Bitcoin now facing ‘gravity pull’ to $50,000, warns strategist

Bloomberg Intelligence senior commodity strategist Mike McGlone says Bitcoin (BTC) may be entering a decisive phase as market conditions increasingly point toward a potential drawdown toward the $50,000 zone.

Notably, the outlook comes as Bitcoin continues to face downward pressure, dropping below the $90,000 mark for the first time since April. At press time, the asset was trading at $91,431, down over 4% in the past 24 hours and 13% over the past week.

McGlone’s latest assessment argued that markets may be approaching the early stages of a deflationary environment, with year-end positioning, muted stock-market volatility, and a steep rise in gold adding strain to speculative assets.

“Stock Market Reversion? $50,000 Bitcoin Gravity Pull May Guide – Broad markets may be approaching the start of some post-inflation deflation, if Bitcoin’s a guide,” McGlone said.

He noted a 10% decline in the Bloomberg Galaxy Crypto Index through mid-November highlights this shift, reinforcing expectations that risks for Bitcoin are tilting lower.

McGlone’s insights are further supported by long-term data showing Bitcoin’s yearly candle for 2025 is tracking toward its first negative annual close since the 2022 downturn, a contrast to the strong rebound seen in 2023 and 2024.

Historically, red yearly candles in Bitcoin’s cycle have often preceded extended cooling phases rather than immediate recoveries.

Notably, the S&P 500 continues to climb steadily, but the widening gap between Bitcoin’s late-2024 peak and its current level signals fading crypto momentum even as equities push higher.

McGlone highlights $50,000 as a key threshold, aligning with the upper range of prior yearly candles, and warns that this level now acts as a gravitational pull for Bitcoin as liquidity tightens and speculative appetite weakens.

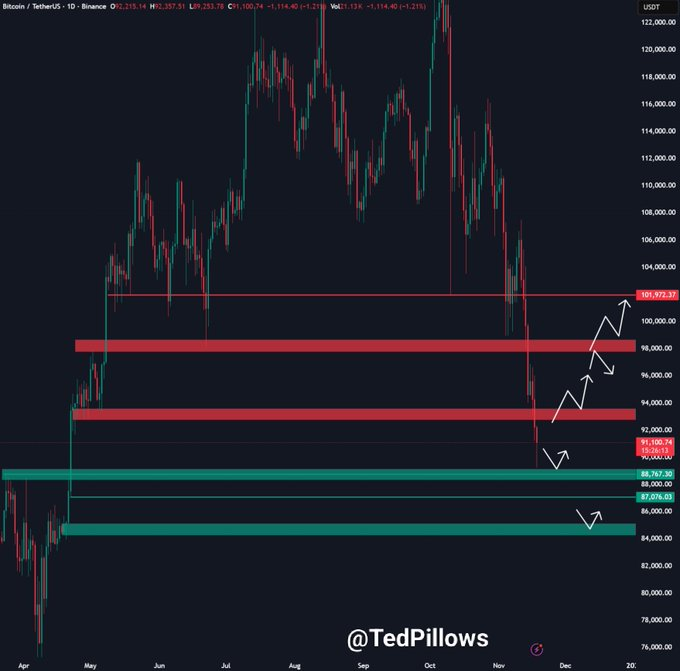

Bitcoin key price levels to watch

Meanwhile, Bitcoin extended its sharp decline after filling the widely watched CME futures gap, breaking below the $90,000 level and triggering renewed volatility across the market.

According to analyst Ted Pillows, the drop pushed BTC directly into a critical support region between $88,000 and $90,000, which he views as a potential liquidity-sweep zone.

He added that Bitcoin often gravitates toward untested levels after major dislocations, and this latest move may help establish a local bottom if buyers step in.

At the same time, he cautioned that a deeper, “capitulation-style” wick remains possible before stability returns, given the speed and intensity of the recent sell-off.

Featured image via Shutterstock