Nvidia (NASDAQ: NVDA) insiders sold more than $1 billion worth of company stock in 2025, cashing in on the chipmaker’s sustained rally driven by its advances in artificial intelligence (AI).

Notably, across 2025, the stock has hit several high rallying by over 52% year-to-date to trade at $190 as of the last market close.

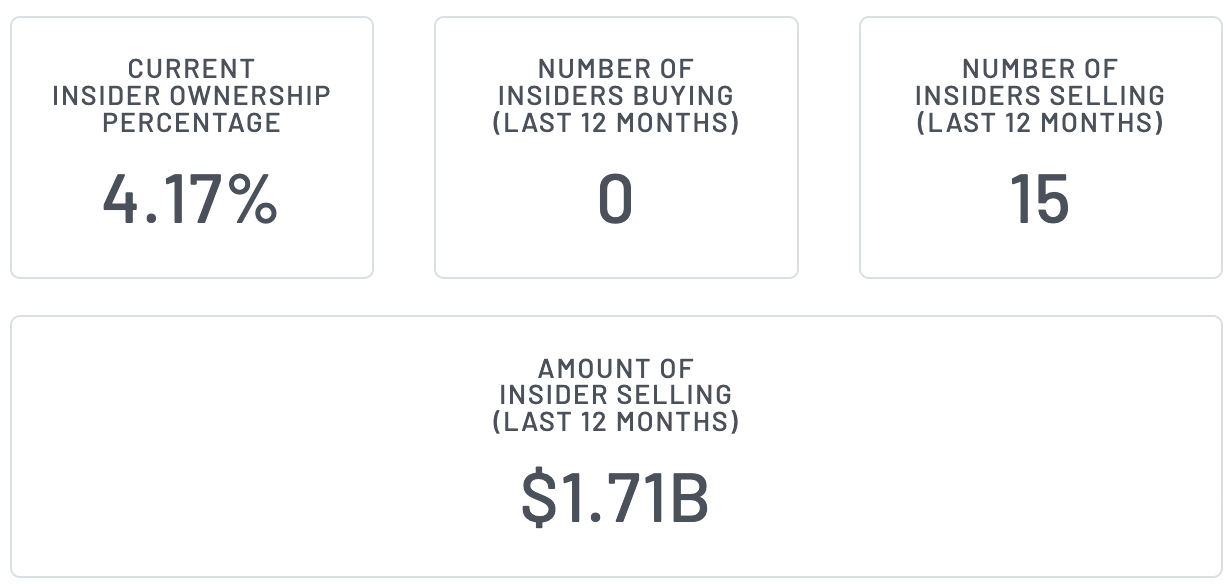

Regulatory filings show consistent selling by top executives and board members throughout the year, with no insider purchases reported.

Over the past 12 months, Nvidia’s insider ownership stands at about 4.17%, with 15 insiders selling shares and none buying. Total insider sales reached roughly $1.7 billion as of December 29, according to Finbold data retrieved from MarketBeat.

Nvidia stock’s biggest insider sellers

The largest and most consistent seller was Chief Executive Jensen Huang. Throughout 2025, Huang executed a series of sales under pre-arranged Rule 10b5-1 trading plans.

For instance, in early July, he sold just over 205,000 shares worth about $36 million. That activity continued into September, when he disposed of roughly 225,000 shares valued at nearly $40 million, followed by similar-sized transactions in October.

Other board members also took advantage of the elevated share price. In September, director Harvey Jones sold approximately 250,000 Nvidia shares worth about $44 million.

Toward the end of the year, director Mark Stevens disclosed the sale of more than 220,000 shares valued at around $40 million, while the company’s principal accounting officer sold stock worth several million dollars in December.

The wave of selling comes during a period when Nvidia’s market capitalization ballooned to above $4 trillion on the back of explosive demand for>Revenue growth and margins have far outpaced much of the semiconductor industry, helping justify premium valuations. Against that backdrop, insider sales have largely been framed as diversification moves rather than signals of deteriorating fundamentals.

Impact of NVDA stock insider sales

However, the absence of insider buying alongside heavy selling may influence investor sentiment.

Large, visible sales can add to near-term volatility, particularly if broader market conditions weaken or expectations around AI spending moderate.

While pre-scheduled trading plans limit the informational value of individual transactions, the aggregate scale of selling could weigh on confidence if Nvidia’s growth trajectory shows signs of slowing.

Featured image via Shutterstock