Tokenized money market funds surge to $9B, BIS warns of new risks

Tokenized money market funds are emerging as one of the most important yield-bearing assets on public blockchains, offering money-market returns and securities-level protections that stablecoins can’t provide, according to a new report from the Bank for International Settlements (BIS).

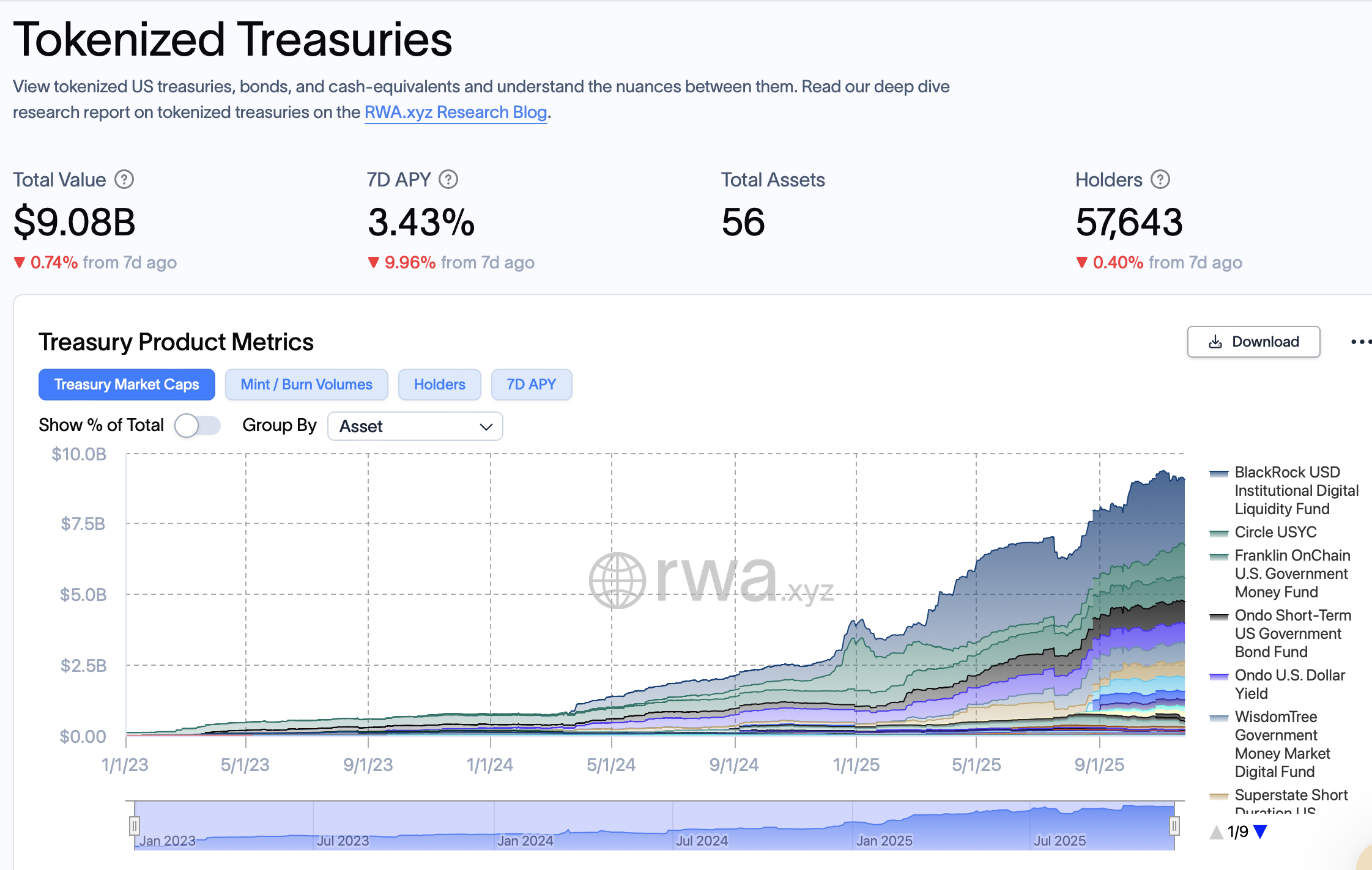

According to the bulletin, tokenized money market funds now hold nearly $9 billion in assets, up from about $770 million at the end of 2023. The BIS warned that as these tokenized Treasury portfolios become a key source of collateral in the crypto ecosystem, they also bring new operational and liquidity risks.

Tokenized money market funds are blockchain-based representations of traditional money market portfolios, providing investors with onchain access to short-term, interest-bearing assets, such as US Treasurys.

The BIS noted that while these tokens offer the flexibility of stablecoins, they depend on permissioned wallets, offchain market plumbing and a small set of large holders; factors that could accelerate stress if redemptions spike or onchain liquidity thins out.

Although the tokens move on public blockchains, the underlying portfolios, pricing and settlement still occur in traditional markets. BIS says that gap creates a structural mismatch: token transfers settle instantly, while the assets behind them do not. During periods of heavy withdrawals, this gap may make it more challenging for funds to meet redemptions without contributing to further volatility.

Interlinkages with stablecoins create additional risk, as some tokenized money market funds also enable rapid conversions into stablecoins or are used for leveraged trades. The BIS warns that these feedback loops could allow market stress to spread much faster than in traditional money market funds.

The analysis was released just a day after the institution appointed International Monetary Fund chief and CBDC backer Tommaso Mancini-Griffoli as the next head of its Innovation Hub.

Related: Tokenized money market funds emerge as Wall Street’s answer to stablecoins

Asset managers ramp up fund tokenization

The world’s top asset managers have been accelerating the expansion of tokenized money market funds across multiple blockchain networks.

Franklin Templeton announced on Nov. 12 the integration of its Benji tokenization platform with the Canton Network, bringing tokenized assets — including its onchain US government money market fund — into a blockchain ecosystem designed for financial institutions.

Asset manager BlackRock also recently announced the expansion of its tokenized money market fund, the USD Institutional Digital Liquidity Fund (BUIDL), to Aptos, Arbitrum, Avalanche, Optimism and Polygon, broadening beyond Ethereum.

RWA.xyz data shows that BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) currently dominates the onchain money market landscape, with more than $2.5 billion in tokenized assets.

Franklin Templeton’s BENJI fund has over $844 million in tokenized US government securities, according to the data.

Magazine: Getting scammed for 100 Bitcoin led Sunny Lu to create VeChain