Rumble (NASDAQ: RUM) shares are surging in pre-market trading after the video-sharing platform reported third-quarter results showing sharp improvement in profitability despite a modest dip in revenue.

By press time, the stock was trading at $5.89, up 17% in pre-market activity. Even with this rally, Rumble remains down more than 50% year to date, reflecting a volatile 2025 performance.

Why Rumble stock is rallying

The company reported a net loss of $16.3 million, or $0.06 per share, for the quarter, matching Wall Street expectations and marking a notable improvement from the $31.5 million loss recorded a year earlier. Revenue came in at $24.8 million, slightly below the consensus estimate of $26.86 million and about 1% lower than the same quarter last year.

Rumble’s monthly active users declined to 47 million from 51 million in the previous quarter, which the company attributed to lower news and political engagement outside the U.S. election cycle and reduced creator activity during summer months. However, average revenue per user rose 7% to $0.45, signaling progress in monetization.

A key bright spot in the report was expense management. Operating costs fell with the cost of services down 31% to $25.2 million, driven by an $11.9 million reduction in programming and content spending.

Beyond cost improvements, Rumble continues to broaden its strategic partnerships. For instance, in August, it formed an alliance with Cumulus Media to expand content distribution and monetization across both platforms.

In October, it teamed up with Perplexity to integrate AI-powered search features that enhance video discoverability.

Wall Street cautious on RUM stock

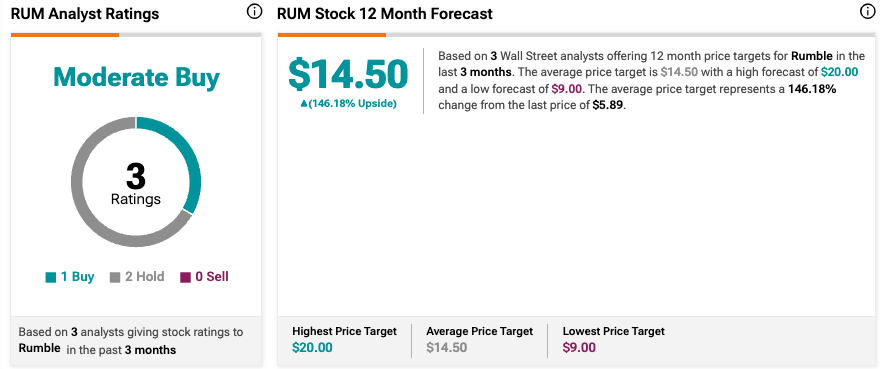

Meanwhile, Wall Street analysts are turning cautiously optimistic on Rumble, assigning the stock a ‘Moderate Buy’ rating amid expectations of a significant rebound over the next year.

According to data from the past three months, three analysts over at TipRanks have issued ratings for the video-sharing platform, one ‘Buy’ and two ‘Hold’ recommendations, with no ‘Sell’ ratings.

The analysts’ average 12-month price target stands at $14.50, representing a potential 146% upside from Rumble’s recent price of $5.89. Forecasts range from a high target of $20 to a low estimate of $9.

Featured image via Shutterstock