Bitcoin Reverses From Channel Resistance as Whale Shorting Intensifies

- The Bitcoin price faces a bearish reversal from the key resistance trendline of a falling channel pattern, signalling a potential downturn.

- The Federal Reserve approved a 25-basis-point rate reduction on December 10, setting the federal funds range at 3.5%–3.75%.

- On-chain data shows BTC whales have exited their long position and opened a fresh short position.

The Bitcoin price witnessed low volatility trading on Wednesday, evidenced by a neutral candle formation near $92,488. The coin price initially surged to the intraday high of $94,500, but the latest released Federal Reserve rate cut decision acted as a sell-the-news event for market participants. The overhead supply, along with crypto whales entering short positions in the market, signals a risk of a potential sideways trend to an extended correction ahead.

Fed Cuts Rates but Signals Near-Term End to Easing

On December 10, 2025, the FOMC meeting of the Federal Reserve led to a decrease of 25 basis points in the federal funds rate, bringing it in a range of 3.5% – 3.75%. This step was the third straight adjustment downwards, but signs were pointing towards stopping the leading movement, and only one more is expected in 2026.

The action was restrictive despite the trim, but retained the same forward guidance. Starting December 12, the Fed plans to buy $40 billion in Treasury bills, including those maturing out to three years. Officials emphasized these buys are aimed at managing reserves, not at quantitative easing.

In the ensuing briefing by Chair Jerome Powell, his tone went softer than expected. He noted that the cumulative 75 basis points of loosening since September had put the policy at a balanced point, which allows the Fed to wait for incoming data. Powell described the decision as decidedly close, on the back of a slowdown in the shift in employment.

He pointed to information yet to be received before January, that the role of artificial intelligence is still not reflected in workforce figures, and that the monthly job addition might be exaggerated by around 60,000, raising the prospect of minor employment contractions since spring. Risks to the job sector lean negative, he added, with barriers to trade playing a major role in excess price pressures. The Treasury bill buyups may persist at increased levels over a period of months.

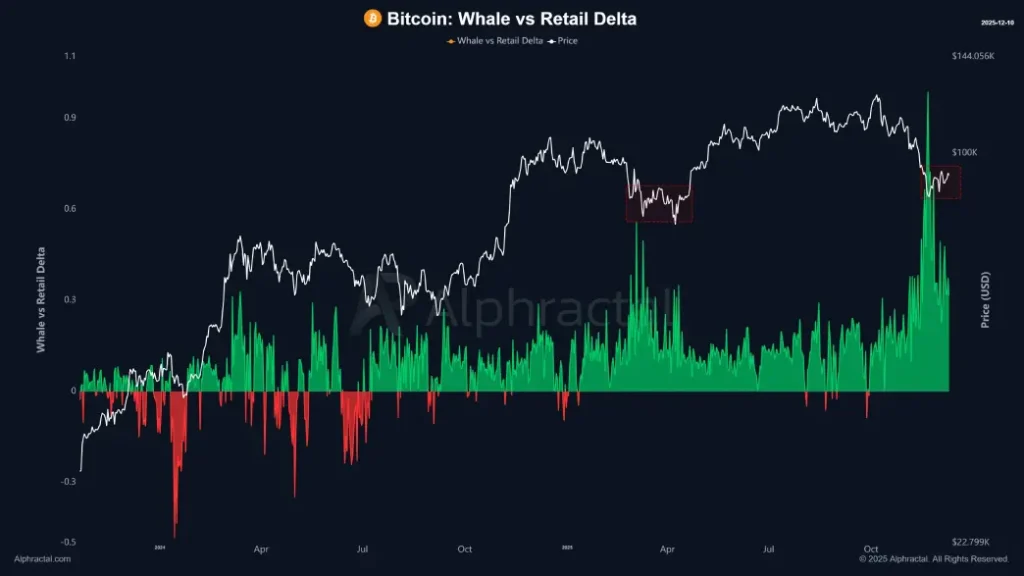

Insights from Aphractal’s chief executive, Joao Wedson, show large investors taking off their bullish bets after strong accumulation, now launching bearish trades. Smaller participants are heading in the opposite direction.

This dynamic repeats similar trends seen from February to April 2025 and is indicative of asset values potentially moving in a rather narrow band for a prolonged period of time beyond typical forecasts.

Bitcoin Price Sparks Fresh Reversal From Channel Resistance

By price time, Bitcoin price trades at $92,200, showcasing a neutral to bearish candle with an intraday loss of 0.5%. The long-wick rejection attached to the daily candle is currently positioned at the resistance trendline of a falling channel pattern.

Over the past two months, the coin price has been witnessing a steady downtrend, resonating between the two downsloping slopes of this pattern. Historically, a reversal from the upper boundary has reincorporated the bearish momentum in price for a deeper correction towards the lower end.

The Bitcoin price is also positioned below the key exponential moving averages (20, 50, 100, 200), reinforcing bearish market sentiment.

If the supply pressures at this resistance, the Bitcoin coin could plunge below $89500 as a signal for a potential downturn. The post-reversal fall could push the BTC another 20% to $73,100 support.