Tether backs Parfin to push institutional USDT adoption across Latin America

Tether has invested in Parfin, a London- and Rio de Janeiro-based digital asset platform, to push USDT deeper into Latin America’s institutional market and expand onchain settlement across the region.

According to Tether, the investment underscores its push to position USDt (USDT) as an institutional settlement rail for high-value activities, including cross-border payments, real-world asset (RWA) tokenization, and credit markets tied to trade finance, commercial invoices and card receivables.

Founded in 2019, Parfin builds infrastructure for institutions to custody, tokenize and transact digital assets. In October, the company secured official registration in Argentina as a virtual asset service provider and was recognized by the country’s financial regulator. It has been operating in Brazil since 2020.

Tether CEO Paolo Ardoino said the investment reflects the company’s “belief in Latin America as one of the global powerhouses for blockchain innovations.”

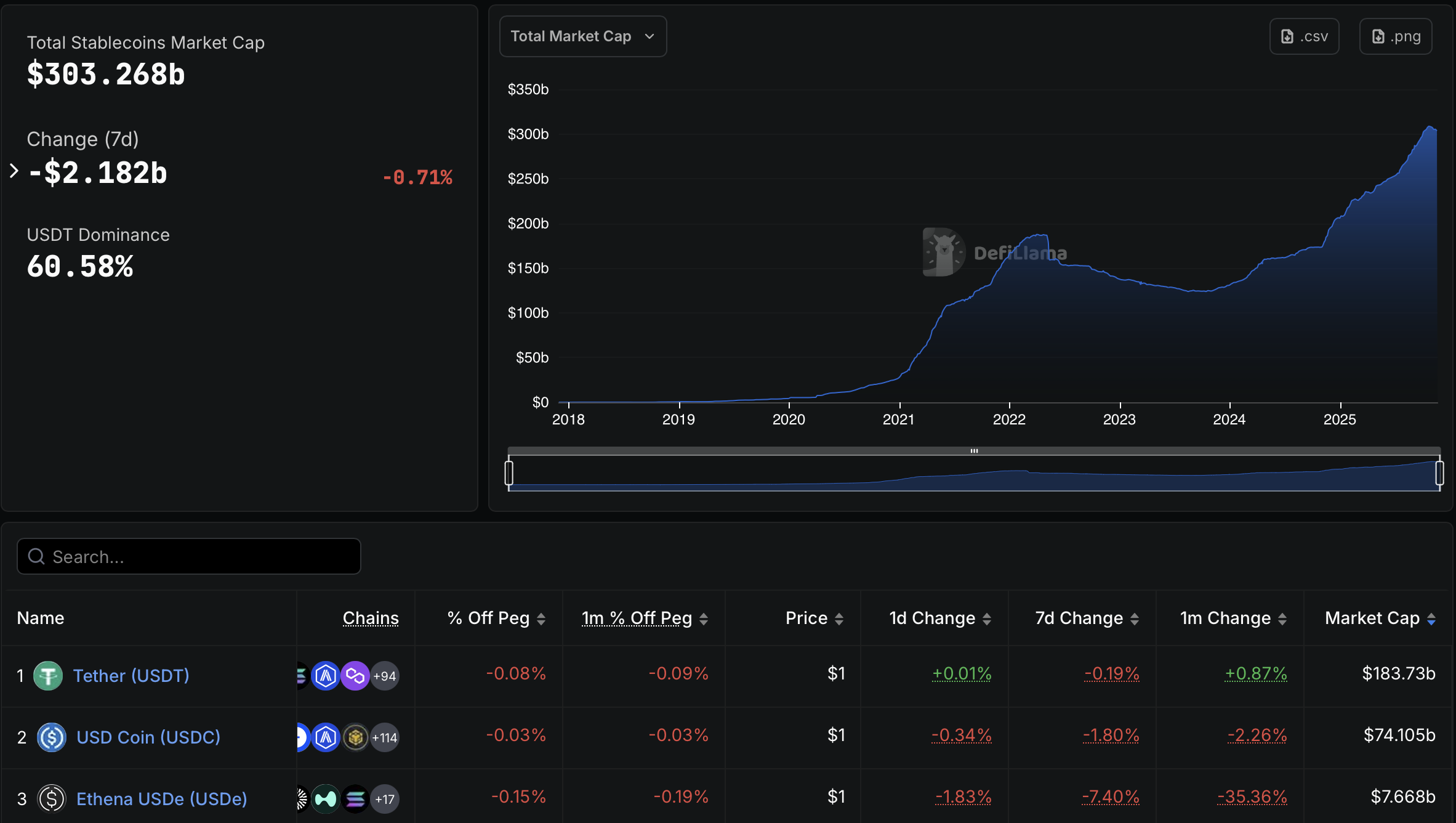

Tether’s USDT is the largest stablecoin in the world, with a market cap of about $183.73 billion, according to DefiLlama data. The total market capitalization of all stablecoins is currently around $303.2 billion.

Tether’s investment, the size of which was not disclosed, comes a few days after it invested in Ledn, a Bitcoin-backed lending platform.

Related: Tether mulls $1.15B deal with AI robotics startup Neura: Report

The rise of crypto in Latin America

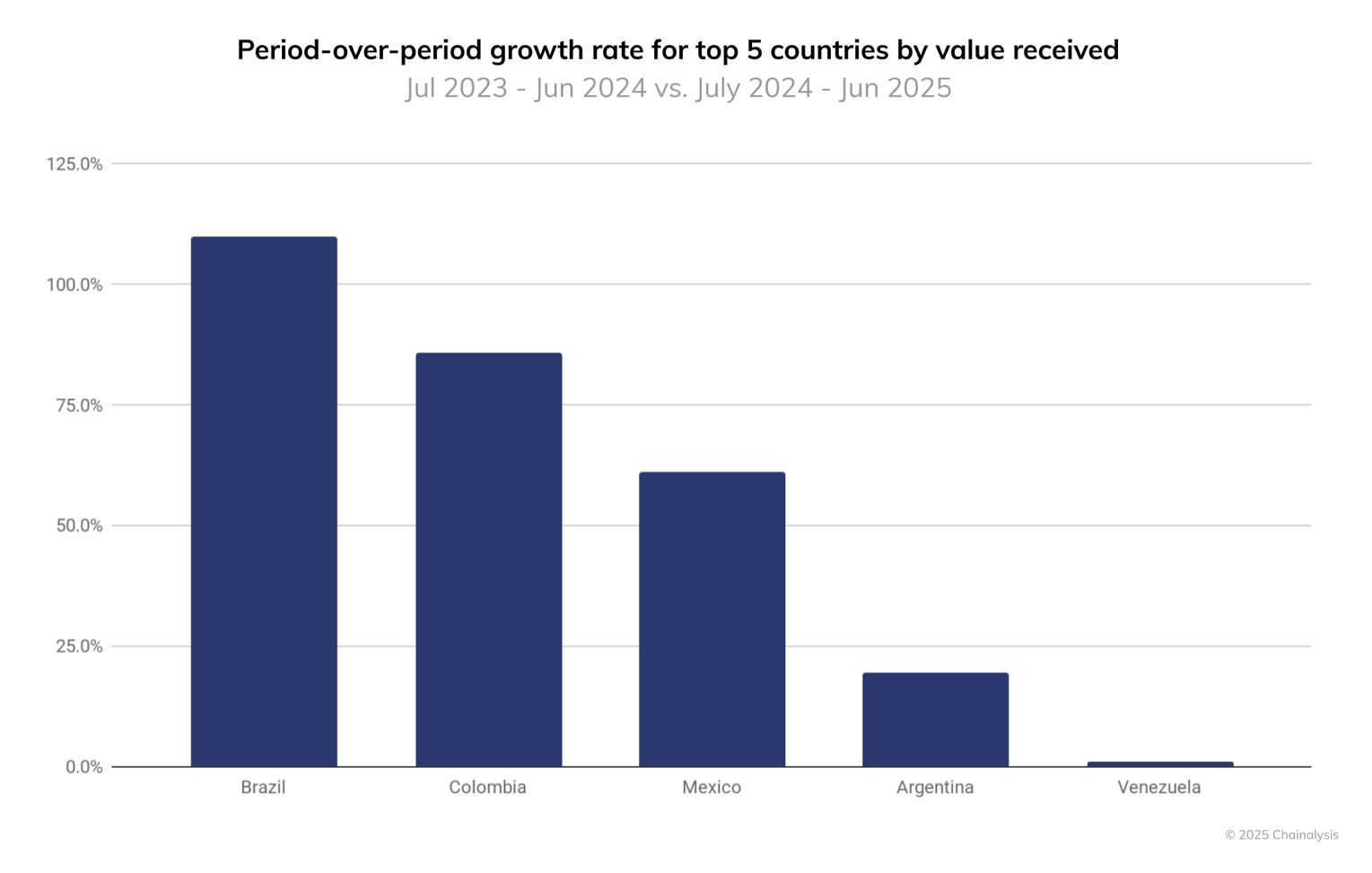

According to an October report from Chainalysis, Latin America has emerged as a leading crypto hub. From July 2022 to June 2025, the region saw nearly $1.5 trillion in crypto transactions. Brazil leads with $318.8 billion in crypto inflows, nearly a third of all LATAM activity, while Argentina follows with $93.9 billion.

One of the major drivers of crypto adoption in Latin America is the search for protection against inflation. Argentina, for example, has battled with soaring inflation for years, and in September it suffered a run on the peso that forced the country’s central bank to spend over $1 billion.

Stablecoins have proven to be one solution to the problem. A report from Mexico-based crypto exchange Bitso in March said stablecoins have become a “store of value” for many citizens in Latin America. In 2024, USDT and Circle’s USDC (USDC) comprised 39% of all crypto purchases on the platform.

Latin Americans are also turning to crypto to fill gaps in the region’s banking systems, using stablecoins for daily payments, savings and cheaper remittances that avoid SWIFT’s high fees.

As the CEO of crypto exchange Bybit’s Latin American division told Cointelegraph in October, “Crypto is actually changing the lives of people” in the region.

Magazine: Ethereum’s Fusaka fork explained for dummies: What the hell is PeerDAS?