No, whales are not accumulating massive amounts of Bitcoin: CryptoQuant

Speculation that Bitcoin whales are engaged in a massive reaccumulation phase has been significantly overstated, suggesting the digital asset market structure has not materially changed, according to onchain data from CryptoQuant.

The popular narrative that large holders are aggressively buying Bitcoin (BTC) is misleading, said Julio Moreno, head of research at CryptoQuant. Much of the publicly shared “whale accumulation” data is distorted by exchange-related activity rather than genuine investor behavior.

Cryptocurrency exchanges routinely consolidate funds from many smaller wallets into fewer large ones for operational and regulatory reasons. This process artificially increases the number of wallets holding very large balances, leading onchain trackers to misclassify the activity as whale accumulation.

When these exchange-related distortions are filtered out, the data shows that large holders are still distributing Bitcoin rather than accumulating it, Moreno said.

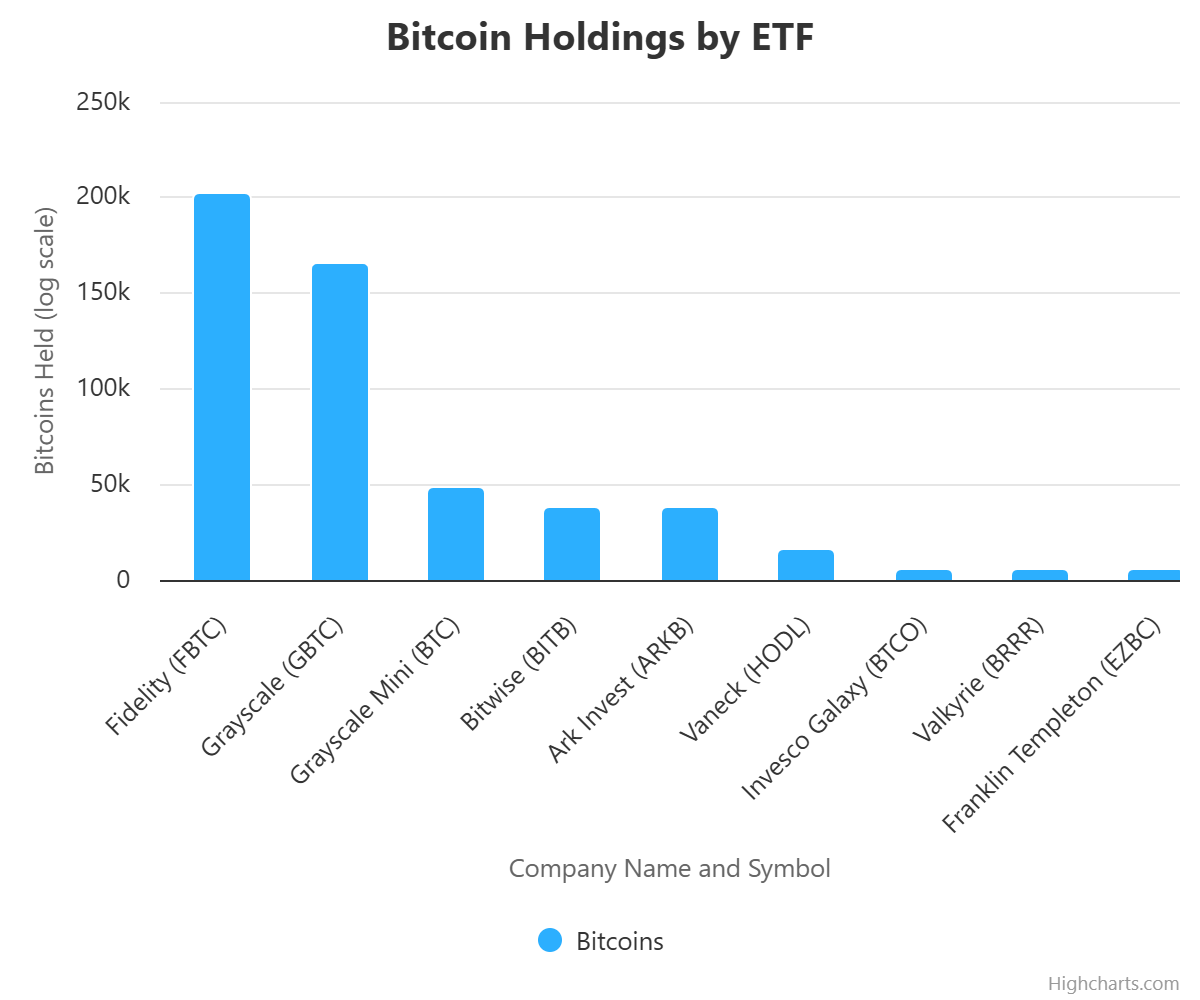

As a result, overall whale balances continue to decline. Holdings among addresses with 100 to 1,000 BTC are also falling, a trend that suggests ongoing exchange-traded fund (ETF) outflows.

The data is significant because Bitcoin whales exert an outsized influence on the market, with large transactions often driving price action and periods of volatility. However, the market’s structure has shifted since early 2024 with the launch of US spot Bitcoin ETFs, which have emerged as major holders of the digital asset.

Source: Bithumb flags $200M in dormant crypto assets across 2.6M inactive accounts

A silver lining: Long-term holders turn to accumulation

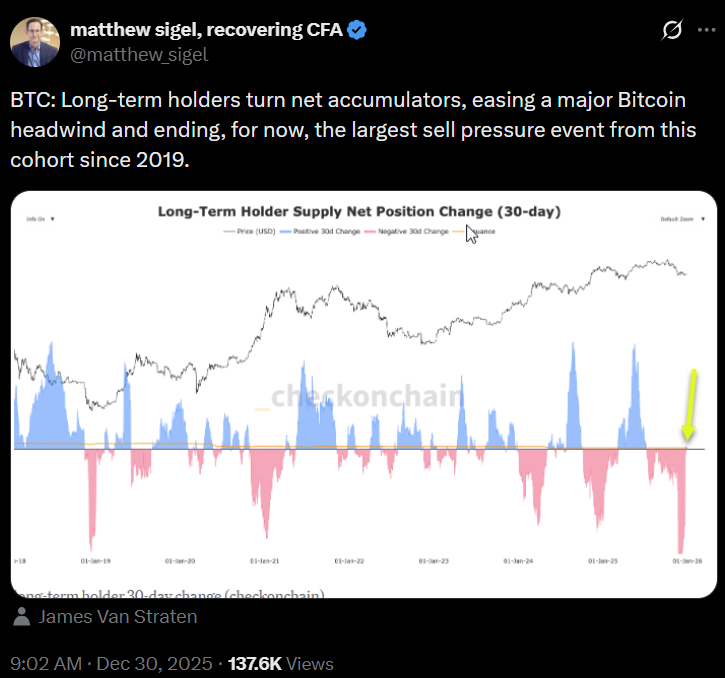

While debate continues over whether Bitcoin whales are reaccumulating, other onchain data point to a more constructive shift among a closely watched cohort: long-term holders.

Matthew Sigel, head of digital assets research at VanEck, said Bitcoin’s long-term holders have become net accumulators over the past 30 days, following what he described as the cohort’s largest selling event since 2019.

The shift suggests that one of Bitcoin’s most significant sources of recent selling pressure may be easing, at least in the near term.

Bitcoin’s price action has yet to reflect a sustained recovery, but the asset has also avoided a retest of its sub-$80,000 low from November. Bitcoin was trading slightly above $90,000 at time of writing.

Source: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Leave a Reply

You must be logged in to post a comment.