BTC Price Analysis: Key Support Levels to Watch Around $80K

Bitcoin’s price continues to consolidate just below the $90K mark after weeks of selling pressure. Buyers are trying to hold the mid-range, but momentum remains weak across higher timeframes. The current PA (price action) shows signs of temporary relief, but the broader sentiment points to continued caution from institutional players.

Bitcoin Price Analysis: Technicals

By Shayan

The Daily Chart

On the daily chart, BTC is still trading within the descending channel formed over the past couple of months. Both the 100-day and 200-day moving averages are above the price, acting as resistance near $103K and $108K. So far, each bounce attempt has been capped inside the descending channel.

Key support remains at $80K, which has already been tested twice. If this zone fails, the next major demand lies around $72K. The RSI is also curling upward from oversold, hinting at short-term bullish momentum, but there’s no strong reversal yet.

The 4-Hour Chart

On the 4H chart, BTC broke down from the rising wedge that had formed earlier in December. After sweeping the $90K lows, buyers are attempting to reclaim ground, but the move lacks volume.

The price is trying to establish a local higher low, but the structure still leans bearish. There is a visible rejection near $88K, which was the prior support-turned-resistance. If buyers can’t flip that area soon, another retest of the $80K area will be likely.

The RSI has also recovered from the lows but remains below 60, signaling limited strength. As a result, there is still a high chance of more downside if the BTC does not break back above $90K soon.

Sentiment Analysis

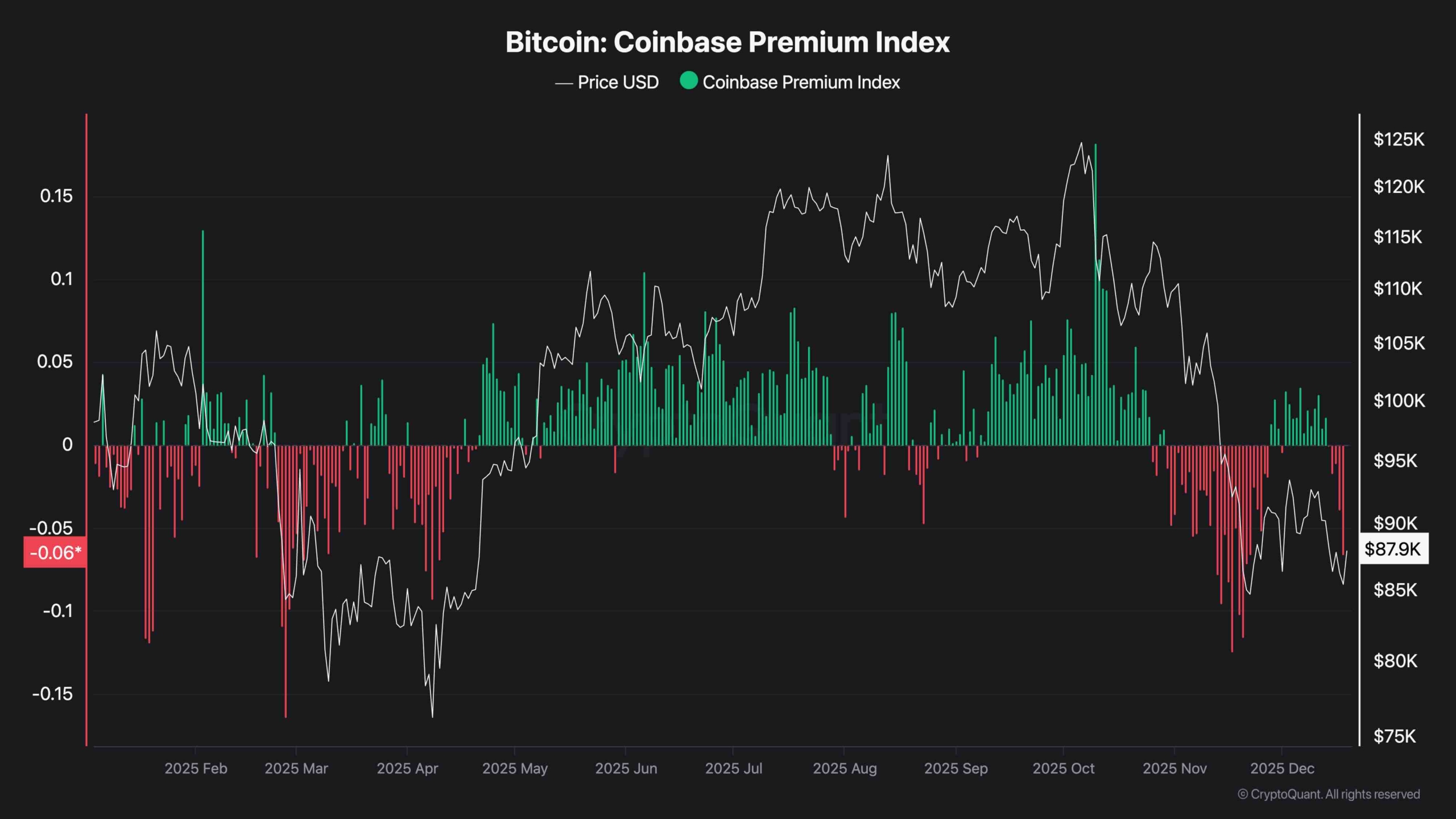

Bitcoin Coinbase Premium Index

The Coinbase Premium Index remains in negative territory, showing persistent selling pressure from U.S.-based institutions. This divergence has been present throughout the last couple of months and is yet to reverse.

Every local pump has been met with stronger negative premium readings, suggesting that Coinbase whales are offloading into strength. Until this flips back into positive or at least neutral, macro upside remains capped.

Overall, sentiment remains risk-off on the U.S. side, confirming that institutions are not yet ready to re-accumulate aggressively.