Bitcoin price forecast: Will BTC retest $80k amid renewed bearish sentiment?

Key takeaways

- BTC dropped below $86k on Monday mainly due to macro pressures.

- The leading cryptocurrency could retest the $80k low if the bearish trend persists.

BTC dips below $86k

Bitcoin, the leading cryptocurrency by market cap, is off to a bearish start in December, as it has lost over 5% of its value in the last 24 hours. At press time, Bitcoin is trading above $86k after temporarily dropping to the $85k region earlier today.

The bearish performance has affected altcoins too, with Ether trading below $2,800, while XRP is hanging on above $2.0

The recent selloff comes after the Bank of Japan (BoJ) Governor Kazuo Ueda revealed that possible interest rate hikes could be considered if the economy continues to evolve as predicted. The interest rate hike could increase borrowing costs and negatively affect carry trades.

In addition to that, the hacking of the Yearn Finance protocol a few hours ago contributed to the renewed pressure on Bitcoin and the broader cryptocurrency market. Thanks to the latest selloff, over $140 billion was wiped out from the crypto market in the last 24 hours, with $500 million worth of leveraged positions also liquidated.

JUST IN: $140,000,000,000 wiped out from the crypto market cap in the past 4 hours. pic.twitter.com/c32OHlyafS

— Watcher.Guru (@WatcherGuru) December 1, 2025

Bitcoin comes under pressure once again

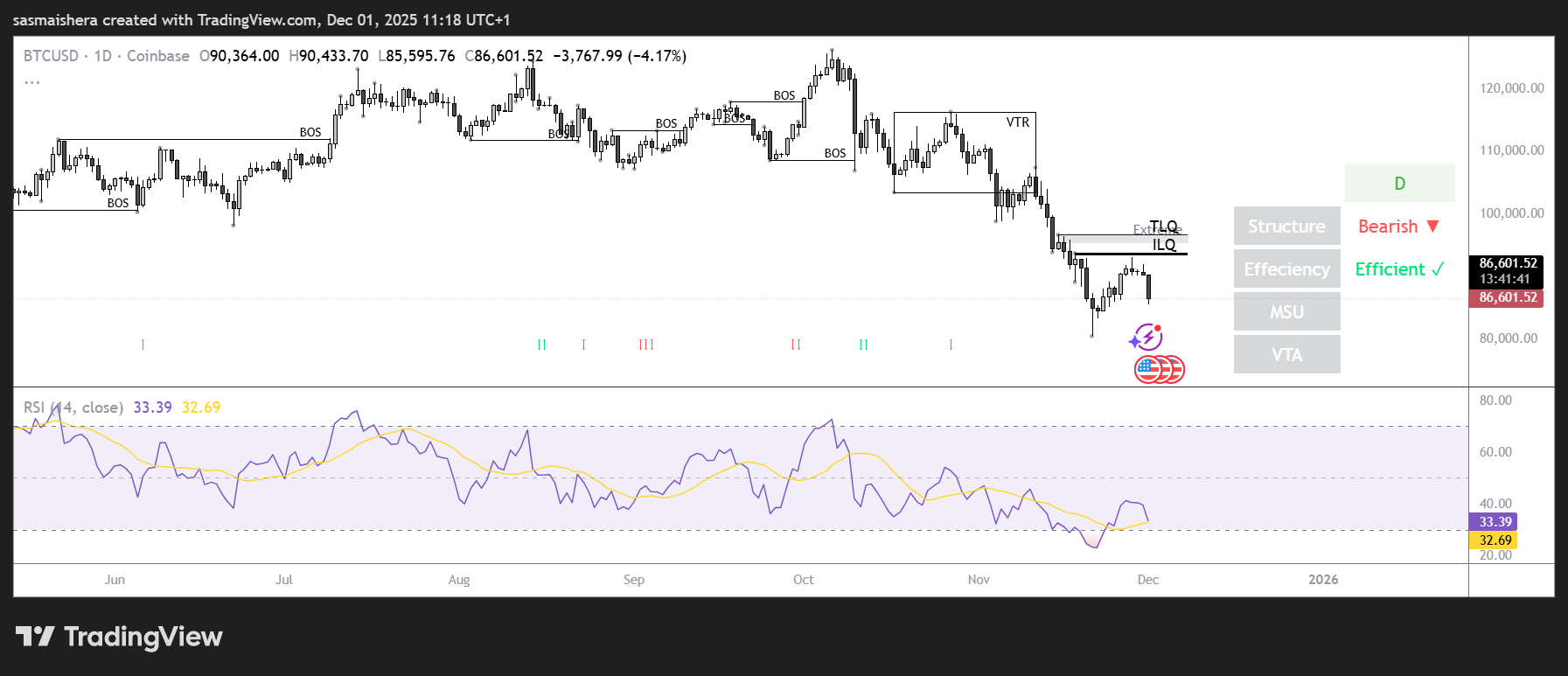

The BTC/USD daily chart remains bearish and efficient as Bitcoin lost 5% of its value in the last few hours. The leading cryptocurrency is trading above $86k, as the daily, weekly, and monthly candles all confirm a bearish bias.

The RSI on the daily chart reads 32, pivoting downside towards the oversold after the brief recovery recorded last week. If the daily RSI remains below 30, Bitcoin could face further downward movement in the near term.

Additionally, the Moving Average Convergence Divergence (MACD) has shifted to a bearish momentum, with the sell signal shown a few hours ago.

If the selloff continues, the bears will look to target the $80,600 support in the near term. Failure to defend this level could see Bitcoin revisit the April 7 low of $74,508.

However, if the bulls recover, Bitcoin could rebound to $90,000 over the next few hours or days.