Bitcoin Faces Short Squeeze Risk Above $87K as Funding Rates Hint Local Bottom

Bitcoin BTC$87,261.34 is trading close to a crucial level that endangers large bearish bets, creating conditions ripe for a “short squeeze” higher while other indicators hint at local bottom.

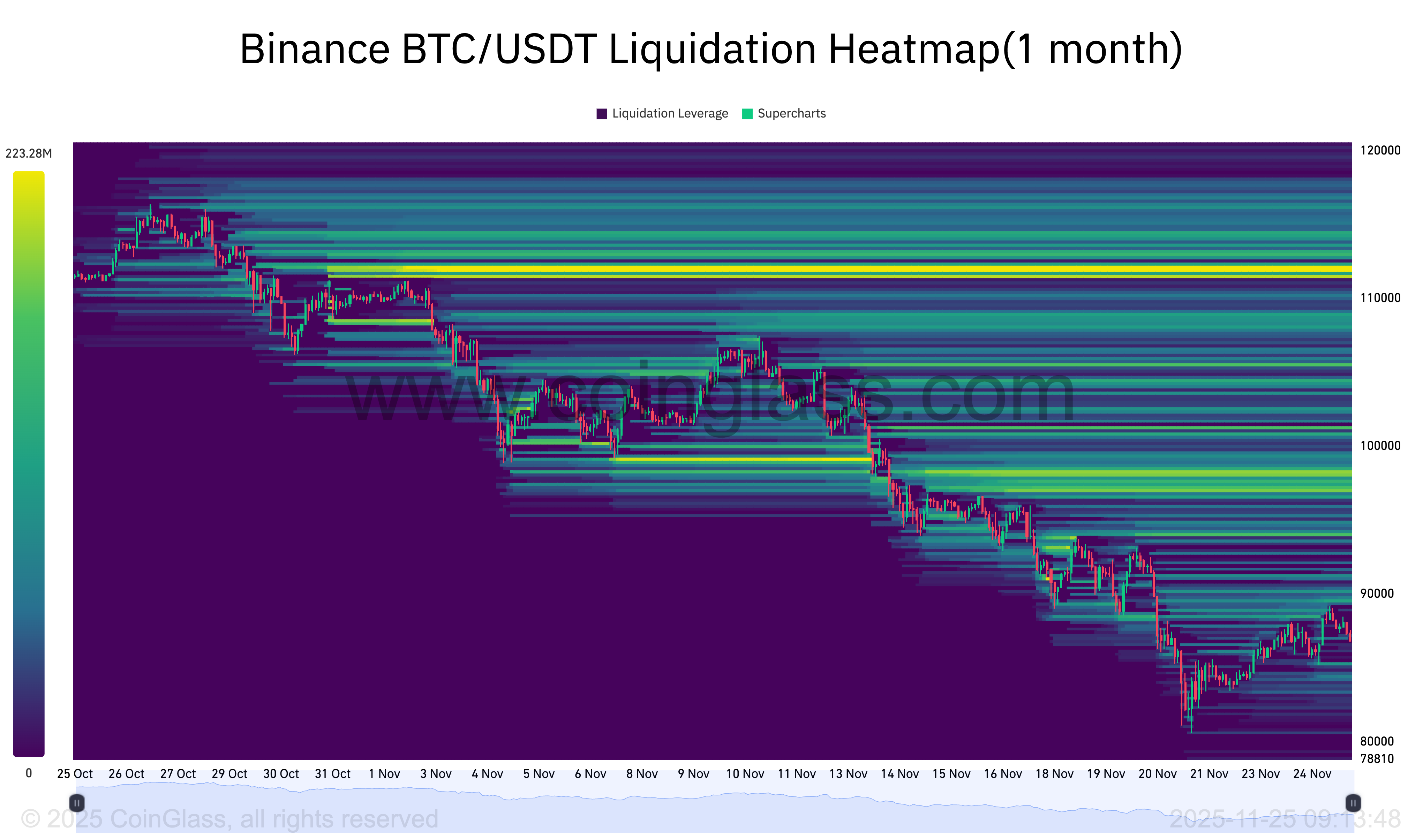

These large bearish bets, likely initiated on Binance during the recent market rout, face liquidation risks around $87,000., according to data source Coinglass. What it means it that a potential rally above $87,000 could prompt the exchange to force close these bearish positions, inadvertently injecting bullish pressures in the market. That, in turn, could drive the market higher in a classic “short squeeze.”

The chart below shows most of the high density liquidation leverage in Binance’s BTC/USDT pair is concentrated above the $87,000.

In short, watch out for volatility to pick up in the event of a breakout above $87,000, which seems possible as key indicators such as the perpetual funding rates have flipped negative, a development observed at previous market bottoms.

Negative funding rates and clearer market structure

The global average funding rates, which represent costs associated with holding long and short positions, stood at -0.006%, a sign of shorts paying longs to keep their bearish bets open. In other words, negative rates indicate a bias for short positions, the first such instance since Oct. 17, according to data source Glassnode.

Historically, the negative flip in funding rates has actually marked seller exhaustion, aligning with local bottoms when sustained, the firm said.

At the same time, open interest points to a cleaner market structure with less leverage at risk.

Coinglass data shows that open interest, which climbed as high as about 752,000 BTC on Nov. 21 during bitcoin’s local low of roughly $80,000, has since unwound sharply to roughly 683,000 BTC. That places the tally well below the approximately 741,000 BTC seen on Oct. 10 just before the major crypto liquidation cascade.

Taken together, these things point to potential for continued price recovery, assuming macroeconomic conditions don’t worsen.