Bitcoin forms short-term bottom, $100K relief rally in sight: Analyst

Bitcoin may be carving out a short-term bottom after weeks of heavy selling, with one market analyst arguing that conditions are in place for a relief rally toward the $100,000–$110,000 range.

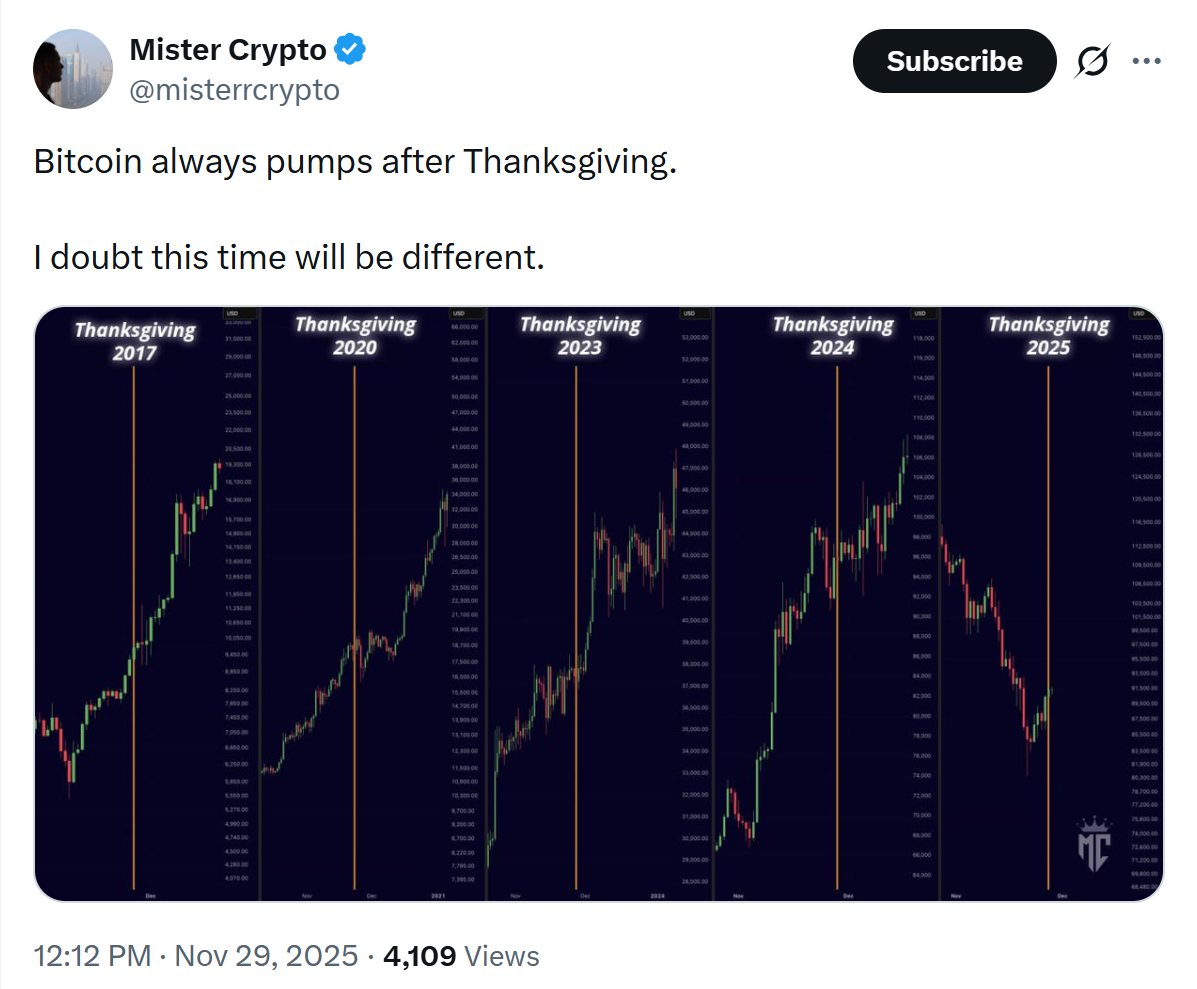

In a recent video, trader Mister Crypto said Bitcoin (BTC)’s short-term structure shows signs of stabilization following what he described as “capitulation” across the market. He claimed that indicators tied to trader behavior suggest that large players have begun opening new long positions despite the sentiment plunging into extreme fear territory, a mix that has historically preceded bounces during downturns.

One of the main technical signals cited is the Bitcoin Relative Strength Index (RSI) on the weekly chart, which is approaching the 30 level. “We have bottomed out for Bitcoin right here. We have been reaching the 30 level. Boom,” he said.

The analyst noted that, in past cycles, this zone has coincided closely with market bottoms. While he cautioned that this does not guarantee the start of a new bull run, he said the current setup often signals at least a temporary reversal.

Related: Why China’s Bitcoin mining activity is surging again after a 4-year crackdown

$102,000 level in focus

Another factor adding weight to the rebound scenario is Bitcoin’s distance from the 50-week moving average, currently near $102,000. According to the analysis, Bitcoin has repeatedly retraced toward this level after dipping below it in previous market cycles. The expectation now is a bounce that could lift prices back into six figures before any deeper trend emerges.

Macro conditions are also feeding optimism in the near term. The analyst pointed to expectations that quantitative tightening could soon end, combined with speculation around another interest rate cut at an upcoming policy meeting. Both developments tend to favor risk assets such as Bitcoin by easing financial conditions.

However, the longer-term outlook remains cautious. The analyst claimed that the broader market is in bear territory. He warned that any bounce could be followed by renewed weakness later on, as broader conditions have yet to show a decisive shift back into sustained growth.

Related: Crypto sentiment moves up from ‘extreme fear’ after 18-day stretch

Crypto sentiment lifts from ‘extreme fear’

After spending 18 days in “Extreme Fear,” the Crypto Fear & Greed Index finally lifted to a “Fear” level of 28.

Meanwhile, Bitwise Europe research head André Dragosch has said that Bitcoin could have major upside ahead, as its current price doesn’t reflect improving macro expectations. He said Bitcoin now offers an “asymmetric” risk-reward similar to the COVID crash of March 2020, when prices plunged before rebounding strongly, arguing the market is already pricing in an extremely bleak global outlook.

Magazine: 2026 is the year of pragmatic privacy in crypto — Canton, Zcash and more