Bitcoin Slides Below Key Levels as Short-Term Holders Face Deep Losses

Bitcoin (BTC) has entered a critical phase of structural repair, stabilizing near $86,470 after a sharp rejection from the $92,000 resistance band. While the asset has paused its descent, on-chain data reveals a severe “cost basis trap” that could cap upside momentum for weeks.

The pullback erased earlier gains and pushed Bitcoin back toward levels that traders view as key for market direction heading into December.

Market charts indicate that Bitcoin’s decline accelerated after a rejection at the $92,000 level, a point where sellers have repeatedly stepped in throughout the quarter. The retreat pushed the asset toward the $81,000 to $84,000 range, a zone that has served as a major demand floor in recent months. Buyers were active at that band, slowing the drop and allowing the price to rebound toward $86,000.

$BTC got rejected from the $92,000-$93,000 resistance level.

It dumped nearly $7,000 and is now consolidating around the $86,000 zone.

Bitcoin needs to reclaim the $88,000-$89,000 level here; otherwise, it’ll drop towards the November low. pic.twitter.com/9ze6xsPBB2

— Ted (@TedPillows) December 1, 2025

Analysts note that Bitcoin must reclaim the $88,000 to $89,000 region to avoid retesting November’s lows. A move above $90,000 would place the asset back within reach of the $94,000 to $96,000 resistance cluster. Chart projections indicate that a break above this barrier could pave the way for the $100,000 level, although supply remains substantial near $102,000.

Short-Term Holders Face Deep Losses

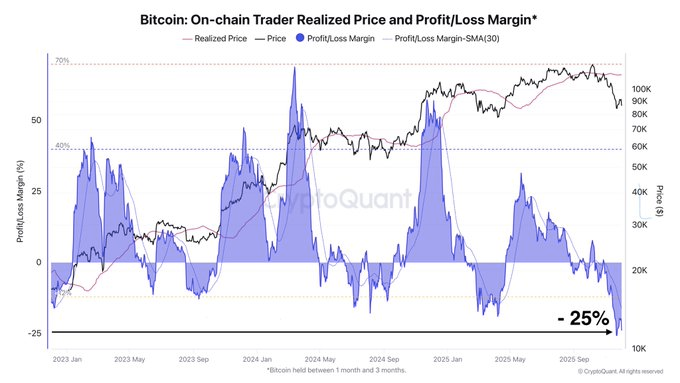

On-chain data, as reported by crypto analyst Darkforest, provides a detailed view of market tension. The realized price for the one- to three-month holder cohort has fallen to $113,692, with average unrealized losses ranging between 20% and 25%. Analysts tracking this segment describe it as one of the strongest capitulation phases since early 2023.

Charts from CryptoQuant show profit-and-loss margins pulling into negative territory, reflecting sustained pressure on newer market entrants. Prior cycles have seen similar declines occur near local bottoms once a major portion of these traders either sold or stopped repositioning. However, current readings indicate that the realized price continues to decline, while the spot price remains far from recent highs.

Darkforest further noted that leveraged positions are continuing to unwind, either through forced liquidations or voluntary closures, as traders adopt a more cautious stance. He noted that the current environment has solidified a risk-off approach, resulting in a contraction of Bitcoin’s derivatives exposure.

❌ Leveraged positions continue to get liquidated or are being closed voluntarily.⁰This period of uncertainty isn’t encouraging traders to increase their exposure to risk.

Right now we’re facing more of a risk-off attitude, which makes perfect sense given the current… pic.twitter.com/7Rn3ZchASH

— Darkfost (@Darkfost_Coc) December 1, 2025

According to his data, BTC open interest has fallen by roughly $20 billion since October 6, marking the largest reduction of this cycle and one of the most severe in the history of Bitcoin’s derivatives market.

Market Data Shows Heavy Liquidation Pressure

Bitcoin dropped more than 5% over the past 24 hours to trade near $86,473, according to figures from CoinMarketCap. Market capitalization dropped to about $1.72 trillion as trading volume surged by 70% to above $63 billion.

The surge in volume reflects a strong repositioning after Bitcoin fell from above $91,000 to below $87,000 in continuous overnight trading.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.