Coinbase's $100 billion milestone sparks trillion-dollar company speculation

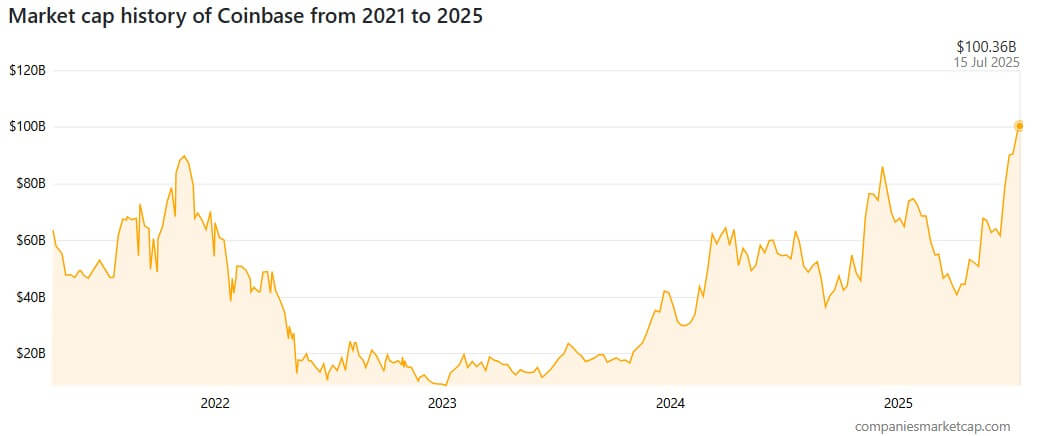

Coinbase has crossed a significant milestone, reaching a market capitalization of over $100 billion amid renewed momentum across the crypto sector.

According to Google Finance data, shares of Coinbase (COIN) reached a new all-time high of $398.50 during trading hours on July 14. However, the stock’s value ended the day at around $394, reflecting a 2% increase during the period.

Considering this performance, Kylie Reidhead, co-owner of the crypto media outlet Milk Road, suggested that Coinbase could grow into a trillion-dollar company.

He likened Coinbase’s trajectory to the rise of Amazon in retail and Netflix in entertainment, adding that the US-based crypto exchange is positioning itself as a pillar of “upgrading” the current financial system.

Reidhead noted that this positioning could help the Brian Armstrong-led firm overtake traditional banking giants like JPMorgan as crypto infrastructure becomes more integrated with mainstream finance.

Why Coinbase stock is rallying

The Coinbase surge is, in part, due to improving macro conditions for the crypto industry, rising digital asset prices, and the company’s expanding role in merging traditional finance with the emerging industry.

Its inclusion in the S&P 500 Index earlier this year signaled growing confidence in the exchange’s fundamentals and profitability. The move is also expected to increase institutional ownership as index funds adjust their portfolios.

The COIN stock rally also coincided with rising crypto prices, particularly Bitcoin, which surged to an all-time high of more than $120,000 on the same day.

Is Coinbase overvalued?

Despite the positive outlook, some analysts believe Coinbase’s valuation may be inflated.

Analysts at 10x Research have warned that Coinbase might be overvalued, particularly as institutional investors prefer large-cap Bitcoin miners as proxies for the top crypto asset.

According to the firm, Coinbase is still trading at a premium relative to Bitcoin, despite both assets experiencing gains.

The firm stated:

“Coinbase remains overvalued relative to Bitcoin, though both have gained. Only a few assets, including Circle and Robinhood, show stronger momentum than Bitcoin.”

Notably, HC Wainwright recently downgraded Coinbase from Buy to Sell, citing its 150% rally over the past quarter and a price-to-earnings ratio that may not reflect underlying fundamentals.