Just 16% Profit? Peter Schiff Challenges Strategy’s Billion-Dollar Bitcoin Bet

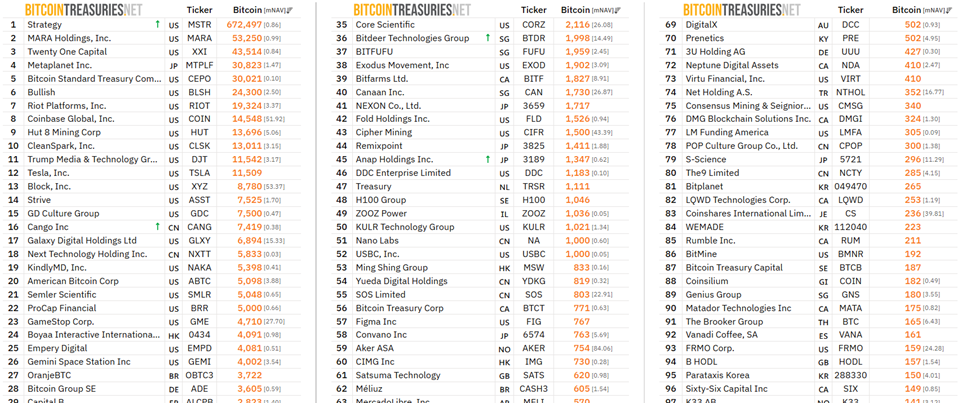

Michael Saylor’s Strategy, formerly of MicroStrategy, continues its resolve to accumulate Bitcoin, progressively strengthening its position at the helm of public companies holding BTC.

Likewise, Tom Lee’s BitMine technologies is pulling its weight on the Ethereum front, also leading public companies holding ETH.

Peter Schiff Critiques Strategy’s Multi-Billion Bitcoin Holdings

Last week, Strategy purchased an additional 1,229 BTC for roughly $108.8 million at an average price of $88,568 per coin. This brings the company’s total Bitcoin holdings to 672,497 BTC, acquired at an average cost of $74,997 per Bitcoin and valued at approximately $50.44 billion.

Strategy has acquired 1,229 BTC for ~$108.8 million at ~$88,568 per bitcoin and has achieved BTC Yield of 23.2% YTD 2025. As of 12/28/2025, we hodl 672,497 $BTC acquired for ~$50.44 billion at ~$74,997 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/UGvjHj5WPg

— Strategy (@Strategy) December 29, 2025

Strategy reports a BTC yield of 23.2% YTD 2025, sitting on an unrealized profit of $8.31 billion, or roughly 16% over five years.

Despite these staggering numbers, investor and gold maxi Peter Schiff voiced skepticism over the Strategy’s returns. Schiff highlighted that a 16% paper profit over five years translates to an average annual return of just over 3%, a figure he described as underwhelming compared to traditional asset classes.

“MSTR would have been much better off had Saylor bought just about any other asset instead of Bitcoin,” wrote Schiff, framing the Bitcoin accumulation as a potentially inefficient allocation of capital.

While Schiff questions the efficiency of Strategy’s Bitcoin holdings, the company’s approach reflects a broader trend of institutional accumulation in the crypto market.

MicroStrategy’s long-term buy-and-hold strategy mirrors confidence in Bitcoin as a store of value, even amid debates over opportunity cost and realized returns.

Tom Lee’s BitMine Pushes Toward ‘Alchemy of 5%’ Ethereum Goal

Parallel to Strategy’s Bitcoin plays, Tom Lee’s BitMine Immersion (BMNR) is making significant moves in Ethereum.

BitMine purchased an additional 44,463 ETH last week, bringing its total holdings to 4,110,525 Ether tokens, valued at $12.02 billion. This represents 3.41% of the total ETH supply.

Tom Lee(@fundstrat)’s #Bitmine bought another 44,463 $ETH($130M) last week and currently holds 4,110,525 $ETH($12.02B).https://t.co/HtqNP2C0qD pic.twitter.com/ZLBcKEHYIL

— Lookonchain (@lookonchain) December 29, 2025

Additionally, BitMine holds 408,627 staked ETH, with its MAVAN staking solution on track for a Q1 2026 launch.

BitMine’s total crypto, cash, and “moonshots” holdings now total $13.2 billion, including $1 billion in cash and $23 million in other strategic investments.

The company is supported by institutional investors such as ARK’s Cathie Wood, Founders Fund, Pantera, Galaxy Digital, Kraken, and personal investor Tom Lee. BitMine has also established itself as one of the most widely traded US stocks, with an average daily trading volume of $980 million, ranking #47 among 5,704 listed stocks.

The contrasting approaches of Strategy and BitMine highlight an ongoing debate in the institutional crypto arena. While Strategy focuses on Bitcoin accumulation, BitMine aggressively expands its Ethereum treasury and staking operations.

Both strategies signal growing institutional confidence in digital assets, but Schiff’s critique highlights the tension between holding for long-term gains and evaluating realized investment efficiency.

BitMine will host its Annual Stockholder Meeting at the Wynn Las Vegas on January 15, 2026, with key proposals aimed at achieving its “Alchemy of 5%” strategic plan in ETH.

Meanwhile, Strategy continues to quietly amass Bitcoin, maintaining its position as the largest BTC treasury globally. This is despite the existing risks associated with MSCI exclusion.

The post Just 16% Profit? Peter Schiff Challenges Strategy’s Billion-Dollar Bitcoin Bet appeared first on BeInCrypto.