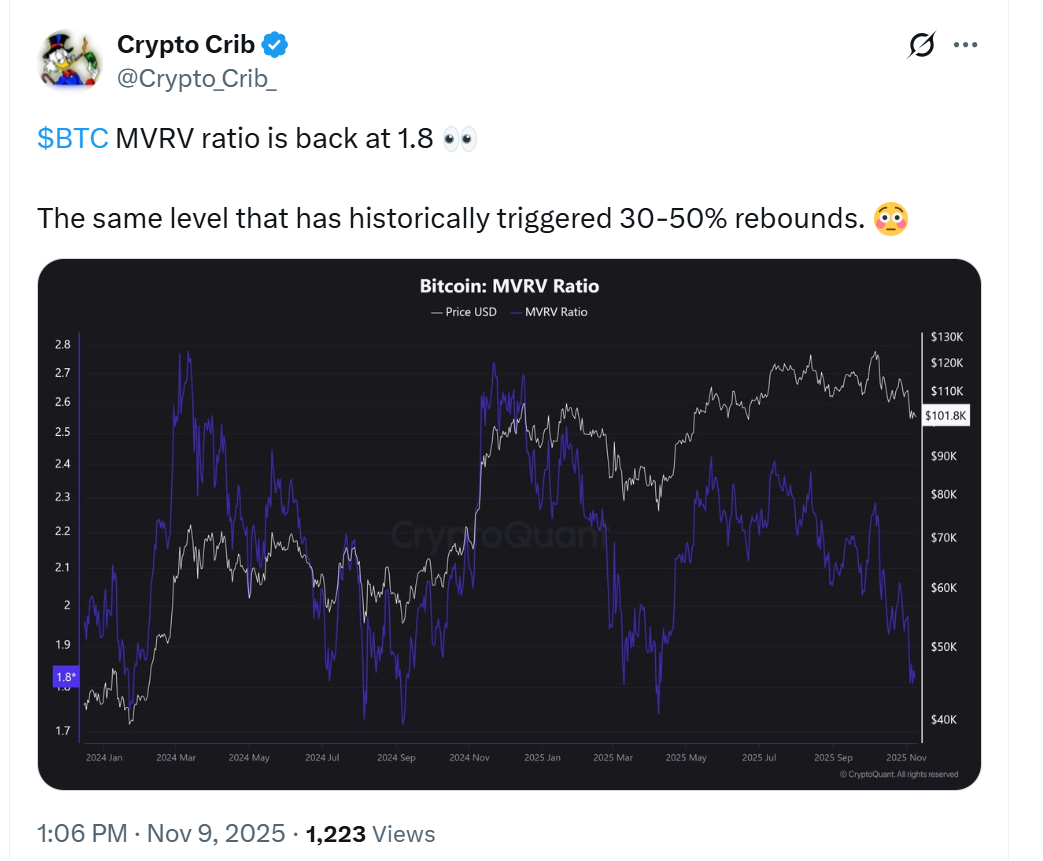

Meanwhile, on-chain data appears to support a potential turnaround for Bitcoin. Market analytics platform Crypto Crib noted that Bitcoin’s Market Value by Realised Value (MVRV) ratio, a key indicator of market value versus realized value, has returned to 1.8, a level that has historically preceded 30–50% rebounds.

Related: French Gov’t Set to Review Motion to ‘Embrace Bitcoin and Cryptocurrencies’

Hayes says rising US debt will fuel Bitcoin rally

Last week, former BitMEX CEO Arthur Hayes said that the Federal Reserve will be forced into a form of “stealth quantitative easing (QE)” as US government debt continues to surge. He said the Fed will likely inject liquidity into the financial system through its Standing Repo Facility to help finance Treasury debt without officially calling it QE.

According to Hayes, this quiet balance sheet expansion will be “dollar liquidity positive”, ultimately driving up asset prices, particularly Bitcoin and other cryptocurrencies.

Magazine: Bitcoin OG Kyle Chassé is one strike away from a YouTube permaban