BlackRock dumped over $1 billion of this crypto in a week

The ongoing Bitcoin (BTC) price correction is now evident in flows involving exchange-traded funds (ETFs) for the asset.

In this context, BlackRock’s iShares Bitcoin Trust (IBIT) has recorded one of its sharpest weekly reversals to date, with more than $1 billion in net Bitcoin outflows over the past five trading days.

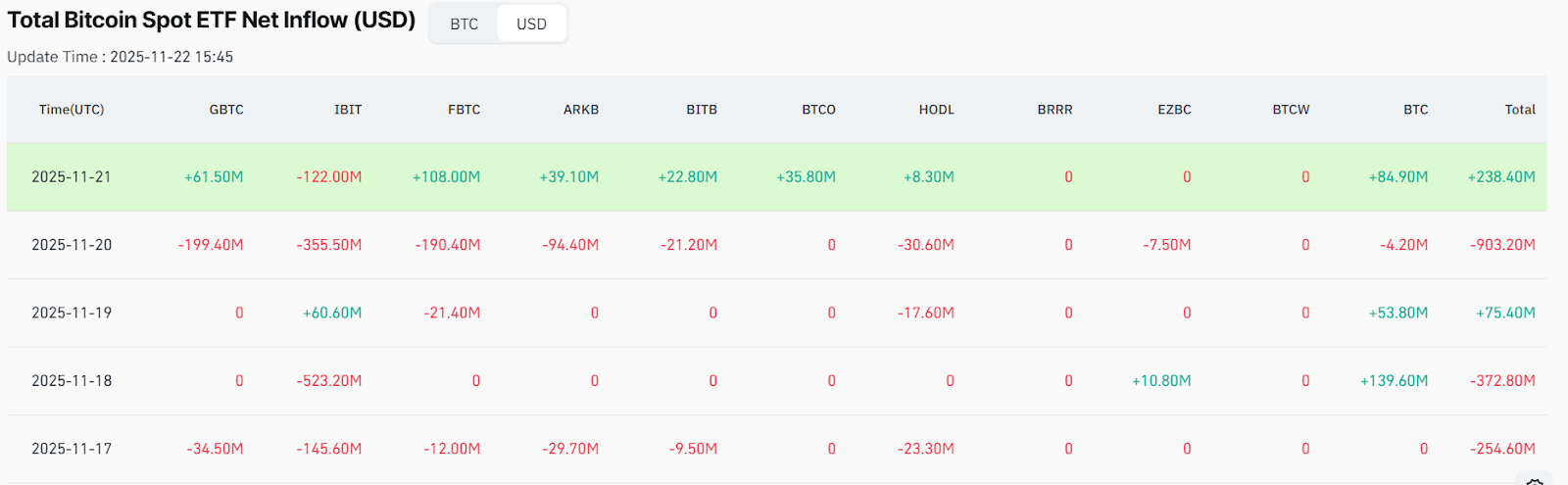

Data from November 17 to November 21 shows IBIT shedding a massive $1.09 billion, driven by heavy withdrawals on multiple days.

The largest wave of selling occurred on November 18, when the fund saw $523 million leave in a single session. That was followed by $355 million in outflows on November 20 and another $122 million on November 21, pointing to a broad retreat from institutional holders.

However, there was a brief pause in the sell-off on November 19, when IBIT attracted a $60.6 million inflow, its only positive day of the week.

The sudden shift raises questions about whether institutional investors are securing profits, reducing risk exposure, or responding to broader macroeconomic uncertainty.

Notably, Bitcoin ETFs have become a key indicator of market sentiment, and this level of withdrawal suggests a notable, though possibly temporary, pullback.

Amid the sell-off, the Bitcoin market itself is showing similar caution. The cryptocurrency has slipped below $90,000, testing lows near $80,000–$82,000, marking its weakest point in seven months.

Macro factors are playing a major role in this downturn. The Federal Reserve’s hesitation to commit to further rate cuts, tighter global liquidity, and heavy institutional selling have all weighed on Bitcoin’s appeal as a risk asset.

At the same time, some institutions see opportunity in the current weakness. Strategy (formerly MicroStrategy) has signaled potential further accumulation as Bitcoin trades below $90,000, suggesting the correction could be a chance to buy at lower levels.

Bitcoin price analysis

By press time, Bitcoin was trading at $83,901, up about 0.4% in the past 24 hours, while on the weekly timeline, BTC has fallen almost 13%.

At the current price, Bitcoin sits well below both its 50-day simple moving average (SMA) of $108,236 and 200-day SMA of $105,224, signaling a persistent bearish trend across short- and medium-term horizons.

The price has broken through these key supports, reflecting sustained selling pressure and the potential for a deeper correction.

However, the 14-day Relative Strength Index (RSI) at 23.14 indicates oversold conditions, deep in sub-30 territory, hinting at a possible short-term rebound as buying interest could emerge to counter exhaustion, though confirmation from volume or an SMA crossover would be needed to validate any reversal amid the broader downtrend.

Featured image via Shutterstock