95% of Bitcoin has now been mined: Here’s why it’s important

Bitcoin’s total circulating supply has just crossed 95% of its 21 million hard supply cap — a massive milestone baked in nearly 17 years ago when creator Satoshi Nakamoto mined the genesis block on Jan. 3, 2009.

With 19.95 million Bitcoin now in circulation, this leaves just 2.05 million Bitcoin to be mined. The question is, what does this mean for the future of Bitcoin and its price?

Speaking to Cointelegraph, Thomas Perfumo, a global economist at crypto exchange Kraken, said it’s an important milestone in the Bitcoin narrative, because annual supply inflation is currently around 0.8% per annum, and hard money “requires a credible narrative for people to confidently adopt a currency as a store of value.”

“Bitcoin uniquely combines its functionality as a global, real-time and permissionless settlement protocol with the certainty of authenticity and scarcity you’d expect from a masterpiece like the Mona Lisa.”

“This milestone is a reminder of Bitcoin’s resistance against debasement and intervention, operating as designed nearly 17 years later,” Perfumo added.

95% Bitcoin supply issued won’t alone pump prices

It has been speculated that by limiting the entrance of new supply, each coin’s value should increase as demand increases while supply is choked.

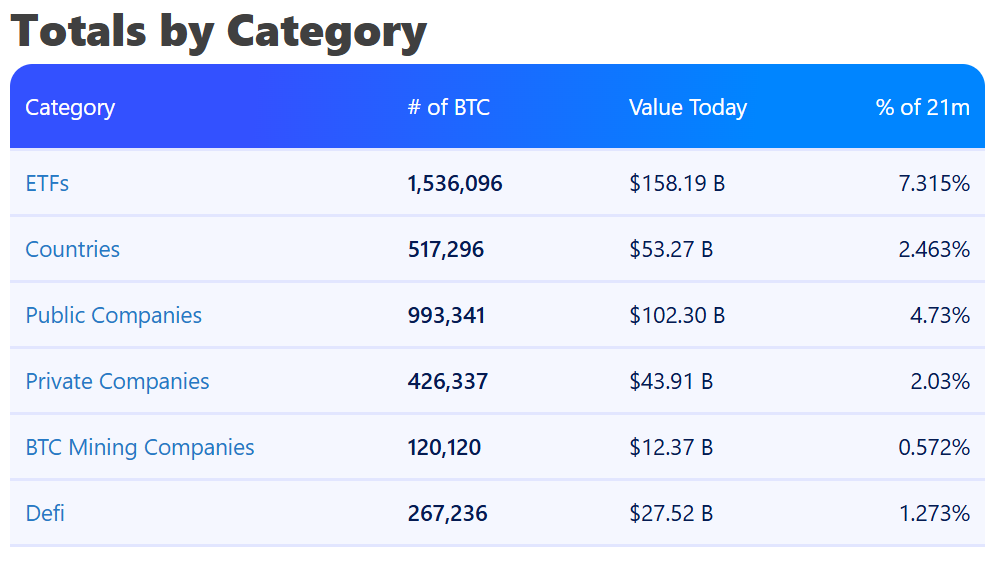

However, Jake Kennis, a senior research analyst at onchain analytics platform Nansen, said the milestone is unlikely to immediately move the market. It does, however, validate Bitcoin’s digital gold narrative and highlights how core holders and institutional players are locking up the limited supply for long-term holding.

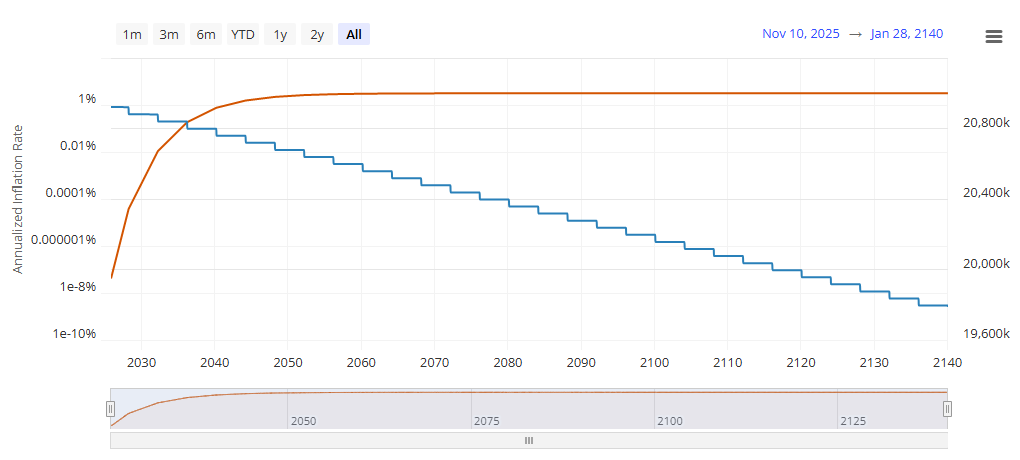

“It emphasizes Bitcoin’s scarcity, but the remaining 5% will take well over 100 years to reach 100% circulation due to halving events. While increased scarcity can psychologically support prices, this particular milestone is more of a narrative event than a direct price catalyst,” Kennis said.

“The real story isn’t the 95% number itself, but Bitcoin’s supply schedule working exactly as designed, it is predictable and scarce in an era of unlimited fiat money printing,” he added.

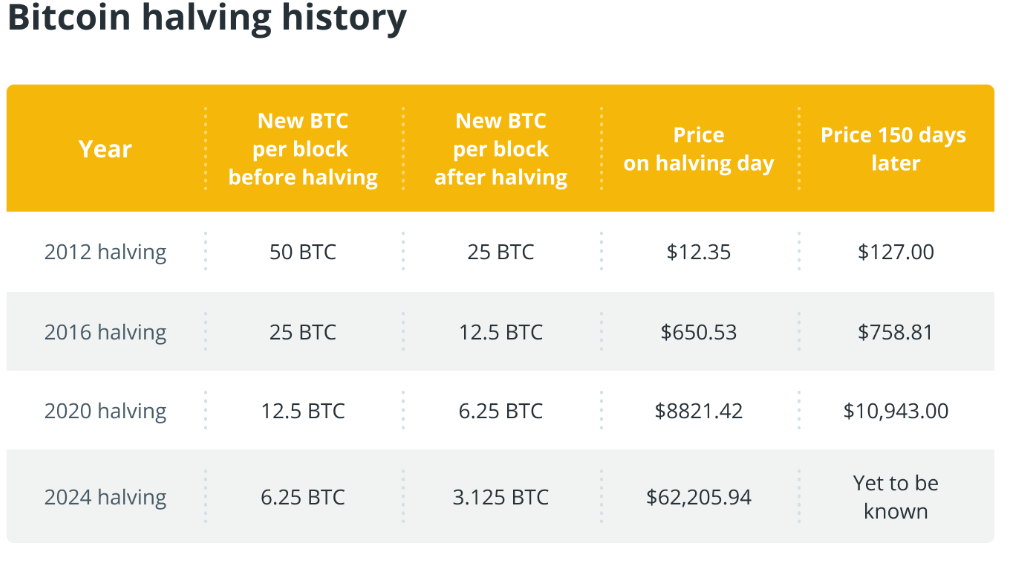

Based on the block discovery rate and the halving process, which occurs roughly every four years, or every 210,000 blocks of transactions, the last Bitcoin is predicted to be mined around 2140.

Supply milestone is a sign of Bitcoin’s maturity

Marcin Kazmierczak, the co-founder of blockchain oracle RedStone, also believes the 95% milestone is unlikely to be an immediate price catalyst, as Bitcoin’s supply dynamics are already well-known, tokens have been released over the past decade, and markets have gradually absorbed them.

However, he said the milestone highlights why scarcity matters for Bitcoin’s long-term value, and traders should be more focused on whether the infrastructure supporting it can scale to support the next phase of institutional integration.

Related: Bitwise’s exec says 2026 will be crypto’s real bull year, here’s why

“What matters more is macroeconomic context, adoption trends, and regulatory clarity than hitting an arbitrary percentage threshold,” Kazmierczak said.

“The real inflection points were earlier in the supply curve. What this does represent is Bitcoin’s maturitydash — we’re moving from a growth-phase asset toward one with fixed, predictable long-term scarcity. That’s valuable for institutional adoption, but it’s not a market-moving event in itself.”

Miners could be forced to change soon

A price spike might not be incoming, but Kennis said the dwindling supply is likely to increase the pressure on miners who are already feeling the pain from the April 2024 halving, which reduced the reward for each block to 3.125 Bitcoin.

“Miners are already feeling the impact of reduced block rewards from halvings, most recently in 2024, forcing them to rely increasingly on transaction fees for profitability,” he said.

“The 95% milestone underscores this long-term transition, potentially pushing out less efficient miners while the network hash rate typically recovers quickly.”

Kazmierczak shared a similar view, stating that as supply growth slows dramatically, the economics of mining will undergo a fundamental shift.

“We’re transitioning from block reward-dependent miners to transaction-fee-dependent miners. This creates pressure on miners to consolidate or seek efficiency gains,” he said.

Magazine: Big Questions: Did a time-traveling AI invent Bitcoin?