Traditional companies enter the crypto treasury game with BTC, XRP and SOL buys

A growing number of traditional companies are beginning to experiment with digital assets as part of their corporate treasury strategies, signaling a shift in how businesses view crypto’s role in financial management.

This week alone, companies from sectors as diverse as agriculture, consumer manufacturing and even a nearly 80-year-old Japanese textile company announced allocations to tokens like Bitcoin (BTC), XRP (XRP), and Solana (SOL).

On Wednesday, Nature’s Miracle, an agricultural technology company, announced it would allocate up to $20 million for an XRP (XRP) corporate treasury, making it one of the latest firm to move to an altcoin treasury strategy.

Consumer manufacturing company Upexi disclosed the acquisition of 83,000 SOL (SOL), valued at $16.7 million, for its corporate treasury, also on Wednesday.

A day before, Kitabo, a publicly listed Japanese company primarily involved in textiles and recycling, revealed plans to buy 800 million Japanese yen, or about $5.6 million, of Bitcoin for its company reserve.

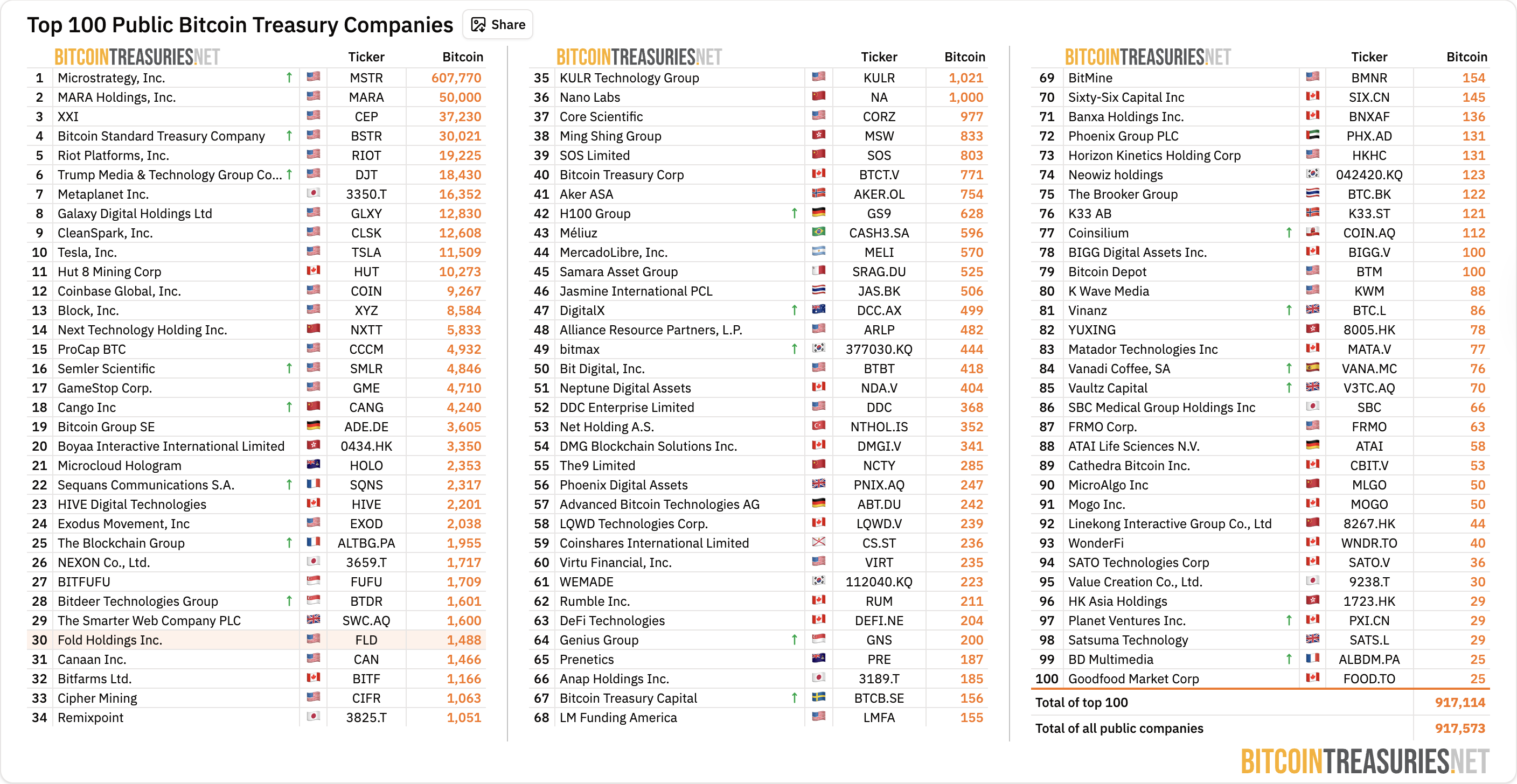

The rise of Bitcoin treasury companies has led to the expansion of corporate treasury options, with many businesses now considering digital assets for treasury strategies. As the trend grows, analysts warn of the mounting market and investment risks of crypto treasury companies.

Risks associated with the growing trend of crypto treasury companies

Crypto holding firms, including Bitcoin treasury companies, carry several legal and market risks that analysts warn could implode these companies and potentially cause wider fallout in the crypto markets.

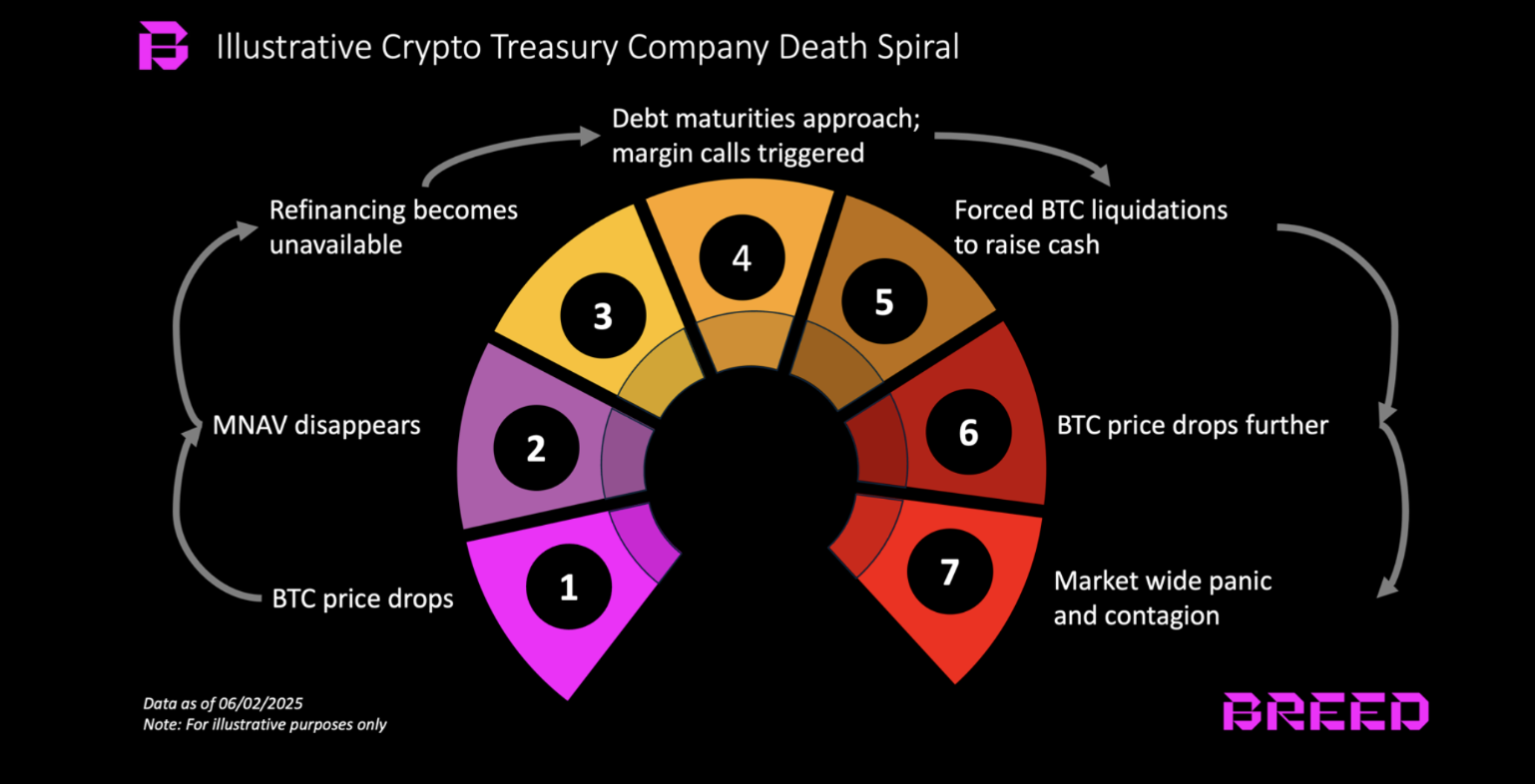

Only a few Bitcoin treasury companies will survive, according to a June report from venture capital company Breed.

The authors of the report argued that even minimal drops in Bitcoin’s price could trigger a death spiral of overleveraged BTC firms, who would be forced to sell their BTC to cover debt obligations, potentially leading to a vicious cycle of lower prices and dried-up corporate credit.

Digital asset holding companies could also face costly investor lawsuits if crypto markets do not perform or if traditional financial metrics like share prices sink.

These risks are compounded by altcoin holding companies, which hold inflationary assets that can experience 90% drawdowns between market cycles and often peak during a single market cycle.

“Altcoins have no floor and thus are cooked once ‘the music stops,’ whereas the BTC treasury companies have a floor, and this floor is independent of them, and it tends to go up with time,” content creator and community member Viktor wrote on X.