A major crypto investor has significantly expanded short positions in Bitcoin and Ethereum, deepening bearish sentiment amid a broader market struggling to regain momentum.

On-chain data shows that a whale wallet identified as 0x94d3 has continued to build downside exposure after sharply reducing its Bitcoin holdings earlier in the week. The activity underscores a growing conviction that the recent market rebound may be fragile.

According to blockchain analytics firm Lookonchain, the wallet sold 255 BTC last Friday at $21.77 million at an average price of $85,378 per Bitcoin. Shortly after exiting part of its spot exposure, the wallet pivoted aggressively toward leveraged short positions.

Leveraged Shorts Expand Across Bitcoin and Ethereum

Lookonchain data indicates that the whale opened 10× leveraged shorts in both Bitcoin and Ethereum on Friday. Specifically, the initial Bitcoin short totaled 876.27 BTC, with a notional value of approximately $76.3 million. At the same time, the wallet shorted 372.78 ETH, worth roughly $1.1 million.

Rather than reducing risk, the trader added to these positions on Monday. An additional 486.49 BTC and 343.01 ETH were placed on the short side.

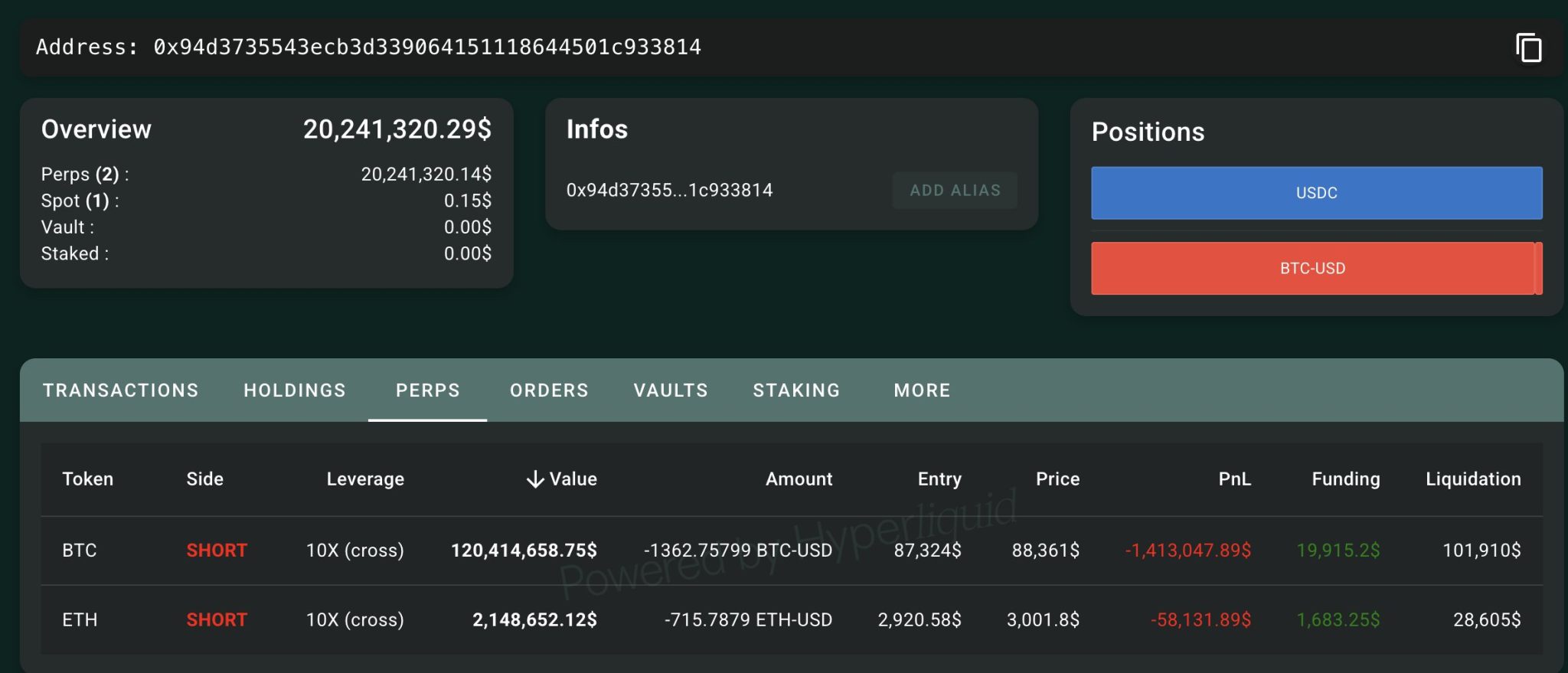

As a result, total Bitcoin short exposure has increased to 1,362.76 BTC, valued at $120.41 million, while the Ethereum short position now stands at 715.79 ETH, with a combined value of around $2.15 million.

Position Metrics Show Early Drawdowns

On-chain metrics provide further insight into the risk profile of the trades. For instance, the Bitcoin short carries an average entry price of $87,324, with liquidation estimated near $101,910.

With Bitcoin currently trading around $88,361, the position is showing an unrealized loss of approximately $1.41 million.

Ethereum data paints a similar picture. The ETH short was entered near $2,920, with a liquidation level far above at $28,605. At a market price close to $3,001, the unrealized loss is estimated at $58,131.

-

On-chain Metrics for Bitcoin and Ethereum Short Positions

On-chain Metrics for Bitcoin and Ethereum Short Positions

These aggressive bearish bets come just as the broader crypto market attempts to stabilize following a prolonged downturn in October. Although prices have staged a cautious recovery, analysts continue to warn that underlying weakness remains.

Several technical indicators suggest the rebound may face renewed pressure.

Technical Analysis Signals Downside Risk

Crypto analyst CryptoOnchain highlighted these concerns in a recent post on X, noting that selling pressure continues to dominate Bitcoin’s price structure.

Bitcoin is currently trading near its Point of Control (POC), a key level where most recent trading occurred and often acts as support or resistance.

The analyst warned that failing to reclaim prior highs increases the risk of a drop toward $70,000–$73,000.

A bearish divergence in the RSI adds further concern for a deeper pullback.

Traders should watch the $72,000 level for signs of a potential bounce, but staying above $70,000–$73,000 is essential. Falling below could trigger a larger correction.

Citi Outlook Echoes Caution

This technical outlook aligns with recent projections from Citigroup. In a research note, the bank outlined a wide range of possible outcomes for Bitcoin over the next year.

Under its bearish scenario, Citi estimates Bitcoin could fall to $78,000. Conversely, a bullish case could see prices climb as high as $189,000, thereby highlighting the unusually high degree of uncertainty facing the market.