Figure Technology files ‘second IPO’ to bring native equity issuance to Solana

Figure Technology, a blockchain-based financial services company focused on tokenized assets and lending, has filed for a second public offering aimed at issuing native equity directly on a public blockchain. The move, which follows the company’s recent Nasdaq listing, is designed to expand decentralized finance (DeFi) use cases on Solana.

Speaking at the Solana Breakpoint conference, Figure executive chairman Mike Cagney said the company has submitted a filing with the US Securities and Exchange Commission (SEC) to launch what he described as “a new version of Figure equity on a public blockchain,” specifically Solana.

Cagney said the blockchain-native equity would not trade on traditional exchanges such as Nasdaq or the New York Stock Exchange, nor would it rely on introducing brokers like Robinhood or prime brokers such as Goldman Sachs.

Instead, the security would be issued and traded natively onchain via Figure’s alternative trading system, which he characterized as “effectively a decentralized exchange.”

By issuing equity directly on Solana, investors would be able to take the tokenized security into DeFi protocols, where it could be borrowed against or lent out, Cagney said.

He added that the company’s broader goal extends beyond tokenizing its own shares, with plans to support native equity issuance for other companies directly within the Solana ecosystem:

“One of the focus points that we have is not only bringing that equity over to the Solana ecosystem but allowing for native Solana equity issuance as well.”

Related: Figure Technology boosts IPO size, total deal could reach $800M

Tokenization on Solana is gaining momentum

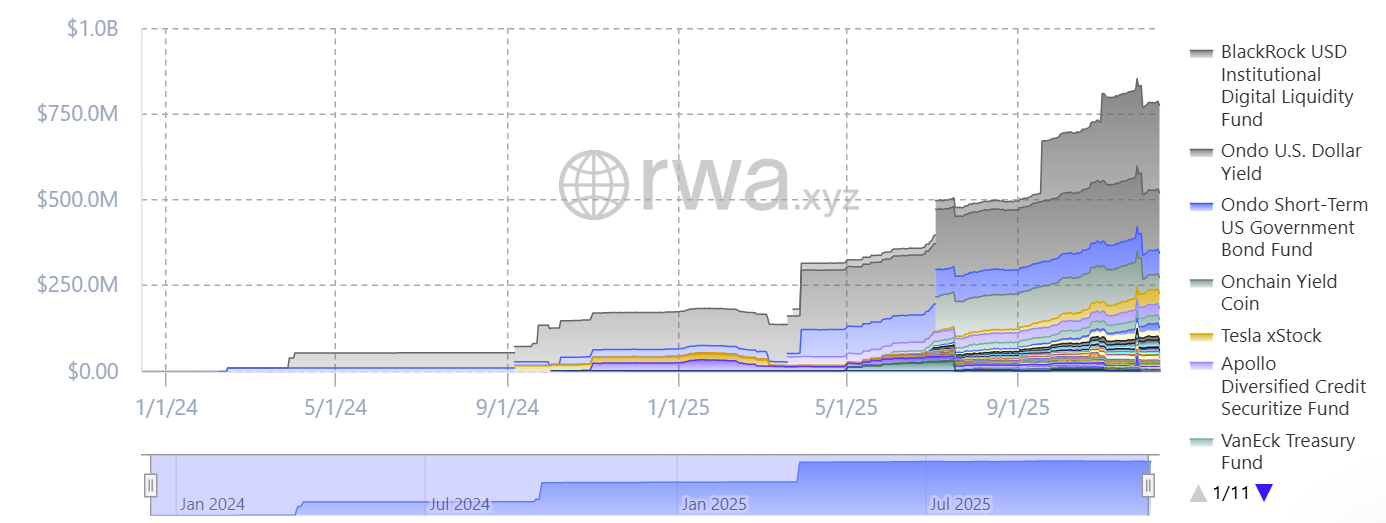

Already one of the largest public blockchains by activity, Solana is increasingly emerging as a hub for tokenized assets, with its share of the real-world asset (RWA) market expanding steadily over the past year.

While Ethereum continues to dominate tokenization today, Solana is likely to become the financial industry’s preferred network for stablecoins and tokenized assets over time, according to Matt Hougan, chief investment officer at Bitwise.

As Wall Street evaluates the long-term viability of tokenized assets, attention is expected to shift toward blockchains that offer high speed, throughput and fast transaction finality, areas where Solana holds a competitive advantage over many rival networks, Hougan said.

Research from RedStone identified Solana as a “high-performance challenger” in the RWA space, particularly in tokenized US Treasury markets.

Related: Scaramucci predicts ‘exponential opportunity’ for crypto at LONGITUDE