Bitcoin 'sharks' add over 54,000 BTC in a week as accumulation spikes

Bitcoin “sharks,” defined as entities holding between 100 and 1,000 BTC, have significantly increased their exposure over the past week, adding more than 54,000 Bitcoin as on-chain data points to renewed accumulation among mid-sized holders.

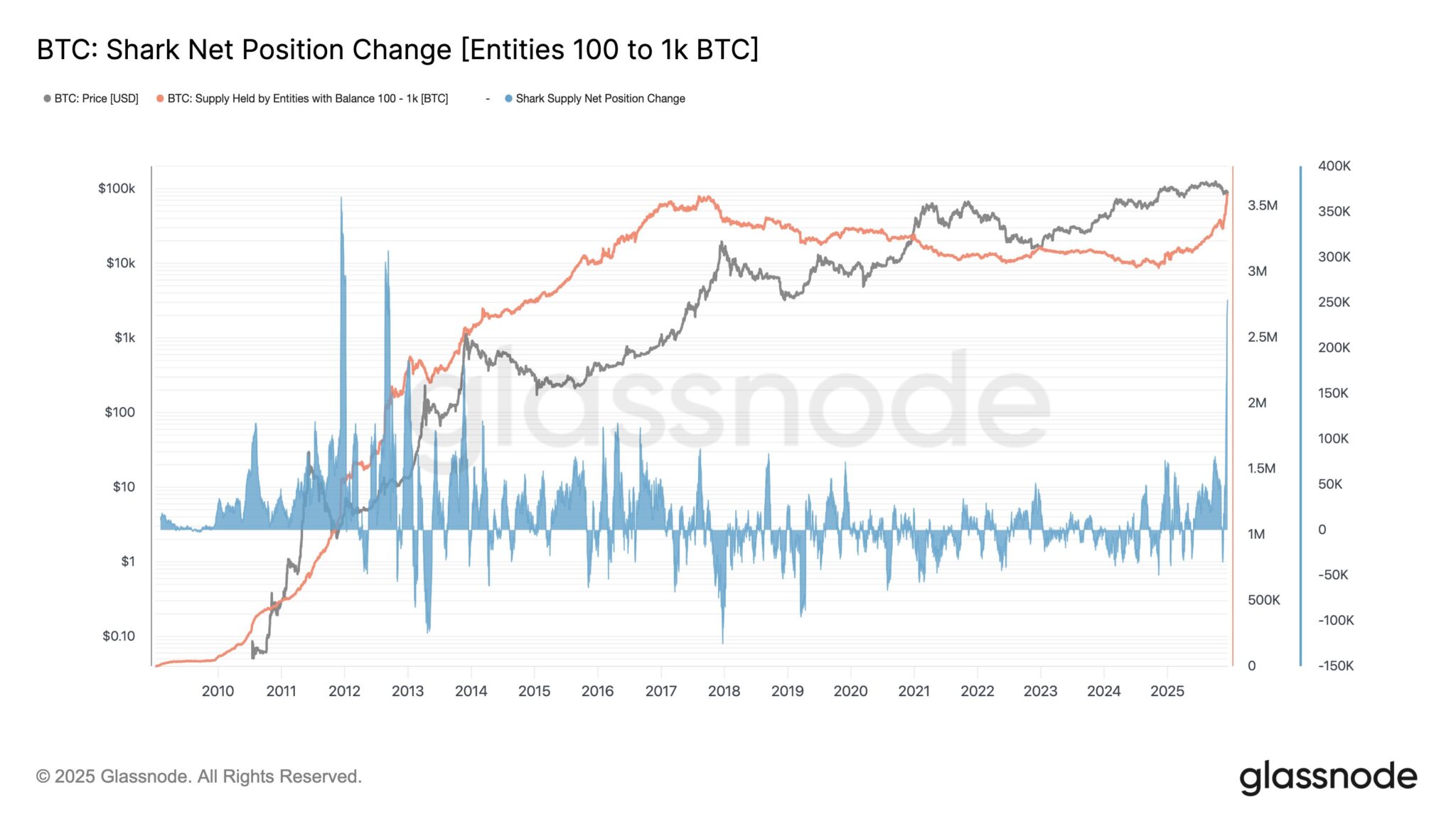

Bitcoin sharks collectively added approximately 54,000 BTC over the past seven days, lifting their total holdings to around 3.575 million BTC, per Glassnode data. The move marks one of the strongest weekly accumulation phases for this cohort in recent months and suggests growing conviction despite recent market volatility.

Bitcoin price overview

At the time of publication, Bitcoin was trading at $87,060, down 2.85% over the past 24 hours, and a further 3.53% in the previous week. Despite the short-term pullback, on-chain positioning indicates that sharks continued to absorb supply rather than distribute into price weakness.

Glassnode’s Shark Net Position Change metric shows a sharp positive spike, reflecting net inflows of Bitcoin into wallets holding between 100 and 1,000 BTC. Historically, sustained accumulation by this cohort has often coincided with periods of consolidation or early-stage trend reversals, as sharks tend to scale positions ahead of broader market participation.

While large institutional flows and ETF activity have dominated headlines in 2025, the behavior of mid-sized holders offers additional insight into underlying market sentiment.

Notably, the recent accumulation occurred as Bitcoin traded below its recent highs, suggesting sharks were willing to add exposure during short-term price weakness rather than waiting for a clear breakout. This pattern contrasts with retail behavior, which historically becomes more active during periods of price acceleration.

If the accumulation trend persists, it could provide a supportive backdrop for Bitcoin’s price structure in the near term. However, analysts caution that broader macro conditions and liquidity dynamics remain key variables, particularly as volatility continues to shape near-term market direction.