Bitcoin (BTC) is facing renewed downward pressure as more traders signal intentions to offload the asset amid intensifying bearish conditions.

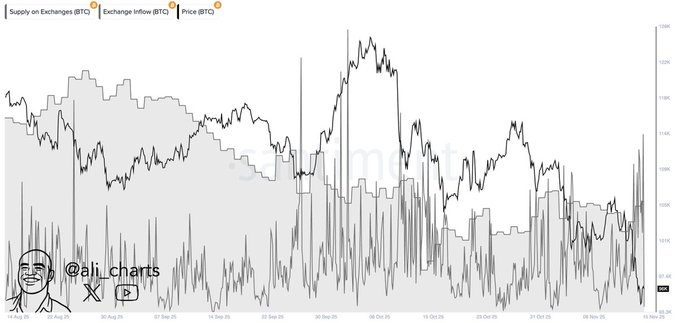

Data shows that more than 10,000 BTC, worth nearly $1 billion, flowed onto crypto exchanges within 72 hours, according to insights from Santiment shared by analyst Ali Martinez on November 16.

The sharp spike in exchange inflows is raising concerns about increased selling activity at a time when market sentiment is already fragile.

Notably, this pattern is often associated with investors preparing to sell. Inflows have risen sharply, coinciding with short-term price drops, while overall exchange supply has edged higher after months of decline.

This shift is widely considered a bearish catalyst. Large inflows boost liquidity and heighten the risk of aggressive sell-offs, especially as Bitcoin struggles to hold key support levels.

Historically, heavy inflows have closely aligned with rapid spot-price declines, highlighting how sensitive Bitcoin is to sudden supply changes. If this trend continues, deeper retracements are likely as traders brace for further selling.

Bitcoin under more bearish pressure

The continued transfer of coins to exchanges comes as Bitcoin battles to hold the $95,000 support zone, increasing the likelihood of additional losses.

To this end, crypto analyst Ted Pillows in an X post on November 17 highlighted a major technical warning: Bitcoin’s weekly Supertrend has turned red for the first time in nearly three years, a signal that has historically preceded deeper corrections.

The indicator flipped bearish as Bitcoin extended its decline from the $130,000 region, breaking the multi-year uptrend that began in late 2022. Previous red phases, last seen in 2021–2022, coincided with prolonged downturns, while green periods supported steady higher highs.

Now trading around $95,000 and $100,000, Bitcoin has fallen decisively below the Supertrend support band, indicating sellers have regained control. With lower highs forming and momentum fading after the failed breakout above $120,000 and $130,000, downside risk remains elevated.

Notably, a rebound is still possible, but the bearish Supertrend suggests any recovery will face strong resistance unless buyers reclaim key weekly trend levels.

Bitcoin price analysis

By press time, Bitcoin was trading at $95,498, down nearly 1% in the past 24 hours, while on the weekly timeframe the asset has dropped almost 10%.

With potential selling pressure building, Bitcoin bulls now face the crucial task of stepping in to defend the fragile $95,000 support zone.

Featured image via Shutterstock