After a strong weekly rally, the crypto market faced renewed selling pressure over the past 24 hours. Bitcoin led the move lower as several overlapping factors weighed on sentiment, including large liquidations, regulatory uncertainty in the US, institutional developments, and growing macroeconomic caution.

Rather than a single catalyst, the pullback reflects a stacking of risks that pushed traders into a more defensive stance.

Bitcoin Rejected at Resistance Triggers Liquidations

$Bitcoin failed to break above the $94,500 resistance zone, a level closely watched by traders. The rejection sparked aggressive selling, which quickly escalated into forced liquidations across leveraged positions.

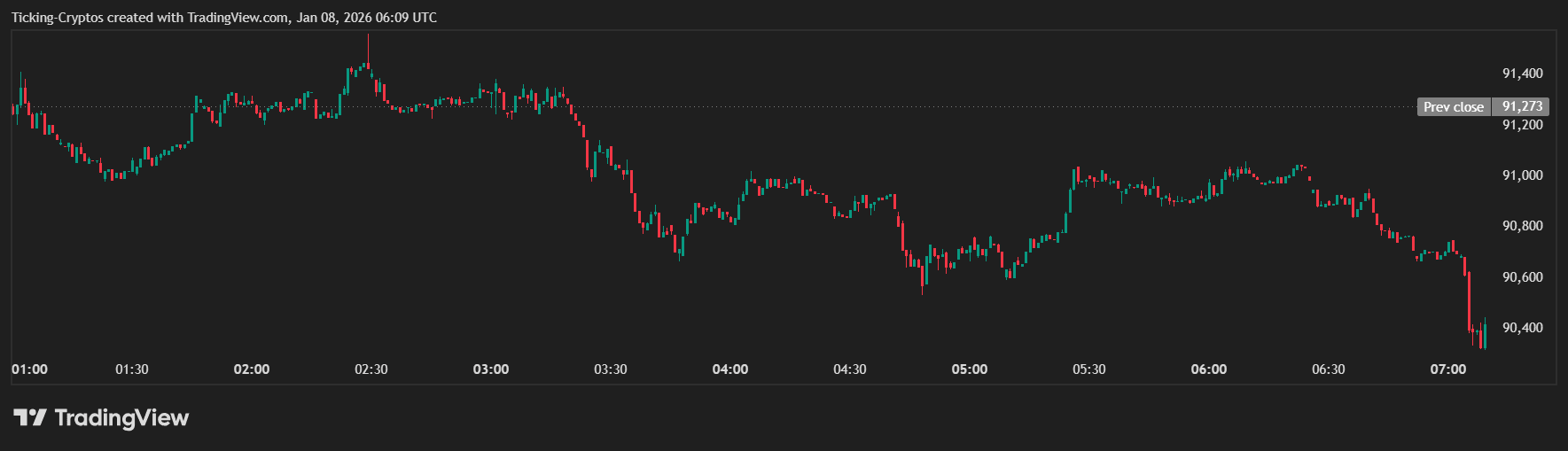

Bitcoin price in USD over the past 24 hours – TradingView

As stop-losses and margin calls were triggered, downside momentum accelerated, dragging Bitcoin back toward the $90,000 area and amplifying losses across altcoins.

This technical rejection and liquidation cascade played a major role in the sharp short-term correction.

Regulatory Uncertainty Returns to the Spotlight

Adding pressure to the market, renewed attention turned toward US regulatory developments, with reports that the Senate Agriculture Committee is preparing to advance crypto-related oversight discussions following recent banking panel activity.

While no immediate decisions were announced, the prospect of tighter regulation or expanded oversight introduced uncertainty, often enough to prompt traders to reduce exposure in the short term.

Regulatory risk remains one of the most sensitive variables for crypto pricing, especially during periods of elevated leverage.

JPMorgan Stablecoin News Fuels Sector Rotation

On the institutional side, JPMorgan announced plans to issue its own stablecoin directly on a privacy-focused blockchain network. While the news highlights continued institutional adoption of blockchain technology, it also triggered capital rotation within the crypto market.

Such announcements often lead traders to reposition across sectors, temporarily increasing volatility as liquidity shifts between assets rather than expanding the overall market.

Macro Events Push Traders Into Risk-Off Mode

Broader macroeconomic uncertainty also contributed to the pullback. Traders are closely watching upcoming US jobs data and a potential Supreme Court ruling on global tariffs, both of which could influence inflation expectations, interest rate outlooks, and risk appetite.

As a result, some investors opted to reduce exposure to high-volatility assets like crypto until greater clarity emerges on the macro front.

Leave a Reply

You must be logged in to post a comment.