RWA Sector Smashes $25 Billion Barrier—72% Asset Holder Surge in Just 30 Days

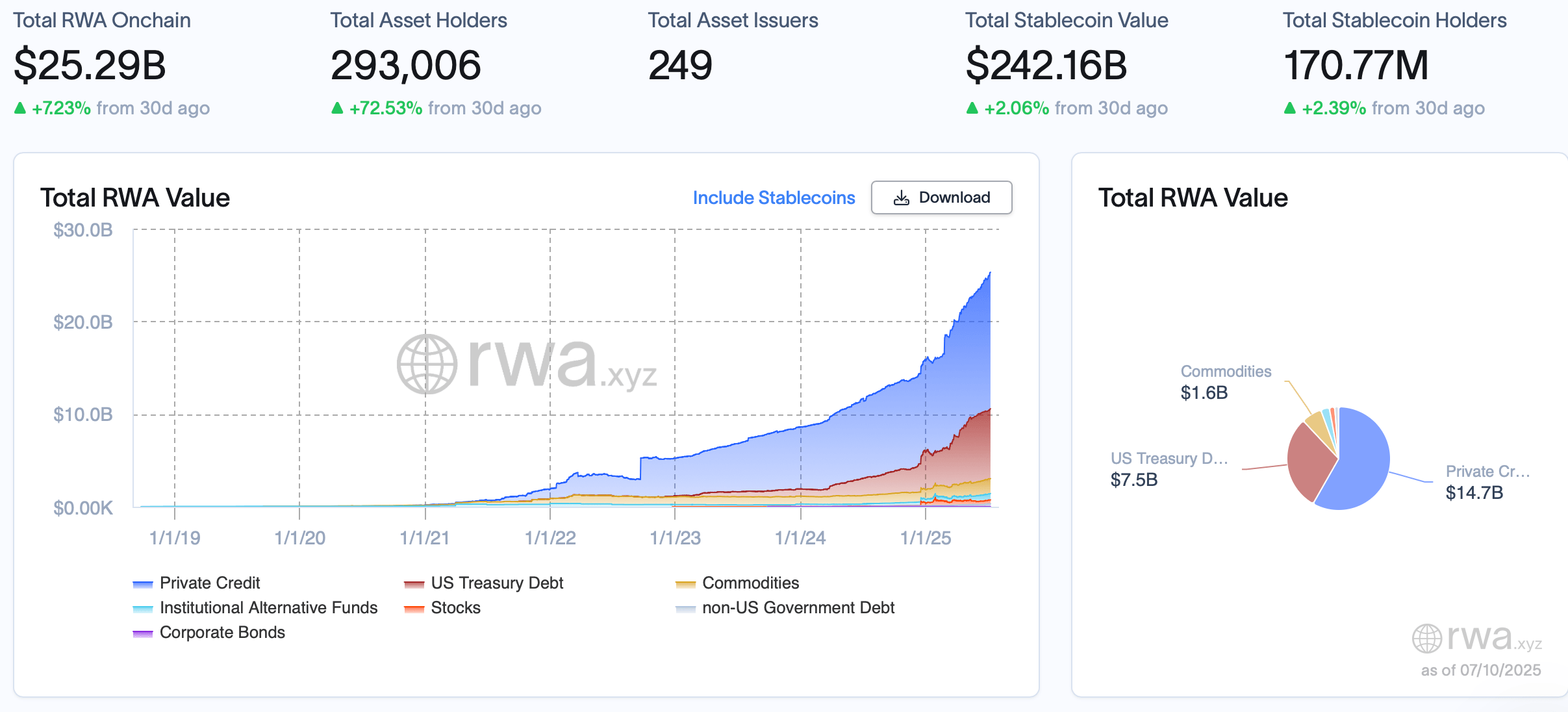

This week, the real-world asset (RWA) sector crossed the $25 billion threshold, carving out a fresh milestone in the annals of finance. On top of that, the total number of asset holders has soared to 293,006—marking a jump of over 72% in just 30 days.

Tokenized Assets Continue to See Massive Growth

As of Thursday, July 10, 2025, the value of tokenized real-world assets (RWAs) has climbed past $25 billion. That’s a 7.23% increase since June 10. Right now, private credit claims the top spot in onchain value.

A hefty $14.73 billion is parked in blockchain-verified private credit offerings from firms like Figure, Tradable, and Maple. Leading the pack, Figure boasts $13.6 billion in cumulative onchain loans, according to data compiled by rwa.xyz.

U.S. Treasury debt or tokenized Treasury funds hold the second spot, totaling $7.53 billion—up 1.96% over the past week. Blackrock’s BUIDL leads the pack with $2.82 billion onchain. Franklin Templeton’s BENJI follows with $790.44 million as of July 10, while Superstate’s USTB clocks in at $711 million. Just behind Treasurys, tokenized commodities land in third with a current market cap of $1.61 billion.

The bulk of that comes from the two heavyweight gold-backed tokens, PAXG by Paxos and XAUT from Tether. Further down the chain are sectors with smaller onchain footprints, including institutional alternative funds, stocks, non-U.S. government debt, and corporate bonds.

Having ballooned nearly fivefold over the past three years, the RWA market shows no signs of slowing down. Looking forward, projections from top financial institutions and consulting giants differ in scale but agree on one thing: this market’s heading for the trillions.

McKinsey puts the estimate at $2 trillion, while Boston Consulting Group (BCG) envisions a leap to $16 trillion by 2030.