Bitcoin Flashes Reliable Bottom Signal as Short-Term Holders Capitulate

Bitcoin may have finally hit the kind of exhaustion zone that has marked every short-term bottom of the past two years.

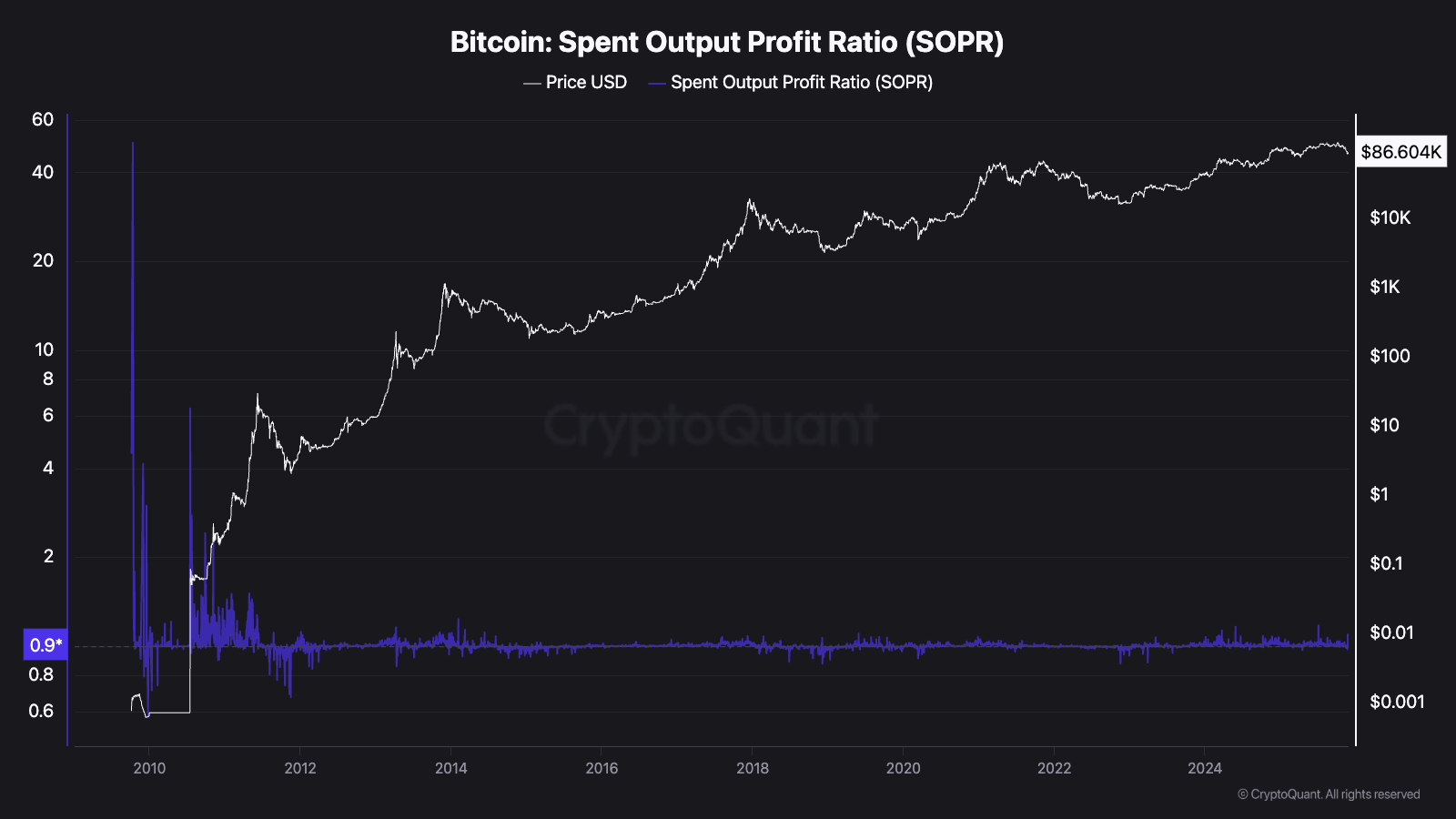

Data from CryptoQuant shows the Short-Term Holder SOPR — a measure of whether recent buyers are selling at a profit or loss — fell to 0.94 earlier this week while prices hovered between $80,000 and $90,000.

Any reading below 1.0 signals capitulation from newer entrants. Historically, these flushes have tended to coincide with local lows and sharp recovery windows shortly after.

The pattern is familiar. Similar SOPR dips in early 2023, late 2023, mid-2024, and again this month all showed short-term holders realizing losses into deep selloffs, followed by stabilization as liquidity rotated to stronger hands.

CryptoQuant described the latest reading as loss realization rather than structural deterioration, suggesting the move is a function of aggressive unwinding rather than a breakdown in long-term positioning.

Market structure has echoed that stress. Bitcoin’s slide below $90,000 came almost entirely during U.S. hours, with equities rebounding on weaker U.S. consumer data and rising odds of a December rate cut.

A rebound in global risk assets helped BTC briefly reclaim $89,000 on Monday night before sliding back toward $87,000 as U.S. markets closed.

FxPro analyst Alex Kuptsikevich noted that the entire crypto rebound is still tracking U.S. equity strength almost tick-for-tick, with the market showing little ability to generate momentum on its own.

He added the recent bounce looks “more like a counter-trend move within a broader seven-week decline,” and warned that reclaiming $88,000 remains the key threshold needed to confirm a local bottom.

Other indicators suggest the market is still trying to form a floor. Open interest in derivatives has unwound sharply, a sign that leveraged longs have been mostly cleared out.

Funding rates have eased, and perpetual swaps are trading near flat after a week of persistent negative premiums. Some analysts have flagged this as the type of low-energy environment that has historically preceded short-term price reversals.

With Fed officials leaning more openly toward easing and global risk sentiment improving, a stabilizing SOPR may be the first hint that sellers are running out of steam.